FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Metro Media Company pays its employees monthly. Payments made by the company on October 31 follow. Cumulative amounts for

the year paid to the persons prior to the October 31 payroll are also given.

1. Tori Parker, president, gross monthly salary of $20,000; gross earnings prior to October 31, $160,000.

2. Carolyn Catz, vice president, gross monthly salary of $14,000; gross earnings paid prior to October 31, $126,000.

3. Michelle Clark, independent accountant who audits the company's accounts and performs consulting services, $16,500; gross

amounts paid prior to October 31, $42,500.

4. Will Wu, treasurer, gross monthly salary of $6,000; gross earnings prior to October 31, $54,000.

5. Payment to Review Services for monthly services of Tom Bradley, an editorial expert, $6,000; amount paid to Review Services prior

to October 31, $30,000.

Required:

1. Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on allI

earnings for Medicare taxes. Prepare a schedule showing the following information:

a. Each employee's cumulative earnings prior to October 31.

b. Each employee's gross earnings for October.

c. The amounts to be withheld for each payroll tax from each employee's earnings; the employee's income tax withholdings are

Parker, $5,600; Catz, $4,200; Wu, $1,320.

d. The net amount due each employee.

e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees.

2. Prepare the general journal entry to record the company's payroll on October 31.

3. Prepare the general journal entry to record payments to employees on October 31.

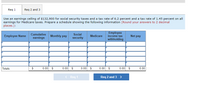

Transcribed Image Text:Req 1

Req 2 and 3

Use an earnings ceiling of $132,900 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all

earnings for Medicare taxes. Prepare a schedule showing the following information (Round your answers to 2 decimal

places.):

Employee

income tax

withholding

Cumulative

Social

Employee Name

Monthly pay

Medicare

Net pay

earnings

security

Totals

$

0.00 $

0.00 $

0.00 $

0.00 $

0.00 $

0.00

< Req 1

Req 2 and 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vishnuarrow_forwardRiver Signorini works for New & Old Apparel, which pays employees on a semimonthly basis. River's annual salary is $177,500. Required: Calculate the following Note: Round your final answers to 2 decimal places. Pay Date Prior YTD Earnings October 15 December 31. Social Security Taxable Wages Medicare Taxable Wages Employer Share Social Security Taxi Employer Share Medicare Taxarrow_forwardBonita Consulting Inc's gross salaries for the biweekly period ended August 24 were $15,000. Deductions included $743 for CPP, $282 for El, and $6,308 for income tax. The employer's payroll costs were $743 for CPP and $395 for El. Prepare journal entries to record (a) the payment of salaries on August 24; (b) the employer payroll costs on August 24, assuming they will not be remitted to the government until September; and (c) the payment to the government on September 15 of all amounts owed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. Date Account Titles and Explanation Debit Credit (a) (Ь) (c)arrow_forward

- River Signorini works for New & Old Apparel, which pays employees on a semimonthly basis. River's annual salary is $193,000. Required: Calculate the following: Note: Round your final answers to 2 decimal places. Pay Date October 13 Prior YTD Earnings Social Security Taxable Wages Medicare Taxable Wages Employer Share Social Security Tax Employer Share Medicare Tax December 29arrow_forwardCascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Cascade include the following: Account Number Title Balance on June 1 101 Cash $71,200 211 Employee Federal Income Tax Payable 3,555 212 Social Security Tax Payable 5,135 213 Medicare Tax Payable 1,181 218 Savings Bond Deductions Payable 1,225 221 FUTA Tax Payable 592 222 SUTA Tax Payable 3,996 511 Wages and Salaries Expense 0 530 Payroll Taxes Expense 0 The following transactions relating to payrolls and payroll taxes occurred during June and July: June 15 Paid $9,871 covering the following May taxes: Social Security tax $5,135 Medicare tax 1,181 Employee federal income tax withheld 3,555 Total $9,871 30 June payroll: Total wages and salaries expense $46,000 Less amounts withheld: Social Security tax $2,852 Medicare tax 667…arrow_forwardAlpine Company pays its employees time-and-a-half for hours worked in excess of 40 per week. The information available from time cards and employees’ individual earnings records for the pay period ended October 14 is shown in the following chart: Earnings at End Daily Time Income Tax Name of Previous Week M T W T F S Pay Rate Allowances or Amount Bardin, J. 43,627.00 8 8 8 8 8 2 21.30 2 Caris, A. 44,340.00 8 8 8 8 8 8 21.60 1 Drew, W. 43,845.00 8 10 10 8 8 0 21.50 1 Garen, S. 117,600.00 8 8 8 8 8 0 49.00 $227.83 North, O. 43,875.00 8 8 8 8 8 5 21.40 3 Ovid, N. 40,150.00 8 8 8 8 8 0 21.50 1 Ross, J. 6,430.00 8 8 8 8 8 4 20.50 1 Springer, O. 44,175.00 8 8 8 8 8 3 21.25 2 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. *Round to the nearest penny. Required: 1. Complete the payroll register…arrow_forward

- In 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0". a. November 15 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $163,200 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 Grath, John, VP Finance 138,000 fill in the blank 5 fill in the blank 6 fill in the blank 7 fill in the blank 8 James, Sally, VP Sales 69,600 fill in the blank 9 fill in the blank 10 fill in the blank 11 fill in the blank 12 Kimmel, Joan, VP Mfg. 54,000 fill in the blank 13 fill in the blank 14 fill in the blank 15 fill in the blank 16 Wie, Pam, VP Personnel 51,600 fill in the blank 17 fill in the blank 18 fill in the blank 19…arrow_forwardSandler Company completed the following two transactions. The annual accounting period endsDecember 31.a. On December 31, calculated the payroll, which indicates gross earnings for wages ($260,000),payroll deductions for income tax ($28,000), payroll deductions for FICA ($20,000), payrolldeductions for United Way ($4,000), employer contributions for FICA (matching), and stateand federal unemployment taxes ($2,000). Employees were paid in cash, but payments for thecorresponding payroll deductions have not been made and employer taxes have not yet beenrecorded.b. Collected rent revenue of $1,500 on December 10 for office space that Sandler rented toanother business. The rent collected was for 30 days from December 11 to January 10 and wascredited in full to Unearned Revenue.Required:1. Give the entries required on December 31 to record payroll.2. Give ( a ) the journal entry for the collection of rent on December 10 and ( b ) the adjusting journal entry on December 31.3. Show how any…arrow_forwardOn January 15, the end of the first biweekly pay period of the year, North Company;s payroll register showed that its employees earned $48,000 of sales salaries. Withholdings from the employees; salaries include FICA Social Security taxes at the rate of 6 2%, FICA Medicare taxes at the rate of 145%, $3.100 of federal income taxes, $1,037 of medical insurance deductions, and $130 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company39;s January 15 (employee) payroll expenses and iabilities View transaction list Journal entry worksheet Record the employee payroll for period Notei Enter debits baface Credts, Date General Journal Debit Credit Jan 15 Sales saiañies expense 48,000 cA-Medicare faxes payable FICA Social sec taxes payable Employ es lfeinsurance payable Emoloyes unign dues payabls mplo ee fed inc tares payabearrow_forward

- Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Cumulative Pay Ken S $5,000 Tim V Steve S 43,400 90,000 Employee Michelle W Michael M. Zach R Cumulative Pay $146,500 109,900 131,400 Employee Lori K Kitty O John W Cumulative Pay $133,900 39,900 7,000 a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes.arrow_forwardDuring the month of January, an employee earned $5, 800 of salary. Withholdings from the employee's salary consist of FICA Social Security taxes of $359.60, FICA Medicare taxes of $84.10, federal income taxes of $617.70, and medical insurance deductions of $246.50. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid in early February. Note: Round your final answers to 2 decimal places.arrow_forwardLakeview Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($80,000), payroll deductions for income tax ($8,000), payroll deductions for FICA ($6,000), payroll deductions for American Cancer Society ($3,000), employer contributions for FICA (matching), and state and federal unemployment taxes ($600). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded. b. Collected rent revenue of $6,000 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Deferred Revenue. Required: 1. & 2. Prepare the journal entries to record payroll on December 31, the collection of rent on December 10 and adjusting journal entry on December 31. 3. Show how any of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education