FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

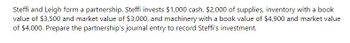

Transcribed Image Text:Steffi and Leigh form a partnership. Steffi invests $1,000 cash, $2,000 of supplies, inventory with a book

value of $3,500 and market value of $3,000, and machinery with a book value of $4,900 and market value

of $4,000. Prepare the partnership's journal entry to record Steffi's investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $23,400 in cash and merchandise inventory valued at $62,600. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $60,000. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow in the image below. The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $19,000 (Keene) and $24,000 (Wallace), and the remainder equally. The journal entries for both Keene and Wallace are also attached below. Prepare a balance sheet as of March 1, 20Y8, the date of formation of the partnership of Keene and Wallace.arrow_forwardFaith Busby and Jeremy Beatty started the B&B partnership on January 1, Year 1. The business acquired $93,000 cash from Busby and $207,000 from Beatty. During Year 1, the partnership earned $62,900 in cash revenues and paid $34,050 for cash expenses. Busby withdrew $2,900 cash from the business, and Beatty withdrew $4,700 cash. The net income was allocated to the capital accounts of the two partners in proportion to the amounts of their original investments in the business. Required Prepare an income statement, capital statement (statement of changes in equity),arrow_forwardJennifer DeVine and Stanley Farrin decide to organize the ALL-Star partnership. DeVine invests $25,000 cash, and Farrin contributes $20,000 cash and equipment having a book value of $5,500. Prepare the entry to record Farrin’s and DeVine’s investment in the partnership, assuming the Ferrin’s equipment has a fair market value of $9,000arrow_forward

- Sue and Andrew form SA general partnership. Each person receives an equal interest in the newly created partnership. Sue contributes $16,000 of cash and land with an FMV of $61,000. Her basis in the land is $26,000. Andrew contributes equipment with an FMV of $18,000 and a building with an FMV of $39,000. His basis in the equipment is $14,000, and his basis in the building is $26,000. How much gain must the SA general partnership recognize on the transfer of these assets from Sue and Andrew?arrow_forwardFaith Busby and Jeremy Beatty started the B&B partnership on January 1, Year 1. The business acquired $101,500 cash from Busby and $188,500 from Beatty. During Year 1, the partnership earned $62,500 in cash revenues and paid $35,200 for cash expenses. Busby withdrew $2,300 cash from the business, and Beatty withdrew $5,300 cash. The net income was allocated to the capital accounts of the two partners in proportion to the amounts of their original investments in the business. Required Prepare an income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for B&B's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Income Statement Assets Cash Capital Statement Prepare a balance sheet. Note: Do not round intermediate calculations and round your final answer to the nearest whole dollar amount. Total assets Liabilities Equity F. Busby, Capital J. Beatty, Capital Balance Sheet Statement of Cash Flows…arrow_forward2arrow_forward

- Faith Busby and Jeremy Beatty started the B&B partnership on January 1, Year 1. The business acquired $109,200 cash from Busby and $170,800 from Beatty. During Year 1, the partnership earned $67,500 in cash revenues and paid $27,350 for cash expenses. Busby withdrew $1,900 cash from the business, and Beatty withdrew $4,000 cash. The net income was allocated to the capital accounts of the two partners in proportion to the amounts of their original investments in the business. Required Prepare an income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for B&B's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Income Capital Statement Statement Balance Sheet Prepare a balance sheet. (Do not round intermediate calculations and round your final answer to the nearest whole dollar amount.) Assets Cash Stmt of Cash Flows Total assets Liabilities B&B PARTNERSHIP Balance Sheet As of December 31, Year 1…arrow_forwardBarbara Ripley and Fred Nichols decide to organize the ALL-Star partnership. Ripley invests $24,000 cash, and Nichols contributes $10,000 cash and equipment having a book value of $5,120. Prepare the entry to record Nichols's investment in the partnership, assuming the equipment has a fair value of $6.400. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Creditarrow_forwardOn March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $23,400 in cash and merchandise inventory valued at $62,600. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $60,000. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow in the image below. The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $19,000 (Keene) and $24,000 (Wallace), and the remainder equally. Instructions Journalize the entries to record the investments of Keene and Wallace in the partnership accounts.arrow_forward

- After the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forwardAhmed and Salim form a partnership on June 1. Ahmed contributes OMR 15,000 cash, inventory with a market value of OMR 40,000 , and Accounts Payable of OMR 80,000. Ahmed also contributed computer equipment with a cost of OMR 80,000 and accumulated depreciation of OMR 20,000 . Current market value is OMR 85,000 Ahmed's Capital will be Select one: O a. Credit, 30,000 O b. Credit, 60,000 O c. Debit, 30,000 O d. Debit, 60,000arrow_forwardDewwy, Screwum, and Howe are forming a partnership. Dewwy is transferring $93,000 of personal cash to the partnership. Screwum owns land worth $27,000 and a small building worth $205,000, which she transfers to the partnership. Howe transfers to the partnership cash of $19,000, accounts receivable of $47,700 and equipment worth $35,000. The partnership expects to collect $45,000 of the accounts receivable. Cash 93000 Dewwy Capital 93000 Equipment 27000 Building 205000 Screwum Capital 232000 Cash 19000 Accounts Recievable 47700 Equipment 35000 Doubtful 2700 Howe Capital 99000 What amount would be reported as total owners’ equity immediately after the investments? I would have expected $99,000 since this was agreed upon. What did I miss in the reading?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education