FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Compute pension expense for the year 2025.

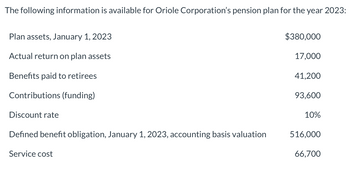

Transcribed Image Text:The following information is available for Oriole Corporation's pension plan for the year 2023:

Plan assets, January 1, 2023

Actual return on plan assets

Benefits paid to retirees

Contributions (funding)

Discount rate

Defined benefit obligation, January 1, 2023, accounting basis valuation

Service cost

$380,000

17,000

41,200

93,600

10%

516,000

66,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How much are Coca-Cola’s Projected Benefit obligation and accumulated benefit obligation at December 31, 2017, for its Pension Benefits plans?arrow_forwardPrepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardSandhill Corporation reports the following January 1, 2023 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $460,000; defined benefit obligation, $460,000. Other data relating to three years of operation of the plan are as follows: 2023 2024 2025 Annual service cost $34,800 $43,700 $58,600 Discount rate 10% 10% 10% Actual return on plan assets 37,100 50,040 54,000 Funding of current service cost 34,800 43,700 58,600 Funding of past service cost 74,000 78,500 Benefits paid 31,500 37,490 49,000 Past service cost (plan amended, 1/1/24) 348,000 Change in actuarial assumptions establishes a December 31, 2025 defined benefit obligation of 1,196,000arrow_forward

- The pension worksheet for Carla Vista Industries is shown below. Carla Vista Industries Pension Worksheet General Journal Entries Memo Record Annual Pension Projected Pension Items Expense Cash Asset/ Liability Benefit Obligation Plan Assets Balance, Jan. 1, 2025 $22000 dr $259000 cr $281000 dr (a) Service Cost $63000 dr 63000 cr (b) Interest Cost 34000 dr 34000 CE (c) Actual Return 35000 cr 35000 dr (d) Contributions $49000 cr 49000 dr (e) Benefits ?? dr 22 cr Journal Entry for 2025 $62000 dr $49000 cr 13000 cr Balance, Dec. 31, 2025 $9000. dr 22 $279000 What amount of benefits were paid during 2025? O $63000 O $86000 O $49000 O $62000arrow_forwardHi, can someone help me with this please?arrow_forwardPlease provide proper tables for each requirement. For the spreadhseet as well as the journal entries so it is easy to understand. Tables with titles and calculations and accounts etc.arrow_forward

- Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2024: Prior service cost at January 1, 2024, from plan amendment at the beginning of 2022 (amortization: $4 million per year) Net loss-pensions at January 1, 2024 (previous losses exceeded previous gains) Average remaining service life of the active employee group Actuary's discount rate ($ in millions) Beginning of 2024 Service cost Interest cost, 8% Loss (gain) on PBO Less: Retiree benefits End of 2024 Beginning of 2025 Service cost PBO $ 300 48 Interest cost, 8% Loss (gain) on PBO Less: Retiree benefits End of 2025 24 (2) (20) $ 350 PBO $ 350 38 28 5 Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2025: ($ in millions) (16) Beginning of 2024 Return on plan assets, 7.5% (10% expected) $ 405 Cash contributions Less: Retiree benefits End of 2024 Beginning of 2025 Return on plan assets, 15% (10% expected) $…arrow_forwardPharoah Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. ProjectedBenefitObligation PlanAssetsValue 2019 $2,340,000 $2,223,000 2020 2,808,000 2,925,000 2021 3,451,500 3,042,000 2022 4,212,000 3,510,000 The average remaining service life per employee in 2019 and 2020 is 10 years and in 2021 and 2022 is 12 years. The net gain or loss that occurred during each year is as follows: 2019, $327,600 loss; 2020, $105,300 loss; 2021, $12,870 loss; and 2022, $29,250 gain. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.)Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the four years, setting up an appropriate schedule.arrow_forwardSunland Toothpaste Company initiates a defined benefit pension plan for its 50 employees on January 1, 2020. The insurance company which administers the pension plan provided the following selected information for the years 2020, 2021, and 2022. For Year Ended December 31, 2020 2021 2022 Plan assets (fair value) $50,000 $85,000 $180,200 Accumulated benefit obligation 44,700 165,300 289,100 Projected benefit obligation 60,000 200,400 326,100 Net (gain) loss (for purposes of corridor calculation) 78,800 83,971 Employer's funding contribution (made at end of year) 50,000 60,000 105,100 There were no balances as of January 1, 2020, when the plan was initiated. The actual and expected return on plan assets was 10% over the 3-year period, but the settlement rate used to discount the company's pension obligation was 13% in 2020, 11% in 2021, and 8% in 2022. The service cost component of net periodic pension expense amounted to the following: 2020, $60,000; 2021, $85,000; and 2022, $118,000.…arrow_forward

- Any past service costs should be included in the a) pension expense of past periods. b) pension expense of the current period. c) pension expense of current and future periods. d) plan assets.arrow_forwardMukharrow_forwardIn accounting for a defined-benefit pension plan __the expense recognized each period is equal to the cash contribution. ___the liability is determined based upon known variables that reflect future salary levels promised to employees. __the employer's responsibility is simply to make a contribution each year based on the formula established in the plan. __an appropriate funding pattern must be established to ensure that enough monies will be available at retirement to meet the benefits promised.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education