Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

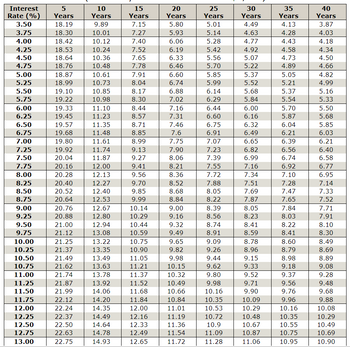

Transcribed Image Text:This table provides a detailed view of investment growth over various periods at different interest rates. Each row represents a specific interest rate, ranging from 3.50% to 13.00%. The columns represent the duration of investment in years, from 5 years to 40 years. The values in the table indicate the future value of a unit investment (e.g., per $100 invested) based on compounding at each rate and duration.

### Table Structure:

- **Interest Rate (%):**

- Listed vertically in the first column (3.50% to 13.00%).

- **Investment Duration:**

- 5 Years

- 10 Years

- 15 Years

- 20 Years

- 25 Years

- 30 Years

- 35 Years

- 40 Years

### Example Values:

- At an interest rate of 3.50%, the value of the investment after:

- 5 Years: 18.19

- 10 Years: 9.89

- 20 Years: 5.80

- At an interest rate of 10.00%, the value of the investment after:

- 5 Years: 21.32

- 15 Years: 13.27

- 30 Years: 8.76

- At the highest interest rate of 13.00%, the value of the investment after:

- 5 Years: 22.75

- 10 Years: 14.93

- 40 Years: 10.99

This table is useful for comparing the effects that different interest rates and time periods have on the growth of an investment. It serves as an educational resource for understanding the impact of compound interest over time.

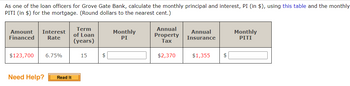

Transcribed Image Text:**Mortgage Calculation Exercise**

As a loan officer for Grove Gate Bank, calculate the monthly principal and interest (PI) using a specified table and determine the monthly PITI for the mortgage. Ensure all values are rounded to the nearest cent.

### Loan Details:

- **Amount Financed**: $123,700

- **Interest Rate**: 6.75%

- **Term of Loan**: 15 years

### Expenses:

- **Annual Property Tax**: $2,370

- **Annual Insurance**: $1,355

### Required Calculations:

- **Monthly PI**: Calculate using the provided tables.

- **Monthly PITI**: Enter the calculated value.

### Assistance:

If you need help, click on "Read It" for guidance.

**Note:** Ensure all calculations are precise to enhance the reliability of the financial advice provided to clients.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Wyatt signs a note for a discounted loan agreeing to pay $4,100 in 6 months at a discount rate of 13%. Determine the amount of the discount and the proceeds to Wyatt.Discount = $ Proceeds = $arrow_forwardam. 113.arrow_forwardPete Frank bought a computer for $4,000. Pete put down $500 and financed the balance at 10 ½% for 36 months. What is his monthly payment? (Use loan amortization table.)arrow_forward

- What is monthly monthly mortgage insurance premium for following FHA mortgage during the first year of the loan: • Gross loan amount including up-front mortgage insurance premium: $180,000 • Average balance of base loan amount in first year: $178,416 Annual premium rate for FHA mortgage insurance (paid monthly): 0.85% (Input your answer rounded to the nearest whole penny and without the $ sign, e.g., 1000.01).arrow_forwardLuis Rivera has taken out a mortgage loan for $225,000 at 4% for 5 years. What will be the total amount of interest paid? a. $27,706.34 b. $21,7567.33 c. $14,855.65 d. $18,566.47 e. $12,444.66arrow_forwardSuppose you earn a gross income of $2,710.00 per month and apply for a mortgage with a monthly PITI of $501.35. You have other financial obligations totaling $428.18 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would you qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% O FHA only O Conventional only O FHA and Conventional O None of the abovearrow_forward

- A mortgage applicant who has a monthly gross income of $4,705.00 applies for a mortgage with monthly PITI of $1,411.50. The applicant's other financial obligations total $282.30 per month. If the lending ratio guidelines are as given in the table below, what type of mortgage, if any, would the applicant qualify for? Mortgage Type Housing Expense Ratio Total Obligations Ratio FHA 29% 41% Conventional 28% 36% O FHA only O Conventional only O FHA and Conventional O None of the abovearrow_forwardTom Bond borrowed $6,600 at 6-% for three years compounded annually. What is the compound amount of the loan and how much interest will he pay on the loan? Compound amount = $ (Round to the nearest cent as needed.) Compound interest = $ (Round to the nearest cent as needed.)arrow_forwardEnter your dollar answers rounded to the nearest two cents and precede numbers that are less than zero (0) with a minus sign (–).) Buy On Time or Pay Cash Cost of Borrowing 1. Terms of the loan a. Amount of the loan $10,000.00 b. Length of the loan (in years) 5 c. Monthly payment $188.70 2. Total loan payments made ($ per month months) $ 3. Less: Principal amount of the loan $ 4. Total interest paid over life of loan $ 5. Tax considerations: – Is this a home equity loan? no – Do you itemize deductions on your federal tax return? yes 6. What federal tax bracket are you in? 35% 7. Taxes saved due to interest deductions ($ x %) $ 8. Total after-tax interest cost on the loan $ Cost of Paying Cash 9. Annual interest earned on savings (6% x ) $ 10. Annual after-tax interest earnings ($ x %) $ 11. Total after-tax interest earnings…arrow_forward

- K On April 1, Hilda made a $2680 deposit to open a savings account paying 3% compounded daily. She then deposited $200 on May 2 and $630 on May 25. Find the balance on June 30 and the interes earned through that date. Click here to view the 3.5% compound interest table. Click here to view the 3.5% compound interest by quarters table View On June 30, what is the balance in the account? S (Round to the nearest cunt as needed.) - X 3.5% Interest Compounded Daily by Quarter Table 1 Interest by Quarter for 3 % Compounded Daily Assuming 90-day Quarters Number of Quarters. Value of (1+i) 1.008667067 1.017409251 1.026227205 1.035121505 3.5% Interest Compounded Daily Table Number R 1 2 3 4 5 6 7 8 9 10 11 12 13 Values of (1+1) for 3% Compounded Daily Valec of Value of 1.000095890 19 35 (1+1) It (1+i) A 1001823491 37 1.003554076 38 1003650307 56 1003746548 57 1000191790 20 1001919556 1.000287699 21 100201 5631 1.000383617 22 1.002111714 1003842797 1000479544 23 1002207807 41 1003939056 59…arrow_forwardAnswer in the box is incorrect.arrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers t Monthly Gross Income Monthly PITI Other Monthly Financial Obligations Housing Expense Ratio (%) Total Obligations Ratio (%) Applicant Expense Emerson $2,900 $777 $290 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education