Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

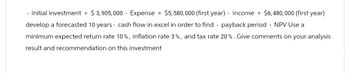

Transcribed Image Text:- Initial investment = $3,905,000 Expense = $5,580,000 (first year) - Income = $6,480,000 (first year)

develop a forecasted 10 years - cash flow excel in order to find - payback period - NPV Use a

minimum expected return rate 10%, inflation rate 3%, and tax rate 20% . Give comments on your analysis

result and recommendation on this investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- XYZ Corporation is considering a capital budgeting project and requires a detailed analysis. The company has provided youwith the following financial information and ratios:Return on Investment (ROI): 15%Payback Period: 3 yearsNet Present Value (NPV): R50,000Internal Rate of Return (IRR): 12%Cash Flows:Year 1: R20 000Year 2: R30 000Year 3: R40 0001.4 Calculate the ARR for XYZ Corporation. Assume depreciation is calculated on the straight-linemethod and that the project has a scrap value of R5000arrow_forwardbased on information on the image attached, Calculate the initial investment required for the project and then Discuss the significance of each ratio in evaluating the project.arrow_forwardMake a CashFlow projection of 10 million rupees investiment in some project ABC for the next 7 years. Recall following topics you have covered in your course: i) Capital Budgeting Techniques ii) Cash flow Estination. Apply all the techniques on your cash flow projections for decision making Assume required rate of return is 15% . Capital Budgeting Techniques: Payback Period. Discounted Payback Period Net Present Value . Internal Rate of Return Modified Internal Rate of Return Average Accounting Returnarrow_forward

- Explain well with step by step type the answer.arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forwardThe HUT is evaluating a 5 year investment projected to yield the following relevant cash flows over its 5 year life: Given that the firm employs a 12% discount rate, what is the value of each of the three criteria: NPV? Profitability Index? Payback Period? Varrow_forward

- Accounting Draw the cash flow diagram for the given project below and then calculate the project net profit. The following table shows the activities description, dependency, duration, and cost elements. Assume the followings: Project overhead 8%. Tax 3%. Bond 1.25%. Profit 6%. Interest rate 9% per year. Down payment 10% with a guarantee letter, which costs 0.25% per month paid to the bank at the project start date. A performance guarantee letter of 10% will be submitted from contractor at the project begin. Invoices are submitted every month and will be paid a month later. Retention 10% and will be paid at the last invoice. Subcontractors: retention 10% will be paid at the last invoice, down payment 20%. Labor: labor expenses to be paid bi-weekly. Equipment: equipment expensesarrow_forwardYou have found an investment opportunity that will provide annual cash flows of $1,234 for 5 years and costs $6789 today. If the required return is 12%, what is the profitability index for this opportunity?arrow_forwardan investment under consideration has a payback of six years and a cost of 885000. Assume the cash flows are conventional. If the required return is 12% what is the worst case NPV. Please use excel when showing how you got therarrow_forward

- c. A company is planning to invest in a project over a 5-year period, but wants to know its financial implications. It expects the cash in-flow return on the investment to steadily increase over the 5 years. Using the information below, help determine the Total Net Cash Flows, the Net Present Value and the estimated Payback Period. Note: Estimate the payback period to the nearest year. Discount Rate 12% Investment Project Initial Investment Year 1 Year 2 Year 3 Year 4 Year 5 Cash Flow $ $ $ $ $ $ Total Net Cash Flow (5,000) 800 ? 900 ? 1,500 ? 1,800 ? 3,200 NPV of investment Estimated Payback Periodarrow_forwardAnswer the question correctly. 7.arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3.0 and 3.5 years, respectively. Time: 0 1 2 3 4 5 Cash flow -$238,000 $66,100 $84,300 $141,300 $122,300 $81,500 Use the discounted payback decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Discounted payback Should it be accepted or rejected? O Rejected O Accepted yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education