FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do fast answer of this question solution

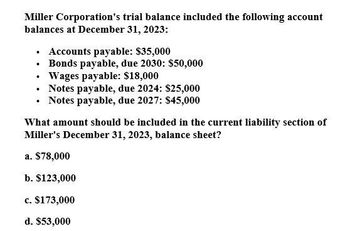

Transcribed Image Text:Miller Corporation's trial balance included the following account

balances at December 31, 2023:

⚫ Accounts payable: $35,000

.

Bonds payable, due 2030: $50,000

Wages payable: $18,000

⚫ Notes payable, due 2024: $25,000

⚫ Notes payable, due 2027: $45,000

What amount should be included in the current liability section of

Miller's December 31, 2023, balance sheet?

a. $78,000

b. $123,000

c. $173,000

d. $53,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At December 31, 2020, Sarasota Corporation has the following account balances: Bonds payable, due January 1, 2029 Discount on bonds payable Interest payable $1,400,000 75,000 68,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classifications. (Enter account name only and do not provide descriptive information.) Sarasota Corporation Balance Sheet (Partial) LA $arrow_forwardMC21. Bay Corporation trial balance included the following account balances at December 31, 2021: Accounts payable - P4,500,000; Bonds payable, due December 31, 2022 P7,500,000; Discount on bonds payable - P900,000; Notes Dividends payable on January 31, 2022 - P2,400,000; payable due January 31, 2025 - P6,000,000. How much is included in the current liabilities section of Bay Corporation's December 31, 2021 statement of financial position?arrow_forwardAt December 31, 2025, Cullumber Corporation has the following account balances: Bonds payable, due January 1, 2034 Discount on bonds payable Interest payable $1,400,000 76,000 71,000 Show how the above accounts should be presented on the December 31, 2025, balance sheet, including the proper classific CULLUMBER CORPORATION Balance Sheet (Partial) LAarrow_forward

- can you show me how to solve this problem for accounting? Presented here are long-term liability items for Metlock, Inc. at December 31, 2022. Bonds payable (due 2026) $660,000 Notes payable (due 2024) 90,000 Discount on bonds payable 28,000arrow_forwardAt December 31, 2020, Hyasaki Corporation has the following account balances: Bonds payable, due January 1, 2029 $2,000,000 Discount on bonds payable 88,000 Interest payable 80,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classifications.arrow_forwardEntity A has the following liabilities as of December 31, 2021. a. Trade accounts payable, net of debit balance in supplier's account of P10,000, net of unreleased checks of P8,000, and net of postdated checks of P4,000 P600,000 b. Credit balance in customers’ accounts 4,000 c. Financial liability designated at FVPL 100,000 d. Bonds payable maturing in 10 equal annual installments of P200,000 2,000,000e. 12%, 5-year note payable issued on Oct. 1, 20x1 200,000 f. Deferred tax liability 10,000 g. Unearned rent 8,000 h. Contingent liability 20,000 i. Reserve for contingencies 50,000 j. Income taxes withheld from employees 50,000 k. Cash in bank at Siniloan Bank 352,000 l. Cash overdraft at Famy Bank 60,000m. Estimated premium claims outstanding 70,000n. Claims for increase in wages covered in a pending lawsuit 190,000 Requirement: How much is the total current liabilities? a. 2,430,000 c. 968,000 b. 1,120,000 d. 940,000arrow_forward

- At December 31, 2020, Crane Corporation has the following account balances: Bonds payable, due January 1, 2029 $2,600,000 Discount on bonds payable 71,000 Interest payable 62,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classifications.arrow_forwardPresented here are liability items for kingbird inc.at December 31,2022 accounts payable 251200 notes payable (due may 1 2023) 3200 bonds payable (due 2026) 1440000 unearned rent revenue 384000 discount on bonds payable 65600 fica 12480 interest payable 64000 notes payable (due 2024) 128000 income taxes payable 5600 sales taxes payable 2720 prepare the liabilities section of kingbird's balance sheetarrow_forwardThe following Is a portion of the current assets section of the balance sheets of Avantl's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for bad debts of $9,884 and $18,755, respectively $178,387 $223,883 Requlred: a. If $11,579 of accounts recelvable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint. Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) Bad debt expense b. The December 31, 2020, Allowance account balance Includes $3,017 for a past due account that is not likely to be collected. This account has not been written off. |(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If It had been written off, will there be any effect of the write-off on net Income and ROI for the year ended December 31, 2020? Yes No c. The level of Avantı's sales…arrow_forward

- 10. Powell Corporation includes the following selected accounts in its general ledger at December 31, 2025: View the selected accounts. Prepare the liabilities section of Powell Corporation's balance sheet at December 31, 2025. Plus: Total Liabilities Powell Corporation Balance Sheet (Partial) December 31, 2025 Selected Accounts - ☑ Notes Payable (long-term) 55,000 Bonds Payable (long-term) 215,000 Interest Payable (due next year) Sales Tax Payable $ 780 640 Accounts Payable 20,000 Premium on Bonds Payable 5,950 Salaries Payable 1,840 Estimated Warranty Payable 1,000 Print Donearrow_forwardMorley Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amortized cost $50,000 Fair value 40,000 Expected credit loss 12,000 a. What is the amount of the credit loss that Morley should report on this available-for-sale security at December 31, 2020? b. Prepare the journal entry to record the credit loss, if any (and any other adjustment needed), at December 31, 2020. c. Assume that the fair value of the available-for-sale security is $53,000 at December 31, 2020, instead of $40,000. What is the amount of the credit loss that Morley should report at December 31, 2020? d. Assume the same information as for part (c). Prepare the journal entry to record the credit loss, if necessary (and any other adjustment needed), at December 31, 2020.arrow_forwardPresented below are long-term liability items for Crane Company at December 31, 2020. Bonds payable, due 2022 $575,000 Lease liability 70,000 Notes payable, due 2025 80,000 Discount on bonds payable 37,375 Prepare the long-term liabilities section of the balance sheet for Crane Company. (Enter account name only and do not provide descriptive information.) Crane CompanyBalance Sheet (Partial) For the Month Ended December 31, 2020For the Year Ended December 31, 2020December 31, 2020 Current AssetsCurrent LiabilitiesIntangible AssetsLong-term InvestmentsLong-term LiabilitiesProperty, Plant and EquipmentStockholders' EquityTotal AssetsTotal Current AssetsTotal Current LiabilitiesTotal Intangible AssetsTotal LiabilitiesTotal Liabilities and Stockholders' EquityTotal Long-term InvestmentsTotal Long-term LiabilitiesTotal Property, Plant and EquipmentTotal Stockholders’ Equity $ Add Less :…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education