FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

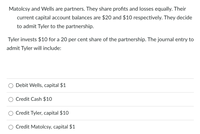

Transcribed Image Text:Matolcsy and Wells are partners. They share profits and losses equally. Their

current capital account balances are $20 and $10 respectively. They decide

to admit Tyler to the partnership.

Tyler invests $10 for a 20 per cent share of the partnership. The journal entry to

admit Tyler will include:

Debit Wells, capital $1

Credit Cash $10

Credit Tyler, capital $10

O Credit Matolcsy, capital $1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- John, Mary and Steven are partners. The capital accounts of each partner on December 31, 2022 are $100,000, $200,000 and $300,000, respectively. The partners have agreed to share profits and loss in proportion to their capital accounts. The partnership decides to buy out Steven's partnership interest. Requirements 1. Journal the purchase for cash of Steven's partnership interest for $345,000. 2. Journal the purchase for cash of Steven's partnership interest for $240,000.arrow_forwardDonald and Landry are partners who share income and losses in the ratio of 3:2, respectively. On August 31, their capital balances were: Donald, $145000 and Landry, $124000. On that date, they agree to admit Neumark as a partner with a one-third capital interest. If Neumark invests $169000 in the partnership, what is Landry's capital balance after Neumark's admittance? $130900 ○ $124000 $146000 ○ $133200arrow_forwardJules and Johnson are partners, each with $40,000 in their partnership capital accounts. Kwon is admitted to the partnership by investing $40,000 cash. Make the entry to show Kwon’s admission to the partnership.arrow_forward

- May, Jun, and Julie have partnership capital account balances of P225,000, P450,000 and P105,000, respectively. The income sharing ratio is May, 50%; Jun, 40%; and Julie, 10%. May desires to withdraw from the partnership and it is agreed that partnership assets of P195,000 will be used to pay May for her partnership interest. How much is the balance of Jun's capital account after May's withdrawal using the asset revaluation method?arrow_forwardJerry and Sherry own and operate a partnership. Jerry's capital balance is $50,000 and Sherry's is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/ loss equally, Allison intends to contribute $40,000 to receive a Twenty-five percent interest in the partnership. Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner's share of the total equity d. Determine the bonus resulting from Allison's equity of her contribution e. Make journal entries to rccord Allison's admission to the partnershiparrow_forwardLucy and Fer are partners having capital balances of 32,000 and 48,000, respectively. They share profits and losses in the ratio of 2:6. Nando is admitted into the partnership upon investing cash of 15,000. His share in the profits is 25% and the balance will be divided by the old partners using their original profit sharing ratio. Required: a) Assume that Nando is allowed a 20% interest in the new firm. 1. What entry would be made in recording the admission of Nando if the goodwill method is used? 2. What entry would be made if the bonus method is used? b) Assume that Nando is allowed a 20% interest in the new firm. 1. What entry would be made if the goodwill method is used? 2. What entry would be made if the bonus method is used?arrow_forward

- zxarrow_forwardSteffi and Leigh form a partnership. Steffi invests $1,000 cash, $2,000 of supplies, inventory with a book value of $3,500 and market value of $3,000, and machinery with a book value of $4,900 and market value of $4,000. Prepare the partnership's journal entry to record Steffi's investment.arrow_forwardBobbi and Stuart are partners. The partnership capital of Bobbi is $40,800 and that of Stuart is $77,700. Bobbi sells his interest in the partnership to John for $58,100. The journal entry for the admission of John as a new partner would include a credit to a.John's capital account for $40,800 and a credit to Stuart's capital account for $77,700 b.Stuart's capital account for $59,250 c.John's capital account for $40,800 d.John's capital account for $58,100arrow_forward

- Michelle Hamilton and Bill Rossi decide to form a partnership. Hamilton invests $36,300 cash and accounts receivable of $30,000 less allowance for doubtful accounts of $2,000. Rossi contributes $26,000 cash and equipment having a $6,800 book value. It is agreed that the allowance account should be $3,600 and the fair value of the equipment is $10,900.Prepare the necessary journal entry to record the formation of the partnership. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)arrow_forwardPeary has $91,500 capital and Hammet has $43,500 capital in the Peary & Hammet partnership. Peary and Hammet share profits and losses equally. Ryanne Potvin contributes cash of $45,000 to acquire a 1/4 interest in the new partnership. Requirements 1. Calculate Potvin's capital in the new partnership. 2. Journalize the partnership's receipt of the $45,000 from Potvin. ..... Requirement 1. Calculate Potvin's capital in the new partnership. (Leave unused cells blank. Do not enter a "0" for a zero balance.) Partnership capital before admission of new partner Contribution of new partner Partnership capital after admission of new partner Capital of new partner Bonus toarrow_forwardRamer and Knox began a partnership by Investing $62,000 and $93,000, respectively. During its first year, the partnership earned $190,000. Prepare calculations showing how the $190,000 income is allocated under each separate plan for sharing income and loss. 2. The partners agreed to share income and loss in proportion to their initial investments. Net income is $190,000. Note: Do not round intermediate calculations. Fraction to Allocate Ramer Ramer's Share of Income Fraction to Allocate Knox Knox's Share of Income Total Income Allocated $ 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education