FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

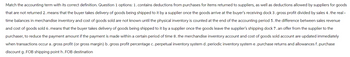

Transcribed Image Text:Match the accounting term with its correct definition. Question 1 options: 1. contains deductions from purchases for items returned to suppliers, as well as deductions allowed by suppliers for goods

that are not returned 2. means that the buyer takes delivery of goods being shipped to it by a supplier once the goods arrive at the buyer's receiving dock 3. gross profit divided by sales 4. the real -

time balances in merchandise inventory and cost of goods sold are not known until the physical inventory is counted at the end of the accounting period 5. the difference between sales revenue

and cost of goods sold 6. means that the buyer takes delivery of goods being shipped to it by a supplier once the goods leave the supplier's shipping dock 7. an offer from the supplier to the

purchaser, to reduce the payment amount if the payment is made within a certain period of time 8. the merchandise inventory account and cost of goods sold account are updated immediately

when transactions occur a. gross profit (or gross margin) b. gross profit percentage c. perpetual inventory system d. periodic inventory system e. purchase returns and allowances f. purchase

discount g. FOB shipping point h. FOB destination

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Requirement a. What are the accounting requirements for a correct sales cutoff? A. A shipment should be recorded as a sale when the risks of ownership transfer to the buyer and collectability is reasonably assured. B. A shipment should be recorded as a sale when the merchandise is shipped. C. A shipment should be recorded as a sale when the payment for the merchandise has beeb received by the seller. D. A shipment should be recorded as a sale when the merchandise is received by the purchaser.arrow_forward2. When Inventory is sold, how is the cost of goods sold account affected? Briefly explainarrow_forwardWhen the net price method is used to record credit sales, the sales discount not taken account is reported as an, a.) addition to sales returns and allowanceson the income statement b.) deduction from gross sales on the income statement c.) deduction from selling expenses on the income statement d.) addition to sales revenue on the income statementarrow_forward

- When sales are made with a right of return, the company_ а. should recognize revenue for the full sales price b. should not recognize any revenue С. record the estimated returns in the Sales Returns account O d. records the returned asset in a separate inventory accountarrow_forwardWhat account balance is not used to computer the cost of good sold? a. Sales b. Purchased c. Purchase discount d. MerchandiseInventoryarrow_forwardIn accounting what is meant by the term 'purchases'? Select one: A. All good purchased and paid for. OB. All items bought. OC. All good bought for re-sale. OD. All goods held in inventory.arrow_forward

- Current Attempt in Progress You have the following information for Blossom Company Blossom uses the periodic method of accounting for its inventory transactions, Blossom only carries one brand and size of diamonds-all are identical Each hatch of diamonds purchased is carefully coded and marked with its purchase cost March 1 March 3 March 5 March 10 March 25 ✓ Your answer is correct Beginning inventory 140 diamonds at a cost of $300 perdiamond Purchased 190 diamonds at a cost of $340 each Sold 170 diamonds for $600 each. Purchased 320 diamonds at a cost of $365 each Sold 300 damonds for $650 each. Assume that Blossom uses the specific identification cost flow method. Demonstrate how Blossom could maximize its gross profit for the month by specifically selecting which diamonds to sell on March 5 and March 25 (1) (2) To maximize gross profit, Blossom should sell the diamonds with the lowest cost Demonstrate how Blossom could minimize its gross profit for the month by selecting which…arrow_forwardllar unless stated otherwise. E5-18 Using accounting vocabulary Match the accounting terms with the corresponding definitions. Learn 1. Credit Terms a. The cost of the merchandise inventory that the business has sold to customers. 2. FOB Destination b. An amount granted to the purchaser as an incentive to keep goods that are not "as ordered." c. A type of merchandiser that buys merchandise either from a manufacturer or a wholesaler and then sells those goods to 3. Invoice 4. Cost of Goods Sold 5. Purchase Allowance consumers. d. A situation in which the buyer takes ownership (title) at the delivery destination point. e. A type of merchandiser that buys goods from manufacturers and then sells them to retailers. 6. FOB Shipping Point 7. Wholesaler 8. Purchase Discount f. A discount that businesses offer to purchasers as an incentive for early payment. 9. Retailer g. A situation in which the buyer takes title to the goods after the goods leave the seller's place of business. h. The terms…arrow_forwardDecreases in the seller's receivable from a customer's return of merchandise or from granting the customer an allowance from the amount owed to the seller. Select one: O a. Freight Out b. Purchases Discount and Allowances c. Freight In d. Sales Discount and Allowancesarrow_forward

- Sandra owns a small manufacturing company, Tamarisk Camping Stuff Co. The company has been working to perfect a lightweight plastic material to be used for a variety of camping products. Sandra plans to enter the marketplace with a durable, lightweight folding table. Similar tables regularly sell for $39-$44 for a 6-foot table, so Sandra realizes that she'll have to stay within that range. She believes her table could sell on the higher end of this range, however, so she is using a target selling price of $44 for planning purposes. Sandra needs to generate an ROI of at least 20% on her invested assets to make this worthwhile in the long term. Her invested assets are $800,000, and she expects to sell 5,000 tables in her first year of activity. (a) Calculate the target cost for one table. Target cost for one table $ (b1) eTextbook and Media Text 12 Attempts: 1 of 1 used If the SG&A portion of that unit cost is estimated to be $7, how much does that leave for the product cost per unit?…arrow_forwardSales Revenue is a(n) Multiple Choice O account and asset; Sales Discounts revenue: Sales Returns and Allowances revenue; Cost of Goods Sold liability; Gross Profit is an expense account.arrow_forwardnot use ai pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education