ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

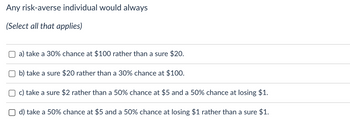

Transcribed Image Text:Any risk-averse individual would always

(Select all that applies)

a) take a 30% chance at $100 rather than a sure $20.

b) take a sure $20 rather than a 30% chance at $100.

c) take a sure $2 rather than a 50% chance at $5 and a 50% chance at losing $1.

d) take a 50% chance at $5 and a 50% chance at losing $1 rather than a sure $1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The value of a successful project is $420,000; the probabilities of success are 1/2 with good supervision and 1/4 without. The manager is risk neutral, not risk averse as in the text, so his expected utility equals his expected income minus his disutility of effort. He can get other jobs paying $90,000, and his disutility for exerting the extra effort for good supervision on your project is $100,000. (a) Show that inducing high effort would require the firm to offer a compensation scheme with a negative base salary; that is, if the project fails, the manager pays the firm an amount stipulated in the scheme. (b) How might a negative base salary be implemented in reality? (c) Show that if a negative base salary is not feasible, then the firm does better to settle for the low-pay, low-effort situation.arrow_forwardWho is most risk-averse? a-an individual with slightly diminishing marginal utility. b-all individuals are equally risk-averse. c-an individual with rapidly diminishing marginal utility. d-an individual who does not experience diminishing marginal utility.arrow_forwardA risk-averse consumer with $100,000 in wealth faces 0.1 probability of losing half of his wealth within the next year. a. What is the consumer's expected wealth one year from now? b. An insurance company offers our consumer full insurance against the possible loss. What premium must the consumer be charged for the insurance company to expect to break even? c. Suppose our risk-averse consumer is indifferent between getting $85,000 wealth with certainty and facing the above described uncertain situation. What is the maximum premium that the insurance company will be able to charge this consumer for its full insurance policy?arrow_forward

- What term do economists use to describe the tendency for people to prefer certain outcomes over risky situations? a. The precautionary principle b. Risk differentiationc. Risk uncertainty d. Risk aversion e. Risk managementarrow_forwardIf a risk-neutral individual owns a home worth $200,000 and there is a three percent chance the home will be destroyed by fire in the next year, then we know 15. that: a) He is willing to pay much more than $6,000 for full cover. b) He is willing to pay much less than $6,000 for full cover. c) He is willing to pay at most $6,000 for full cover. d) None of the above are correct. e) All of the above are correct.arrow_forwardThe injection molding department of a company uses an average of 30 gallons of special lubricant a day. The supply of the lubricant is replenished when the amount on hand is 170 gallons. It takes four days for an order to be delivered. Safety stock is 50 gallons, wNch provides a stockout risk of 9 percent. What amount of safety stock would provide a stockout risk of 3 percent? Assume normality.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education