Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

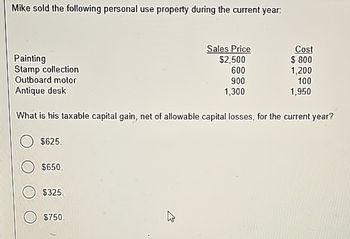

Transcribed Image Text:Mike sold the following personal use property during the current year:

Painting

Stamp collection

Outboard motor

Antique desk

Sales Price

Cost

$2,500

$ 800

600

1,200

900

100

1,300

1,950

What is his taxable capital gain, net of allowable capital losses, for the current year?

$625.

$650.

$325.

$750.

13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardanswer must be in proper format or i will give down votearrow_forwardMilt Payner purchased an automobile several years ago for $40,000 and has held it as a personal asset ever since. This year he sold the automobile. Assume the taxable year is 2022. Required: a. Compute Milt's recognized gain or loss on the sale if Milt's amount realized on sale was $28,300. b. Compute Milt's recognized gain or loss on the sale if Milt's amount realized on sale was $55,000. The automobile was a classic Thunderbird and was purchased by a vintage car collector in Boston. Complete this question by entering your answers in the tabs below. Required A Required B Compute Milt's recognized gain or loss on the sale if Milt's amount realized on sale was $28,300. Note: If the results of a transaction do not result in a gain or loss, select "No recognized gain or loss".arrow_forward

- The executor of Rose Shield's estate listed the following properties (at fair value): $ 350,000 250,000 150,000 Cash Life insurance receivable Investments in stocks and bonds Rental property 100,000 180,000 Personal property Following are the transactions that occur in the months following the decedent's death: 1. Claims of $90,000 are made against the estate for various debts incurred before the decedent's death. 2. Interest of $22,000 is received from bonds held by the estate. Of this amount, $4,000 had been earned prior to death. 3. Ordinary repairs costing $11,000 are made to the rental property. 4. All debts ($90,000) are paid. 5. Stocks recorded in the estate at $21,000 are sold for $29,000 cash. 6. Rental income of $24,000 is collected. Of this amount, $7,000 had been earned prior to the decedent's death. 7. Cash of $7,000 is distributed to Jim Arness, an income beneficiary. 8. The proceeds from the life insurance policy are collected and the money is immediately distributed to…arrow_forwardSubject: acountingarrow_forwardVorst depreciates Asset C by the straight-line method. On June 30, 2020, Vorst sold Asset C for 28,000 cash. How much gain (loss) should Vorst record in 2020 on the disposal of Asset C? a. 2,800 b. (2,800) c. (5,600) d. (8,400)arrow_forward

- Susie purchased her primary residence on March 15, year 4, for 550,000. She sold it on October 15, year 7, for 240,000. What amount of loss from the sale is recognized on her year 7 income tax return? a. 0 b. 60,000 c. 250,000 d. 310,000arrow_forwardIn 2019, Mary sells for $24,000 a machine used in her business. The machine was purchased on May 1,2017, at a cost of $22,000. Mary has deducted depreciation on the machine of $6,000. What is the amount and nature of Mary's gain as a result of the sale of the machine? $2,000 Section 1231 gain $8,000 ordinary income under Section 1245 $6,000 ordinary income and $2,000 Section 1231 gain $6,000 Section 1231 gain and $2,000 ordinary income under Section 1245 None of the abovearrow_forwardJasmine owned rental real estate that she sold to her tenant in an instalment sale. Jasmine acquired the property in 2007 for 400,000; took 178,000 of depreciation on it; and sold it for 210,000, receiving 25,000 immediately and the balance (plus interest at a market rate) in equal payments of 18,500 for 10 years. a. What is the nature of the recognized gain or loss from this transaction? b. Assuming that the interest rate on the installment contract is 5%, what is the present value of the installment payments? See Appendix H for present value factors.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT