FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

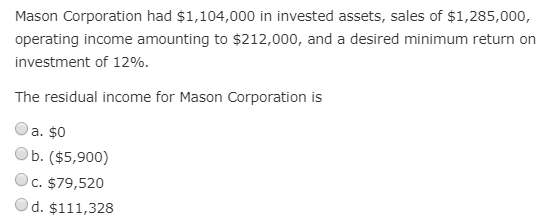

Transcribed Image Text:Mason Corporation had $1,104,000 in invested assets, sales of $1,285,000,

operating income amounting to $212,000, and a desired minimum return on

investment of 12%.

The residual income for Mason Corporation is

a. $0

b. ($5,900)

C. $79,520

d. $111,328

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Last year, LTD limited. reported $11,250 of sales, $4,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had $3,500 of bonds outstanding that carry a 6.50% interest rate, and its federal-plus-state income tax rate was 35.00%. During last year, the firm had expenditures on fixed assets and net operating working capital that totaled $2,000. These expenditures were necessary for it to sustain operations and generate future sales and cash flows. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $1,225. By how much will the depreciation change cause (1) the firm's net income and (2) its free cash flow to change? Note that the company uses the same depreciation for tax and stockholder reporting purposes. Do not round the intermediate calculations.arrow_forwardA company has a minimum cost of capital of 20%. The company reported income of $3,800, sales of $60,000 and an investment base in assets of $25,000. Calculate the residual income. O $1,200 O $ 8,200 O $1,200 O$-8,200 O Other:arrow_forwardMason Corporation had $1,098,000 in invested assets, sales of $1,257,000, operating income amounting to $246,000, and a desired minimum return on investment of 15%. The residual income for Mason Corporation is a.$113,820 b.($6,000) c.$0 d.$81,300arrow_forward

- Killian Corp. has a residual income of $36,000 on invested assets of $451,000. If the hurdle rate is 10%, what is the operating income?A.) 3,600B.) 45,100C.) 81,100D.) 36,000arrow_forwardMason Corporation had $1,027,000 in invested assets, sales of $1,215,000, operating income amounting to $236,000, and a desired minimum return on investment of 15%. The investment turnover for Mason Corporation is a.0.95 b.1.42 c.1.77 d.1.18arrow_forwardPine Corp. has revenues of $520,000 resulting in an operating income of $66,560. Invested assets total $611,000. Residual income is $24,000. Calculate the new residual income if sales increase by 10% and the profit margin and invested assets remain the same. (Do not round your intermediate calculations.) A $0 B $30,656 C $42,560 D $10,496arrow_forward

- Shrives Publishing recently reported $11,500 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. During the year, the firm had expenditures on fixed assets and net operating working capital that totaled $1,550. These expenditures were necessary for it to sustain operations and generate future sales and cash flows. What was its free cash flow?arrow_forwardYour firm has total sales of $1,700. Operating Costs are $745, excluding depreciation and taxes, and operating- related depreciation is $155. The tax rate is 20%. What is the operating cash flow? A. $460. B. $600. C. $640. D. $800. E. $955.arrow_forwardKing Industries has net working capital of $17,700, current assets of $39,800, equity of $55,400, and long-term debt of $11,800. What is the amount of the net fixed assets?arrow_forward

- Estimate a firm's economic value added (EVA) based on the following information: NOPAT = $400,000; amount of financial capital used = $1,600,000; and WACC = 19%. $26,000 $36,000 $96,000 54,000arrow_forwardMason Corporation had $1,096,000 in invested assets, sales of $1,217,000, operating income amounting to $231,000, and a desired minimum return on investment of 13%. The profit margin (rounded to one decimal place) for Mason Corporation isarrow_forwardAssume a company had net operating income of $300,000, sales of $1,500,000, average operating assets of $1,000,000, and a minimum required rate of return on average operating assets of 10.00%. The company's residual income is closest to: Multiple Choice $100,000. $200,000. $150,000. $250,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education