FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

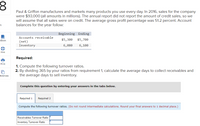

Transcribed Image Text:Paul & Griffon manufactures and markets many products you use every day. In 2016, sales for the company

were $93,000 (all amounts in millions). The annual report did not report the amount of credit sales, so we

will assume that all sales were on credit. The average gross profit percentage was 51.2 percent. Account

balances for the year follow:

ES

Beginning Ending

Accounts receivable

eBook

$5,300

$5,700

(net)

Inventory

6,080

6,100

Hint

Required:

Print

1. Compute the following turnover ratios.

2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and

the average days to sell inventory.

Ferences

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to

sell inventory. (Round your intermediate calculations and final answers to 1 decimal place.)

Average Days to Collect Receivables

Average Days to Sell Inventory

days

days

00

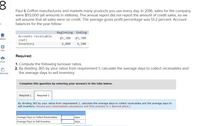

Transcribed Image Text:Paul & Griffon manufactures and markets many products you use every day. In 2016, sales for the company

were $93,000 (all amounts in millions). The annual report did not report the amount of credit sales, so we

will assume that all sales were on credit. The average gross profit percentage was 51.2 percent. Account

balances for the year follow:

ts

Beginning Ending

Accounts receivable

ЕВook

$5,300

$5,700

(net)

Inventory

6,080

6,100

Hint

Required:

Print

1. Compute the following turnover ratios.

2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and

the average days to sell inventory.

ferences

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the following turnover ratios. (Do not round intermediate calculations. Round your final answers to 1 decimal place.)

Receivables Turnover Ratio

Inventory Turnover Ratio

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- To answer the following questions, use the following information. Round to 1 decimal place for percentages. 2018 2017 2016 Cost of merchandise sold 20,441 19,038 17,405 Inventories 5,261 5,055 4,838 Required: A. Calculate the inventory turnover for the Years 2017 and 2018. B. Calculate the days' sales in inventory for the Years 2017 and 2018. C. Is the change in both the inventory turnover and the days' sales in inventory from 2017 to 2018 favorable or is it unfavorable? Explain your answer.arrow_forwardPlease help mearrow_forwardExplain how to do the problem.arrow_forward

- Gary & Company uses a perpetual inventory system. The following information is available for November: Nov. 1 4 7 10 Sale Inventory Purchase Purchase 12 Sale Units 60 120 120 (60) (130) Purchase Sales Price Price $5 $5.50 $9 $10 $10arrow_forwardplease answer part C and part D but not in image formatarrow_forwardhow do i calculate the gross prfoit rate under each tab ( LIFO,FIFO AVERAGE-COST) base off the attachment?arrow_forward

- fast urgent.arrow_forwardReview the following: Data Table Cost of Goods Sold $101 Gross Sales 181 Sales Returns and Allowances 16 Sales Discounts 21 Operating Expenses 47 From the information provided, calculate: a. Gross profit b. Net income or net loss Calculate (a) Gross profit. - = Gross profit - = Calculate (b) Net income or net loss. (Use parentheses or a minus sign to show a net loss.) - = Net income or net loss - =arrow_forwardSolve for the missing information designated by "?" in the following table. (Use 365 days in a year. Round the inventory turnover ratio to one decimal place before computing days to sell. Round days to sell to one decimal place.) Case Beginning Inventory Purchases Cost of Goods Sold Ending Inventory Inventory Turnover Ratio Days to Sell a. $ 130 $ 730 $ 690 b $ 230 $ 1,320 C $ 1,120 $ 135 6.6 32.6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education