FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

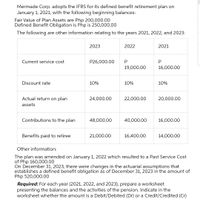

Transcribed Image Text:Mermade Corp. adopts the IFRS for its defined benefit retirement plan on

January 1, 2021, with the following beginning balances:

Fair Value of Plan Assets are Php 200,000.00

Defined Benefit Obligation is Php is 250,000.00

The following are other information relating to the years 2021, 2022, and 2023:

2023

2022

2021

Current service cost

P26,000.00

P

19,000.00

16,000.00

Discount rate

10%

10%

10%

Actual return on plan

24,000.00

22,000.00

20,000.00

assets

Contributions to the plan

48,000.00

40,000.00

16,000.00

Benefits paid to retiree

21,000.00

16,400.00

14,000.00

Other information:

The plan was amended on January 1, 2022 which resulted to a Past Service Cost

of Php 160,000.00

On December 31, 2023, there were changes in the actuarial assumptions that

establishes a defined benefit obligation as of December 31, 2023 in the amount of

Php 520,000.00

Required: For each year (2021, 2022, and 2023), prepare a worksheet

presenting the balances and the activities of the pension. Indicate in the

worksheet whether the amount is a Debit/Debited (Dr) or a Credit/Credited (Cr)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Information regarding the defined-benefit pension plan of Lopez Products included the following for 2024 ($ in millions): December 31: Projected benefit obligation (PBO) Accumulated benefit obligation (ABO) Plan assets Pension expense $ 85 75 50 8 No contributions were made to the pension plan assets during 2024. At December 31, 2024, what amount should Lopez report as its net pension liability? Multiple Choice О $27 million $10 millionarrow_forwardBb.47.arrow_forwardOn January 1, 2021, Pharoah Co. has the following balances: Projected benefit obligation Fair value of plan assets Service cost The settlement rate is 11%. Other data related to the pension plan for 2021 are: $3700000 Benefits paid Actual return on plan assets Amortization of net gain 3200000 Amortization of prior service costs due to increase in benefits Contributions O $3644000. O $3890000. O $4115000. O $3700000. The fair value of plan assets at December 31, 2021 is $320000 108000 520000 245000 415000 34000arrow_forward

- Current Attempt in Progress Blossom Company provides the following information about its defined benefit pension plan for the year 2020. $ 89,400 Service cost Contribution to the plan 104,800 Prior service cost amortization 9,700 Actual and expected return on plan assets 64,400 Benefits paid 40,800 Plan assets at January 1, 2020 627,300 Projected benefit obligation at January 1, 2020 697,700 Accumulated OCI (PSC) at January 1, 2020 149,700 Interest/discount (settlement) rate 10 % Compute the pension expense for the year 2020. Pension expense for 2020arrow_forwardBb.24.arrow_forwardThe following information pertains to a defined benefit pension plan that Arora Inc. sponsors in 2020. PBO balance, January 1, 2020 $160,000 Service cost 19,000 Interest cost 11,200 Prior service cost adjustment based on past service, January 1, 2020 30,000 Amortization of prior service cost 3,000 Actuarial gain on PBO 6,000 Benefits paid to retirees 2,500 Contributions to plan 18,000 What is the PBO balance on December 31, 2020? Select one: a. $228,700 b. $216,700 c. $211,700 d. $193,700arrow_forward

- Pharoah Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2024, with the following beginning balances: plan assets $202,100; projected benefit obligation $247,000. Other data relating to 3 years' operation of the plan are as follows. Annual service cost Settlement rate and expected rate of return Actual return on plan assets Annual funding (contributions) Benefits paid Prior service cost (plan amended, 1/1/25) Amortization of prior service cost Change in actuarial assumptions establishes a December 31, 2026, projected benefit obligation of: (a) (b) Date Dec. 31, 2024 Dec. 31, 2025 Dec. 31, 2026 V Account Titles and Explanation Pension Expense Other Comprehensive Income (G/L) Cash Pension Asset/Liability Pension Expense Other Comprehensive Income (PSC) Cash Pension Asset/Liability Pension Asset/Liability Other Comprehensive Income (G/L) Other Comprehensive Income (PSC) 2024 $16,100 Prepare the journal entries (from the worksheet) to reflect all…arrow_forwardnku.9arrow_forward3b. The following information is available for the pension plan of Vaughn Company for the year 2020. Actual and expected return on plan assets $ 14,700 Benefits paid to retirees 40,800 Contributions (funding) 81,100 Interest/discount rate 10 % Prior service cost amortization 7,600 Projected benefit obligation, January 1, 2020 458,000 Service cost 63,900 (a) Your answer has been saved. See score details after the due date. Compute pension expense for the year 2020. Pension expense for 2020 $enter pension expense for 2017 in dollars Attempts: 1 of 1 used (b) Prepare the journal entry to record pension expense and the employer’s contribution to the pension plan in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for…arrow_forward

- On January 1, 2022, Seascape Ltd. reported the following balances relating to their defined benefit pension plan. Seascape Ltd. uses ASPE. Defined benefit obligation $ 2,100,000 Fair value of plan assets. 1,900,000 Other data related to the pension plan for 2022 are: Current service cost 110,000 Contributions to the plan 105,000 Benefits paid.. 180,000 Actual return on plan assets. 142,000 Interest (discount) rate 7% Past service costs, Jan 1 120,000 Actuary adjustment, Dec 31 220,000 Pension Asset/Liability account on Balance Sheet Instructions a) Calculate the defined benefit obligation at December 31, 2022. b) Calculate the fair value of plan assets at December 31, 2022. c) Calculate pension expense for 2022. d) Prepare the journal entries to record the pension expense and the contributions for 2022. e) How would your answer be different if the company used IFRS? f) What is the funded status of the plan on December 31, 2022? Indicate whether it is underfunded or overfunded.arrow_forward10... 10... Headland Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $201,400; projected benefit obligation $245,000. Other data relating to 3 years’ operation of the plan are as follows. 2019 2020 2021 Annual service cost $15,800 $19,400 $26,100 Settlement rate and expected rate of return 10 % 10 % 10 % Actual return on plan assets 18,000 22,150 24,000 Annual funding (contributions) 15,800 40,000 47,500 Benefits paid 13,700 16,500 20,800 Prior service cost (plan amended, 1/1/20) 160,000 Amortization of prior service cost 53,800 41,700 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 522,200 Prepare a pension worksheet presenting all 3 years’ pension balances and activities. (Enter all amounts as…arrow_forwardSandhill Company provides the following selected information related to its defined benefit pension plan for 2025. Pension asset/liability (January 1) $25.500 Cr. Accumulated benefit obligation (December 31) 403,100 Actual and expected return on plan assets 9,000 Contributions (funding) in 2025 148,600 Fair value of plan assets (December 31) 795,800 Settlement rate 10% Projected benefit obligation (January 1) 702.800 Service cost 79.580 (a1) Your answer is correct. Compute pension expense. Pension expense for 2025 $ 140860 i Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2025. Preparation of a pension worksheet is not required. Benefits paid in 2025 were $39,100. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education