Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What would have been the income before income taxes

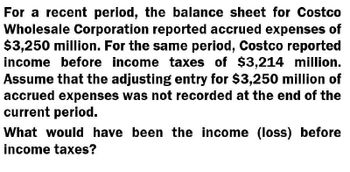

Transcribed Image Text:For a recent period, the balance sheet for Costco

Wholesale Corporation reported accrued expenses of

$3,250 million. For the same period, Costco reported

income before income taxes of $3,214 million.

Assume that the adjusting entry for $3,250 million of

accrued expenses was not recorded at the end of the

current period.

What would have been the income (loss) before

income taxes?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dudley Company failed to recognize the following accruals. It also recorded the prepaid expenses and unearned revenues as expenses and revenues, respectively', in the following year when paid or collected. The reported pretax income was 20,000 in 2018, 25,000 in 2019, and 23,000 in 2020. Required: 1. Compute the correct pretax income for 2018, 2019, and 2020. 2. Prepare the journal entries necessary in 2020 if the errors are discovered at the end of that year. Ignore income taxes. 3. Prepare the journal entries necessary in 2021 if the errors are discovered at the end of that year. Ignore income taxes.arrow_forwardCullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $1,125,000. In the third quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is $6,250,000, and taxable income is expected in all future years.arrow_forwardPrepare the bottom portion of Sheridan's 2021 income statement, beginning with "Income from continuing operations before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) For the Year Ended December 31, 2021 icome from Continuing Operations before Income Taxes 1164000 ncome Tax Expense Current Deferred 189000 ncome from Continuing Operations Gain on Discontinued Operations 195000 Less -39000 156000 let Income / (Loss) %24 %24 > >arrow_forward

- In a recent year, Crane Corporation reported net income of $205800, interest expense of $47000, and income tax expense of $95000. What was Crane's times interest earned for the year? 6.4 O 5.4 O 7.4 O 4.4arrow_forwardPlease answer it in good accounting formarrow_forwardIndicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. Federal income tax due for the previous year is paid.arrow_forward

- Prepare the bottom portion of Sheridan's 2021 income statement, beginning with “Income from continuing operations before income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) For the Year Ended December 31, 2021 ncome from Continuing Operations before Income Taxes 1164000 ncome Tax Expense Current $ Deferred 189000 ncome from Continuing Operations Gain on Discontinued Operations 195000 Less v: -39000 i 156000 let Income / (Loss) $ %24 %24 > >arrow_forwardDraft the income tax expense portion of the income statement for 2024. Begin with the line "Income before income taxes." Assume no permanent differences exist. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) WILDHORSE INC.'s Income Statement (Partial) For the Year Ended December 31, 2024 Income before Income Taxes Income Tax Expense Adjustment Current Net Income/(Loss) +A +A 1665000 i LA 5550000arrow_forwardFor its fiscal year ending October 31, 2022, Pina Colada Corp. reports the following partial data shown below. Income before income taxes Income tax expense (20% x $382,200) Income from continuing operations Loss on discontinued operations Net income $491,400 76,440 414,960 109,200 $305,760 The loss on discontinued operations was comprised of a $45,500 loss from operations and a $63,700 loss from disposal. The income tax rate is 20% on all items. Prepare a correct statement of comprehensive income, beginning with income before income taxes. PINA COLADA CORP. Partial Statement of Comprehensive Income V V V >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning