ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a.

b.

C.

What will the federal government do to taxes? increase

What will the federal government do to government spending? decrease

What impact will this have on consumer spending? they cannot buy as mucl

QUESTION 5

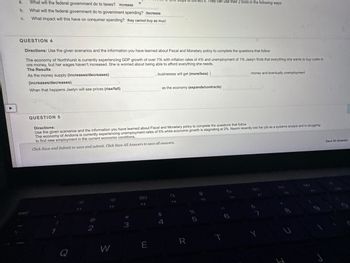

QUESTION 4

Directions: Use the given scenarios and the information you have learned about Fiscal and Monetary policy to complete the questions that follow

The economy of Northhurst is currently experiencing GDP growth of over 7% with inflation rates of 4% and unemployment of 1% Jaelyn finds that everything she wants to buy costs m

ore money, but her wages haven't increased. She is worried about being able to afford everything she needs.

The Results

As the money supply (increases/decreases)

businesses will get (more/less) |

(increases/decreases)

When that happens Jaelyn will see prices (rise/fall)

Q

2

F2

Directions:

Use the given scenarios and the information you have learned about Fiscal and Monetary policy to complete the questions that follow

The economy of Andorra is currently experiencing unemployment rates of 5% while economic growth is stagnating at 2%. Naomi recently lost her job as a systems analyst and is struggling

to find new employment in the current economic conditions.

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

W

3

F3

E

steps

as the economy (expands/contracts)

$

4

O

FA

R

%

They can use their 2 tools in the following ways:

5

ទេ

FS

money and eventually unemployment

T

J

ㄱ

Y

U

م لری

Save All Answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Your company has been trying to grow since its creation in the year 2000, and the board of directors is dissatisfied that your department’s advertising budget has increased 40% since the year 2000 but that little growth has occurred as a result. What argument might you make in your defense? Select one: a. While the nominal value of the budget has grown 40%, the real value (adjusted for inflation) has dropped sharply, so we have been lucky to even stay in business over these years. b. While the real value of the budget has grown 40%, the output of the national economy (as indicated by the mild growth of the GDP deflator) has been stagnant, so our lack of company growth is no surprise. c. While the nominal value of the budget has increased 40%, the real value has increased even greater than that, so the lack of growth has to be attributable to another department of the company. d. While the nominal value of the budget has grown 40%, the real value (adjusted for…arrow_forwardSECTION B: MACROECONOMICS QUESTION 3 The mandate of the South African Reserve Bank (SARB) is to target inflation and keep it within the band of 3% - 6%. The bank does this through adjusting the repo-rates. Discuss three channels of the money transmission mechanism emanating from fluctuations of the interest rates.arrow_forwardFor the following problems, choose from these formulas: Formula 1 A = P +Prt Formula 3 A = P(1 + APR)" P = Formula 2 P A 1+rt Formula 4 A APR (ny) n (1 +³ In your answer, describe whether you used formula 1, formula 2, formula 3, or formula 4. Show supporting work, round your answer to the nearest cent, and include units with your answer. (a) If you want an account balance of $10,000 after 5 years, what amount do you need to invest initially into an account that earns an APR of 3% with quarterly compounding? (b) If you invest $10,000 in an account that earns an APR of 5% with monthly compounding, what will be the account balance after 10 years? (c) If you invest $10,000 in an account that earns an APR of 5% simple interest, what will be the account balance after 10 years?arrow_forward

- #57arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardTopic: Quantity theory of money. Answer 1, 2 and 3. What will happen to nominal GDP if, instead, the money supply decreases by 8 percent and velocity does not change? What will happen to nominal GDP if, instead, the money supply increases by 5 percent and velocity decreases by 5 percent? What happens to the price level in the short run in each of these three situations?arrow_forward

- True or False: Inflation refers to a sustained increase in the general price level of goods and services in an economy over a period of time. Don't use Aiarrow_forwardQuestion 5A Starting from a baseline Long Run Steady State Equilibrium (LRSSE), the federal reserve increases interest rates. i. What kind of policy is this (Monetary or fiscal; ii. iii. expansionary or contractionary? How do you know? As a response which curve will start shifting in which direction? Why? How will this policy make the economy move away from the baseline Long Run Steady State Equilibrium (how would it change unemployment or price level relative to the long run steady state equilibrium )? iv. Draw a graph to show the changes to the long run steady state equilibrium (LRSSE).arrow_forwardOver the last two years, the unemployment rate in Westerlight has risen from 4% to 8%, while GDP growth has been 1.5%. Milo, a citizen of Westerlight, currently doesn’t have a job and although he is actively searching, has been unable to find one.The Federal Reserve notices this change in the economy and decide to take steps to correct it. They can use their 4 tools in the following ways:a. What will the Federal Reserve do to open market operations? b. What will the Federal Reserve do to the reserve requirement? c. What will the Federal Reserve do to the discount rate? d. What will the Federal Reserve do to the interest on reserves? e. What impact will this have on loans from banks?arrow_forward

- Please give me correct answers with explanation and dont use chatGPT and not reject questionsarrow_forwardUse the given scenarios and the information you have learned about Fiscal and Monetary policy to complete the questions that follow The economy of Andorra is currently experiencing unemployment rates of 5% while economic growth is stagnating at 2%. Naomi recently lost her job as a systems analyst and is struggling to find new employment in the current economic conditions. Congress and the President also notice this change in the economy and decide to take steps to correct it. They can use their 2 tools in the following ways: a. What will the federal government do to taxes? b. What will the federal government do to government spending? c. What impact will this have on consumer spending?arrow_forwardFor the following questions, make use of provided information. Since the peak of the pandemic shutdowns, employment has been increasing. Unemployment peaked around 15% in April 2020, and was down to approximately 4% in February 2022. At the same time, estimated inflation rates have increased from approximately 1.5% in January 2021 to nearly 8% in February 2022. The Federal Open Market Committee (FOMC) is meeting this week (March 15-16). It is widely expected that they will increase interest rates by 0.25% (25 basis points). Explain why the FOMC is expected to increase its target overnight interest rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education