Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

MCQ

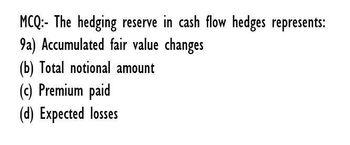

Transcribed Image Text:MCQ: The hedging reserve in cash flow hedges represents:

9a) Accumulated fair value changes

(b) Total notional amount

(c) Premium paid

(d) Expected losses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- TRUE OR FALSE 6. Amortized cost liabilities are subsequently measured at the present value of the cash outflows from the instrument.arrow_forwardHow is the impact of uncertainty reflected in a discounted cash flow (DCF) analysis?a) Debt/equity mixb) Discount ratec) Income tax rated) Interest coverage ratioarrow_forward7. Conceptually all liabilities should be reported on the balance sheet at a. the present value of the future outlays they require b. their maturity value c. face amount d. their current cash equivalent amountarrow_forward

- Which of the following discounts future cash flows to their present value at the expected rate of return, and compares that to the Initial Investment? A. internal rate of return (IRR) method B. net present value (N PV) C. discounted cash flow model D. future value methodarrow_forwardA series of equal cash flows at fixed intervals is termed a(n) a. price-level index b. present value index c. annuity d. net cash flowarrow_forwardUnder IFRS, value-in-use is defined as: a. net realizable value. b. fair value. c. future cash flows discounted to present value. d. total future undiscounted cash flows.arrow_forward

- ,Match the following terms with the appropriate definition.Effective yield or interest rateMonetary liabilityCompound interestPresent ValueFuture value of a single amountA.Fixed obligation to pay an amount in cash.B.The rate at which money will actually grow.C.Interest accumulates on interest.D.Current worth of future cash flows.E.The money to which an amount invested will grow over time.arrow_forwardDefine the term reinvestment rate and describe how it differs for any cash flow series between (1) a PW value calculated at the MARR, and (2) the IROR value i*.arrow_forwardWhich figure of merit provides an interest rate at which the present value of the future cash flows equals the amount invested? a) NPV b) IRR c) Cap Rate d) DCF Please ensure accuracy and explain your choicearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning