FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

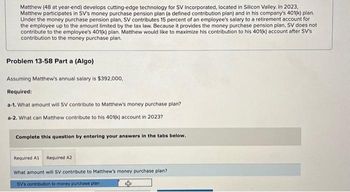

Transcribed Image Text:Matthew (48 at year-end) develops cutting-edge technology for SV Incorporated, located in Silicon Valley. In 2023,

Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan.

Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for

the employee up to the amount limited by the tax law. Because it provides the money purchase pension plan, SV does not

contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's

contribution to the money purchase plan.

Problem 13-58 Parta (Algo)

Assuming Matthew's annual salary is $392,000,

Required:

a-1. What amount will SV contribute to Matthew's money purchase plan?

a-2. What can Matthew contribute to his 401(k) account in 2023?

Complete this question by entering your answers in the tabs below.

Required A1 Required A2

What amount will SV contribute to Matthew's money purchase plan?

SV's contribution to money purchase plan

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Alicia has been working for JMM Corp. for 33 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2020. Before retirement, her annual salary was $645,000, $675,000, and $705,000 for 2017, 2018, and 2019. What is the maximum benefit Alicia can receive in 2020? Maximum benefit in 2020arrow_forward[The following information applies to the questions displayed below.] Matthew (48 at year-end) develops cutting-edge technology for SV Inc., located in Silicon Valley. In 2021, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. (Leave no answers blank. Enter zero if applicable.) Problem 13-54 Part b (Algo) Assuming Matthew's annual salary is $273,000, b-1. What amount will SV contribute to Matthew's money purchase plan? b-2. What can Matthew contribute to his 401(k) account in 2021? Complete this question by entering your…arrow_forward• Matthew is a 6th grade teacher at a public school. Matthew and Rebecca are married and choose to file Married Filing Jointly on their 2023 tax return. Matthew worked a total of 1,500 hours in 2023. During the school year, he spent $733 on unreimbursed classroom expenses. • Rebecca retired in 2020 and began receiving her pension on November 1st of that year. She explains that this is a joint and survivor annuity. She has already recovered $1, 259 of the cost of the plan. Matthew settled with his credit card company on an outstanding bill and brought the Form 1099 - C to the site. They aren't sure how it will impact their tax return for tax year 2023. The Monroes determined that they were solvent as of the date of the canceled debt. • Rebecca received $200 from Jury duty. Their daughter, Safari, is in her second year of college pursuing a bachelor's degree in Biochemistry at a qualified educational institution. She received a scholarship and the terms require that it be used to pay…arrow_forward

- Alicia has been working for JMM Corp. for 33 years. Alicia participates in JMM’s defined benefit plan. Under the plan, for every year of service for JMM she is to receive 2 percent of the average salary of her three highest years of compensation from JMM. She retired on January 1, 2019. Before retirement, her annual salary was $609,000, $639,000, and $669,000 for 2016, 2017, and 2018. What is the maximum benefit Alicia can receive in 2019?arrow_forwardThe XYZ corporation pension plan provides a lifetime annual income to its employees upon retirement at age 65. The plan provides 4% for each year of service of the employee's salary upon retirement. Moreover, those retiring after 65 have their benefit increased by 1.1% for each year beyond 65 that they work. Caitlin retires at age 73 with 16 years of service. If her salary upon retirement is $60, 106, what is her annual pension benefit?arrow_forwardChris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $79,200. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar.a. Compute the following: ChrisFiling Single HeatherFiling Single Gross income and AGI $fill in the blank 488588fb1f91034_1 $fill in the blank 488588fb1f91034_2 Standard deduction (single) fill in the blank 488588fb1f91034_3 fill in the blank 488588fb1f91034_4 Taxable income $fill in the blank 488588fb1f91034_5 $fill in the blank 488588fb1f91034_6 Income tax $fill in the blank 488588fb1f91034_7 $fill in the blank 488588fb1f91034_8…arrow_forward

- Alicia has been working for JMM Corporated for 32 years. Alicia participates in JMM’s defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2021. Before retirement, her annual salary was $570,000, $600,000, and $630,000 for 2018, 2019, and 2020. What is the maximum benefit Alicia can receive in 2021?arrow_forwardT3.arrow_forwardBarbara has worked for one employer her entire career. While she was working, she participated in the employer’s defined contribution plan [traditional 401(k)]. At the end of 2020, Barbara retires. The balance in her defined contribution plan is $4,000,000 at the end of 2019. Use the below provide abbreviated uniform lifetime table to answer the questions. a. What is Barbara’s required minimum distribution for 2020 that must be distributed in 2021 if she is 68 years old at the end of 2020? b. What is Barbara’s required minimum distribution for 2020 if she turns 72 during 2020? When must she receive this distribution? c. What is Barbara’s required minimum distribution for 2020 that must be distributed in 2021 if she turns 75 years old in 2020? d. Assuming that Barbara is 76 years old at the end of 2020 and her marginal tax rate is 32 percent, what amount of her distribution will she have remaining after taxes if she receives only a distribution of $50,000 for 2020?…arrow_forward

- Subject: acountingarrow_forwardA corporation's pension plan provides a lifetime annual income to its employees upon retirement at age 65. The plan provides 3% for each year of service of the employee's salary upon retirement. Those who retire before 65 have their benefit reduced by 1.3% for each year before 65 that they retire. Russ retires at age 61 with 29 years of service. If his salary upon retirement is $76,763, what is his annual pension benefit? Round your answer to the nearest dollar.arrow_forward17 For the past 4 years, Raj has belonged to a contributory defined benefit pension plan in a jurisdiction that has a two-year vesting provision. The time for vesting and locking-in coincide. Over the past four years, Raj's contributions, including interest, have amounted to $16,000 and his employer has contributed an equal amount. Raj has decided to leave his current job. What lump sum cash payment is Raj entitled to receive? a) $0 Ob) $8,000 Oc) $16,000 d) $32,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education