FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

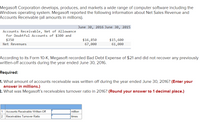

Transcribed Image Text:Megasoft Corporation develops, produces, and markets a wide range of computer software including the

Windows operating system. Megasoft reported the following information about Net Sales Revenue and

Accounts Receivable (all amounts in millions).

June 30, 2016 June 30, 2015

Accounts Receivable, Net of Allowance

for Doubtful Accounts of $300 and

$350

$16,850

67,000

$15,600

61,000

Net Revenues

According to its Form 10-K, Megasoft recorded Bad Debt Expense of $21 and did not recover any previously

written-off accounts during the year ended June 30, 2016.

Required:

1. What amount of accounts receivable was written off during the year ended June 30, 2016? (Enter your

answer in millions.)

2. What was Megasoft's receivables turnover ratio in 2016? (Round your answer to 1 decimal place.)

1. Accounts Receivable Written-Off

2. Receivables Turnover Ratio

million

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer all or skiparrow_forward1) Past experience indicates that 2% of net credit sales will eventually be uncollectible for the Elmerez Rental Company. Selected general ledger account balances at December 31, 2007, and December 31, 2008, appear below: 2007 2008 Sales $421,000 $526,500 Sales returns and allowances 21,000 26,500 Accounts Receivable 80,000 100,000 Allowance for Doubtful Accounts 3,000 Instructionsarrow_forwardI'm studying for a test and I want to know how to do each question for it, can you walk me through step by step how to solve this one? The following data concern XYZ Corporation for 2018:Bad debts expense for the year 11,000Accounts receivable—December 31, 2018 235,000Credit sales during the yearAllowance for doubtful accounts—December 31, 20181,600,00018,000 Calculate the net realizable value of the accounts receivable.arrow_forward

- During 2014, SABA Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2014, the balance of Accounts Receivable was $1,400,000 and Allowance for Uncollectible Accounts had a debit balance of $48,000. SABA Company’s management uses two methods of estimating uncollectible accounts expense: the percentage of net sales method and the accounts receivable aging method. The percentage of uncollectible sales is 1.5 percent of net sales, and based on an aging of accounts receivable, the end-of-year uncollectible accounts total $140,000. Show your computations.arrow_forwardSoftee Sodas and Patterson Beverage Company are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Softee Sodas Patterson Beverage Company Fiscal Year Ended: 2018 2017 2016 2018 2017 2016 Net Sales $ 42,160 $ 46,840 $ 48,600 $ 85,696 $ 86,240 $ 72,900 Accounts Receivable 4,490 4,810 5,030 8,400 8,310 7,930 Allowance for Doubtful Accounts 640 630 620 100 130 140 Accounts Receivable, Net of Allowance 3,850 4,180 4,410 8,300 8,180 7,790 Required: 1. Calculate the receivables turnover ratios and days to collect for Softee Sodas and Patterson Beverage Company for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in…arrow_forwardThe following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, n/45. Accounts receivable, end of year Sales on account 20Y3 $ 725,000 5,637,500 2012 $ 650,000 4,687,500 20Y1 $600,000 Horizontally analyze the financial data in Exercise 17-9. (b) Calculate how many days it took Sigmon Inc. to collect its recieivables (i.e. Sigmon's average collection period) in 20Y3. Show your work.arrow_forward

- es Fizzy Sodas and Hayes Companies are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Fiscal Year Ended: Net Sales Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net of Allowance 2018 $ 40,630 4,410 620 3,790 Fizzy Sodas 2017 $ 45,120 4,710 610 4,100 2016 $ 47,640 4,930 600 4,330 2018 $ 82,416 8,240 100 8,140 Hayes Companies 2017 $82,945 8,150 130 8,020 Required: 1. Calculate the receivables turnover ratios and days to collect for Fizzy Sodas and Hayes Companies for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in 2017? 2016 $ 71,470 7,770 140 7,630arrow_forwardA company had the following sales transactions: 1. Total debit card sales = $280,000. 2. Total credit card sales = $410,000. 3. Total cash sales = $840,000. 4. Total check sales = $160,000. There is a charge of 3% on all credit card transactions. There is no charge on debit card transactions. Calculate total sales revenue recorded for the year. Sales revenuearrow_forwardPlease help me solve itarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education