FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

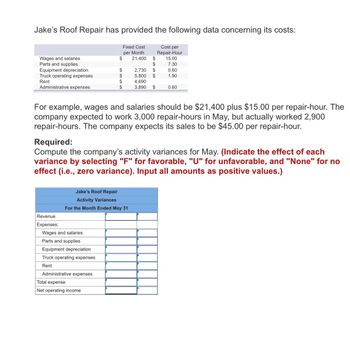

Transcribed Image Text:Jake's Roof Repair has provided the following data concerning its costs:

Fixed Cost

Cost per

per Month

Repair-Hour

Wages and salaries

$

21,400

$

15.00

Parts and supplies

$

7.30

Equipment depreciation

$

2,730 $

0.60

Truck operating expenses

$

5,800 $

1.90

Rent

$

4,690

Administrative expenses

$

3,890 $

0.60

For example, wages and salaries should be $21,400 plus $15.00 per repair-hour. The

company expected to work 3,000 repair-hours in May, but actually worked 2,900

repair-hours. The company expects its sales to be $45.00 per repair-hour.

Required:

Compute the company's activity variances for May. (Indicate the effect of each

variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e., zero variance). Input all amounts as positive values.)

Revenue

Expenses:

Jake's Roof Repair

Activity Variances

For the Month Ended May 31

Wages and salaries

Parts and supplies

Equipment depreciation

Truck operating expenses

Rent

Administrative expenses

Total expense

Net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month $ 21,200 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Repair-Hour $15.00 $ 7.50 $ 0.50 $ 1.60 $ 2,770 $ 5,710 $ 4,680 $ 3,870 Rent Administrative expenses $ 0.40 For example, wages and salaries should be $21,200 plus $15.00 per repair-hour. The company expected to work 2,800 repair-hours in May, but actually worked 2,700 repair-hours. The company expects its sales to be $44.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forwardNonearrow_forwardHASF Glassworks makes glass flanges for scientific use Material cost $ 1 per flange and the glass blowers are paid a wage rate of 20 per hours a glass blower blows 10 flanges per hours. Fixed manufacturing costs for flanges are 20,000 per period. other nonmanufacturing cost associated with flanges are 10,000 per period and are fixed. 1-Find out total fixed cost2-Find out Variable cost per unitarrow_forward

- Do not give answer in imagearrow_forwardWages and salaries Jake's Roof Repair provided the following data concerning its costs: Cost per Repair-Hour $ 15.00 Fixed Cost per Month $ 21,100 Parts and supplies $ 7.40 Equipment depreciation $ 2,750 $ 0.55 Truck operating expenses $ 5,730 $ 1.70. Rent $ 4,690 Administrative expenses $ 3,850 $ 0.70 For example, wages and salaries should be $21,100 plus $15.00 per repair-hour. The company expected to work 2,600 repair-hours in May but actually worked 2,500 repair-hours. The company expects its sales to be $47.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all…arrow_forwardThe receiving department of a firm performs 12,000 hours of uploading work and costs $60,000 per year. What is the activity rate for the receiving department? a.$4.50 per hour b.$14 per hour c.$4 per hour d.$5 per hour e.Cannot be determined from this information.arrow_forward

- Wyckam Manufacturing Incorporated has provided the following estimates concerning its manufacturing costs: Cost per Machine- Hour $ 4.25 Direct materials Direct labor Supplies Utilities Depreciation Insurance Fixed Cost per Month $ 36,800 $ 1,400 $ 16,700 $ 12,700 For example, utilities should be $1,400 per month plus $0.05 per machine-hour. The company expects to work 5,000 machine-hours in June. Note that the company's direct labor is a fixed cost. Required: Prepare the company's planning budget for June. Wyckam Manufacturing Incorporated Planning Budget for Manufacturing Costs For the Month Ended June 30 Budgeted machine-hours Direct materials Direct labor Supplies Utilities Depreciation Insurance Total manufacturing cost $ 0.30 $ 0.05 $ $ 36,000 16,000 1,500 1,650 16,700 1,200 73,050arrow_forwardThe following table provides data concerning a company’s costs: Fixed Cost per Month Cost per Car Washed Cleaning supplies $ 0.40 Electricity $ 1,400 $ 0.08 Maintenance $ 0.15 Wages and salaries $ 4,900 $ 0.30 Depreciation $ 8,400 Rent $ 1,800 Administrative expenses $ 1,400 $ 0.04 For example, electricity costs are $1,400 per month plus $0.08 per car washed. The company expects to wash 8,000 cars in August and to collect an average of $6.10 per car washed. Prepare the company’s planning budget for August. Budgeted Cars Washed Revenue Expenses: Cleaning Supplies Electricity Maintenance Wages and Salaries Depreciation Rent Administrative Expenses Total Expenses Net Operating Income $arrow_forwardPlease help mearrow_forward

- San Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent: Direct materials $8,400 Direct labor 11,250 Variable overhead 12,600 Fixed overhead 16,200 An outside supplier has offered to sell San Clemente the subcomponent for $2.85 a unit. If San Clemente accepts the offer, by how much will net income increase (decrease)? ($8,850) decrease ($2,850) decrease O $19,950 increase $3,750 increasearrow_forwardi need the answer quicklyarrow_forwardThe following data is available for Sheridan Repair Shop for 2022: Repair technicians' wages Employee benefits Overhead Total $410000 90000 $122. $140. $152. $112. 60000 $560000 The desired profit margin is $40 per labor hour. The material loading charge is 40% of invoice cost. It is estimated that 5000 labor hours will be worked in 2022. Sheridan' labor charge per hour in 2022 would bearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education