ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:(a) What is Mike's expected utility.

(b) What is the maximum amount that Mike is willing to pay for auto insurance?

(c) Suppose all car owners are like Mike insofar as they have a 10 percent chance of

having an accident. An insurance company agrees to pay each person who has an

accident the full value of his or her car. The company's operating expenses are

$1,000. What is the minimum insurance premium that the company is willing to

accept?

(d) Will Mike buy the company's policy? Why or why not?

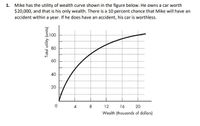

Transcribed Image Text:1. Mike has the utility of wealth curve shown in the figure below. He owns a car worth

$20,000, and that is his only wealth. There is a 10 percent chance that Mike will have an

accident within a year. If he does have an accident, his car is worthless.

100

80

60

40

20

8.

12

16

20

Wealth (thousands of dollars)

Total utility (units)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. Jerry has wealth of $60 and derives utility from this according to the utility function U(w) = 1 - -, Where w is his wealth. Jerry now finds a lottery ticket (whose drawing is tomorrow) that offers a 50% chance of winning $5. (a) What is the expected value of the lottery ticket? (b) What is the minimum amount for which Jerry would be willing-to-sell the ticket? (c) Which is bigger, your answer to (a) or (b)? Use a clearly labelled diagram to explain why. (d) If he does not sell the ticket, what is Jerry's cost of risk?arrow_forwardSuppose that the buyers do not know the quality of any particular bicycle for sale, but the sellers do knowthe quality of the bike they sell. The price at which a bike is traded is determined by demand and supply.Each buyer wants at most one bicycle.(ii) Assuming that each buyer purchases a bike only if its expected quality is higher than the price,and each seller is willing to sell their bike only if the price exceeds their valuation, what is theequilibrium outcome in this market?arrow_forwardI need 4,5,6 answeredarrow_forward

- Billy's income Is equal to / = 100 and his utility function is U = [?. There is a 10% chance that he will be in an accident next year with his skateboard that will cause $70 worth of damage. Get the risk premium for Billy. b. An Insurance company offers a policy that will cover all the damages if an accident occurs Calculate the fair price for the insurance. %3D a.arrow_forward4) Luke is planning an around-the-world trip on which he plans to spend $10,000. The utility from the trip is a function of how much she spends on it (Y ), given by U(Y) = InY a). If there is a 25 percent probability that Luke will lose $1000 of his cash on the trip, what is the trip's expected utility. b). Suppose that Luke can buy insurance to fully against losing the $1,000 with a actuarially fair insurance. What is his expected utility if he purchase this insurance. Will he purchase the insurance? c). Now suppose utility function is U(Y) = Y/1000 What is his expected utility if he purchase the insurance in b). Will he purchase the insurance?arrow_forward7. Consider an individual whose utility function over money is u(w) = 1+2w. (a) Is the individual risk-averse, risk-neutral, or risk-loving? Does it depend on w? (b) Suppose the individual has initial wealth ¥W and faces the possible loss of Y. The probability that the loss will occur is . Suppose insurance is available at price p, where p is not necessarily the fair price. Find the optimal amount of insurance the individual should buy. You may assume that the solution is interior. (c) Is there a price at which the individual will not want to buy any insurance? If so, find it. If no, explain.arrow_forward

- 1. A person with U(w) = w² is facing the following lottery: there are four tickets sold, or which only one wins the prize of $100. a. Calculate the expected value of the lottery. b. Calculate the certainty equivalent. c. Comparing parts (a) and (b), what is this person's risk preference and why?arrow_forwardIndividuals will prefer to fully insure against a potential adverse event if A. individuals are risk-loving and insurance is priced at an actuarially fair rate. B. individuals are risk-averse and insurance is priced at an actuarially fair rate. C. individuals are risk-loving and insurance is priced above the actuarially fair rate. D. individuals are risk-averse and insurance is priced above the actuarially fair rate.arrow_forwardExplain all option ......you will not explain all option then I will give you down upvote..arrow_forward

- Any risk-averse individual would always (Select all that applies) a) take a 30% chance at $100 rather than a sure $20. b) take a sure $20 rather than a 30% chance at $100. c) take a sure $2 rather than a 50% chance at $5 and a 50% chance at losing $1. d) take a 50% chance at $5 and a 50% chance at losing $1 rather than a sure $1.arrow_forwardA. From the graph below explain how an insurance plan which provides the buyer a $15,000 wealth level, regardless of any uncertain event, is a good deal for the buyer? In other words, what does the distance between points D’ and C’ represent? Note we are referring to D prime, not D. B. Considering the graph below, can you explain the difference between expected utility and certainty utility?arrow_forward17. Suppose a risk-neutral power plant needs 10,000 tons of coal for its operations next month. It is uncertain about the future price of coal. Today it sells for $60 a ton but next month it could be $50 or $70 (with equal probability). How much would the power plant be willing to pay today for an option to buy a ton of coal next month at today's price? (Ignore discounting over the short period of a month.) а. 5 b. 4 с. 3 d. NOTE: I KNOW THAT THE ANSWER IS (A), BUT PLEASE INCLUDE ALL THE STEPS HOW TO SOLVE THE PROBLEM BECAUSE I NEED TO PRACTICE. THANK YOU.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education