Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

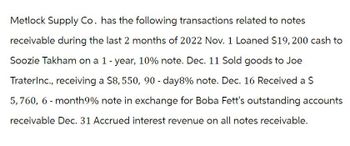

Transcribed Image Text:Metlock Supply Co. has the following transactions related to notes

receivable during the last 2 months of 2022 Nov. 1 Loaned $19,200 cash to

Soozie Takham on a 1 - year, 10% note. Dec. 11 Sold goods to Joe

TraterInc., receiving a $8,550, 90-day8% note. Dec. 16 Received a $

5,760, 6-month 9% note in exchange for Boba Fett's outstanding accounts

receivable Dec. 31 Accrued interest revenue on all notes receivable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forward

- Assume Takham dishonors its note at its maturity in 2023; Oriole expects to eventually collect the note. Record the dishonor of the Takham note. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries) Date 2023 Account Titles and Explanation Debit Creditarrow_forwardPresley Supply Co. has the following transaction related to notes receivable during the last 2 months of 2020. Nov. 1 Loaned $30,000 cash to Logan Ransey on a 1-year, 10% note. Dec. 11 Sold goods to be Joe Noland, Inc., receiving a $9,000, 90-day, 8% note. 16 Received a $4,000, 6-month, 9% note in exchange for Jane Brock's outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Journalize the above transactions for Presley Supply Co. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round interest to the nearest dollar.) (b) Date Account Titles and Explanation Nov. 1 Notes Receivable Cash Dec. 11 Notes Receivable Sales Revenue 16 Notes Receivable Accounts Receivable 31 Interest Receivable Interest Revenue eTextbook and Media Solution List of Accounts Debit 30000 9000 4000 667 Credit 30000 9000 4000 667 Attempts: 3 of 3 used Record the…arrow_forwardJasmine's Supply Co. has the following transactions related to notes receivable during the last 2 months of 2020. Nov. 1 Loaned $24,000 cash to Simone Buil on a 1-year, 7% note. Dec. 11 Sold goods to Dac Jo, Inc., receiving a $12,000, 90-day, 3% note. 16 Received an $18,000, 6-month, 8% note in exchange for Jason Tanner's outstanding accounts receivable. 31 Accrued interest revenue on all notes receivable. Instructions (a) Journalize the transactions for Jasmine's Supply Co. (b) Record the collection of the Buil note at its maturity in 2021.arrow_forward

- Dynatech Supply Corp. has the following selected transactions for notes receivable. Nov. 1 Lent $141,100 cash to A. Bouchard on a one-year, 9% note. Sold goods to Wright Inc., receiving a two-month, 6%, $31,000 note. Interest is due at maturity. The goods cost $19,344. 1 Dec. Received a six-month, 6%, $34,080 note in exchange for an account from Aquilina Corporation. Interest is due at maturity. 15 Feb. 1 Collected the amount owing on the Wright note. 28 Accrued interest on all notes receivable at year end. Assume that interest is calculated to the nearest half month. 28 Analyzed each note and estimated that uncollectible notes at year end totalled $25,544. Record the above transactions for Dynatech Supply Corp. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to the nearest whole…arrow_forwardSwifty Supply Co. has the following transactions related to notes receivable during the last 2 months of 2022. The company does not make entries to accrue interest except at December 31. Nov. 1 Loaned $30,000 cash to Manny Lopez on a 12 month, 10% note. Dec. 11 Sold goods to Ralph Kremer, Inc., receiving a $85,500, 90-day, 8% note. 16 Received a $87,840, 180 day, 10% note to settle an open account from Joe Fernetti. 31 Accrued interest revenue on all notes receivable. 1. Journalize the transactions for Swifty Supply Co. (Ignore entries for cost of goods sold. 2. Record the collection of the Lopez note at its maturity in 2023.arrow_forwardHello, How do I write the entries for this question? Thanksarrow_forward

- Sheridan Supply Co. has the following transactions related to notes receivable during the last 2 months of 2022. The company does not make entries to accrue interest except at December 31. Nov. 1 Dec. 11 16 31 Loaned $21,600 cash to Manny Lopez on a 12 month, 10% note. Sold goods to Ralph Kremer, Inc., receiving a $54,000, 90-day, 8% note. Received a $53,280, 180 day, 10% note to settle an open account from Joe Fernetti. Accrued interest revenue on all notes receivable.arrow_forwardMetlock Supply Co. has the following transactions related to notes receivable during the last 2 months of 2022. The company does not make entries to accrue interest except at December 31. Nov. 1 Dec. 11 (a) 16 31 Loaned $18,500 cash to Manny Lopez on a 12 month, 12% note. Sold goods to Ralph Kremer, Inc., receiving a $45,000, 90-day, 10% note. Received a $47,600, 180 day, 12% note to settle an open account from Joe Fernetti. Accrued interest revenue on all notes receivable. Journalize the transactions for Metlock Supply Co. (Ignore entries for cost of goods sold.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Use 360 days for calculation. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Date Nov. 1 Dec. 11 Dec. 16 Dec. 31 ETEXLUUUK and Media Account Titles and Explanation Debit Creditarrow_forwardElburn Supply Co. has the following transactions related to notes receivable during the last 2 months of 2022. The company does not make entries to accrue interest except at December 31. Nov. 1 Dec. 11 16 31 Loaned $30,000 cash to Manny Lopez on a 12 month, 10% note. Sold goods to Ralph Kremer, Inc., receiving a $6,750, 90-day, 8% note. Received a $4,000, 180 day, 9% note to settle an open account from Joe Fernetti. Accrued interest revenue on all notes receivable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College