FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

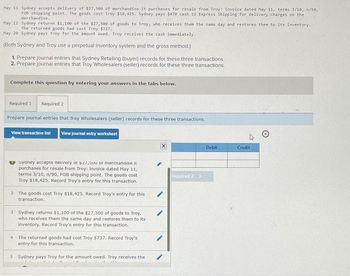

Transcribed Image Text:May 11 Sydney accepts delivery of $27,500 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90,

FOB shipping point. The goods cost Troy $18,425. Sydney pays $470 cash to Express Shipping for delivery charges on the

merchandise.

May 12

Sydney returns $1,100 of the $27,500 of goods to Troy, who receives them the same day and restores them to its inventory..

The returned goods had cost Troy $737.

May 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately.

(Both Sydney and Troy use a perpetual inventory system and the gross method.)

1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.

View transaction list View journal entry worksheet

2

Syaney accepts delivery or $27,50U or mercnanaise it

purchases for resale from Troy: invoice dated May 11,

terms 3/10, n/90, FOB shipping point. The goods cost

Troy $18,425. Record Troy's entry for this transaction.

4

The goods cost Troy $18,425. Record Troy's entry for this

transaction.

3 Sydney returns $1,100 of the $27,500 of goods to Troy,

who receives them the same day and restores them to its

inventory. Record Troy's entry for this transaction.

The returned goods had cost Troy $737. Record Troy's

entry for this transaction.

5 Sydney pays Troy for the amount owed. Troy receives the

EX

Required 2 D

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $22,500 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $15,075. Sydney pays $580 cash to Express Shipping for delivery charges on the merchandise. May 12 Sydney returns $1,200 of the $22,500 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $804. May 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately. (Both Sydney and Troy use a perpetual inventory system and the gross method.) 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions. 2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries that Sydney…arrow_forwardPharoah Company sells merchandise on account for $3600 to Morton Company with credit terms of 2/14, n/30. Morton Company returns $600 of merchandise that was damaged, along with a check to settle the account within the discount period. What entry does Pharoah Company make upon receipt of the check? Cash 2940 Sales Returns and Allowances 600 Sales Discounts 60 Accounts Receivable 3600 Cash 2940 Sales Returns and Allowances 660 Accounts Receivable 3600 Cash 3000 Accounts Receivable 3000 Cash 3528 Sales Discounts 72 Sales Returns and Allowances 600 Accounts Receivable 3000arrow_forwardA seller uses a perpetual inventory system and on April 4 it sells $5,000 in merchandise with a cost of $2,400 to a customer on credit terms of 3/10, n/30.arrow_forward

- Please do not give image formatarrow_forwardRecord the transactions on the books of Martinez corporation.arrow_forwardOn July 2, 2021, Windsor Company sold to Sue Black merchandise having a sales price of $11,100 (cost $6,660) with terms of 2/10. n/30. f.o.b. shipping point. Windsor estimates that merchandise with a sales value of $810 will be returned. An invoice totaling $130, terms n/30, was received by Black on July 6 from Pacific Delivery Service for the freight cost. Upon receipt of the goods, on July 3, Black notified Windsor that $400 of merchandise contained flaws. The same day, Windsor issued a credit memo covering the defective merchandise and asked that it be returned at Windsor’s expense. Windsor estimates the returned items to have a fair value of $150. The freight on the returned merchandise was $20 paid by Windsor on July 7. On July 12, the company received a check for the balance due from Black. Prepare journal entries for Windsor Company to record all the events noted above assuming sales and receivables are entered at gross selling price. (Credit account titles are…arrow_forward

- Ace Company purchases $1,400 of merchandise from Zitco on December 16. Zitco accepts Ace’s $1,400, 90-day, 12% note as payment. Zitco’s accounting period ends on December 31. a. Prepare entries for Zitco on December 16 and December 31. b. Prepare Zitco’s March 16 entry if Ace dishonors the note. c. Instead of the facts in part b, prepare Zitco’s March 16 entry if Ace honors the note. d. Assume the facts in part b (Ace dishonors the note). Then, on March 31, Zitco writes off the receivable from Ace Company. Prepare that write-off entry assuming that Zitco uses the allowance method.arrow_forwardLittleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $3,300, terms 1/10, n/30. May3 Pays cash for freight costs of $200 on books purchased from Readers. May5 Returns books with a cost of $400 to Readers because part of the order is incorrect. May 10 Pays the full amount due to Readers. May 30 Sells all books purchased on May 2 (less those returned on May 5) for $4,000 on account. Questions: Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. Assume that payment to Readers is made on May 24 instead of May 10. Record this payment.arrow_forwardWhispering industries purchased $8,100 of merchandise on february 1, 2025, subject to a trade discount of 10% and with credit terms of 3/15, n/60. it returned $2,100 ( gross price before trade or cash discount) on february 4. the invoice was paid on february 13arrow_forward

- May 11 Sydney accepts delivery of $34,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $22,780. Sydney pays $350 cash to Express Shipping for delivery charges on the merchandise. 12 Sydney returns $1,400 of the $34,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $938. 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately. Both Sydney and Troy use a perpetual inventory system and the gross method.) 1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.arrow_forwardOn December 28, 20Y3, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $10,400. On December 31, 20Y3, Silverman prepared its adjusting entries, yearly financial statements, and closing entries. On January 3, 20Y4, Silverman Enterprises issued Beasley Co. a credit memo for returned merchandise. The invoice amount of the returned merchandise was $4,300 and the merchandise originally cost Silverman Enterprises $2,250. a. Journalize the entries by Silverman Enterprises to record the December 28, 20Y3 sale, using the net method under a perpetual inventory system. If an amount box does not require an entry, leave it blank. b. Journalize the entries by Silverman Enterprises to record the merchandise returned by Beasley Co. on January 3, 20Y4. If an amount box does not require an entry, leave it blank. c. Journalize the entry to record the receipt of the amount due by Beasley Co. on January 7, 20Y4. If an amount box…arrow_forwardApr. 20 Purchased $38,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8%, $35,000 note payable along with paying $3,000 in cash. July 8 Borrowed $57,000 cash from NBR Bank by signing a 120-day, 11%, $57,000 note payable. __?__ Paid the amount due on the note to Locust at the maturity date. __?__ Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $30,000 cash from Fargo Bank by signing a 60-day, 6%, $30,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education