FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

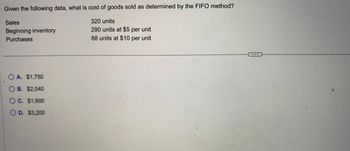

Transcribed Image Text:Given the following data, what is cost of goods sold as determined by the FIFO method?

Sales

Beginning inventory

Purchases

OA. $1,750

O B. $2,040

O C. $1,600

OD. $3,200

320 units

290 units at $5 per unit

88 units at $10 per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 14: You are given the following information about LM Company: Beginning inventory $210,000 Net Purchases 600,000 Net Sales 900,000 Sales return 75,000 Gross profit percentage of sales 30% Using the gross profit method, the estimated ending inventory is: a. $450,000. b. 630,000. c. $810,000. d. $180,000.arrow_forwardDate Transaction Number of Units Unit Cost & 1 Beginning inventory 400 $10 8/3 Purchase No. 1 600 $10 85 Sale No. 1 500 817 Sale No. 2 200 8/11 Purchase No. 2 800 $12 8/17 Sale No. 3 1900 8/19 Purchase No. 3 1500 $11 8/21 Sale No. 4 I 800 8/28 Sale No. 5 500 8/29 Purchase No. 4 900 $10 8/30 Ending inventory Required: Determine the amount of the ending inventory and cost of goods sold under of the following methods assuming the periodic inventory system. Method Weighted-average b FIFO S each Inventory Cost of Goods Sold $ $arrow_forwardSheldon Company's inventory records for the most recent year contain the following data: E (Click the icon to view the data.) Sheldon Company sold a total of 18,600 units during the year. Read the requirements. ..... Requirement 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. (Round the average cost per unit to the nearest cent.) Average-cost method cost of goods sold = 156,240 Average-cost method ending inventory = 2$ 11,760 Requirement 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. FIFO method cost of goods sold = $ 154,000 FIFO method ending inventory = $ 14,000 Requirement 3. Using the LIFO method, compute the cost of goods sold and ending inventory for the year. LIFO method cost of goods sold = LIFO method ending invetory =arrow_forward

- ces aw 11 Given the following: F1 January 1 inventory April 1 June 1 November 1 Cost of ending inventory 5_1442....jpg Cost of goods sold a. Calculate the cost of ending inventory using the LIFO (ending inventory shows 68 units). (@ F2 Number purchased 47 67 57 62 233 #3 b. Calculate the cost of goods sold using the LIFO (ending inventory shows 68 units). 80 F3 Cost per unit $5 8 $ 4 10 900 000 F4 15 Total $ % 235 536 513 620 $1,904 FS 4 8arrow_forwardBRADY-LOMBARDI TROPHY COMPANY: Inventory Records for Year 20X1 Date Beg Inventory Purchases: Oct 01, 20X1 Oct 05, 20X1 Oct 10, 20X1 Oct 15, 20X1 Oct 20, 20X1 Total Inventory Total Sold Retail Price Cost of Goods Available for Sale (COGAFS) # units Cost/Unit O c. $40,000 O d. $34,400 O e. $78,100 100 $ 200 $ 100 $ 150 $ 90 $ 220 $ 900 580units sold $500per unit 100 110 120 130 150 160 S COGAFS 10,000 $ 22,000 $ 12,000 $ 19,500 $ 13,800 $ 35,200 $ 112,500 Applying the Weighted Average (WA) Method to cost Inventory: Calculate Ending Inventory ROUND ANSWERS TO NEAREST $ (if applicable) a. $72,500 O b. $112,500.arrow_forwardPlease given answerarrow_forward

- 8arrow_forwardGiven correct answerarrow_forwardLower-of-Cost-or-Market Method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Item Inventory Quantity JFW1 SAW9 X 69 131 Cost per Unit $50 26 Market Value per Unit (Net Realizable Value) $45 30arrow_forward

- Nonearrow_forwardProblem 1 - Inventory Methods Magic Jelly Beans Company Operating information Sales Price per case $ 150.00 Unit Unit Extended Quantity $ Price Cost $$$ Beginning Inventory 2,000 $ 90.00 $ 180,000.00 Purchased Units 7,000 $ 110.00 $ 770,000.00 Sold 2,000 Sold 4,000 Purchased Units 10,000 $ 130.00 $ 1,300,000.00 Purchased Units 4,000 $ 135.00 $ 540,000.00 Sold 6,000 Sold Units 5,000 Fixed Selling General and Administrative costs $ 75,000.00 Income Tax rate 35% Requirement: Calculate the Cost Flow assumptions for Revenue, Cost of Goods Sold, SGA Income Tax, Net Income and Ending Inventory…arrow_forward5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education