Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

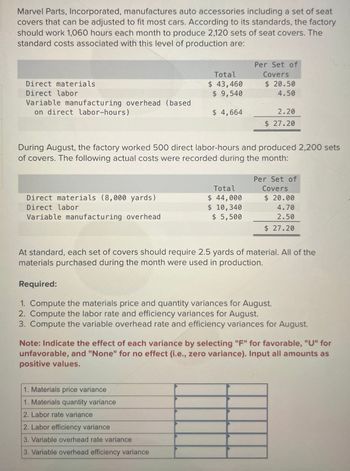

Transcribed Image Text:Marvel Parts, Incorporated, manufactures auto accessories including a set of seat

covers that can be adjusted to fit most cars. According to its standards, the factory

should work 1,060 hours each month to produce 2,120 sets of seat covers. The

standard costs associated with this level of production are:

Total

Per Set of

Covers

Direct materials

$ 43,460

$ 20.50

Direct labor

$ 9,540

4.50

Variable manufacturing overhead (based

on direct labor-hours)

$ 4,664

2.20

$ 27.20

During August, the factory worked 500 direct labor-hours and produced 2,200 sets

of covers. The following actual costs were recorded during the month:

Direct materials (8,000 yards)

Direct labor

Total

$ 44,000

Per Set of

Covers

$ 20.00

$ 10,340

Variable manufacturing overhead

$ 5,500

4.70

2.50

$ 27.20

At standard, each set of covers should require 2.5 yards of material. All of the

materials purchased during the month were used in production.

Required:

1. Compute the materials price and quantity variances for August.

2. Compute the labor rate and efficiency variances for August.

3. Compute the variable overhead rate and efficiency variances for August.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for

unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as

positive values.

1. Materials price variance

1. Materials quantity variance

2. Labor rate variance

2. Labor efficiency variance

3. Variable overhead rate variance

3. Variable overhead efficiency variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cozy, Inc., manufactures small and large blankets. It estimates $950,000 in overhead during the manufacturing of 360,000 small blankets and 120,000 large blankets. What is the predetermined overhead rate if a small blanket takes 2 hours of direct labor and a large blanket takes 3 hours of direct labor?arrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forward

- Steeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardGreen Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- SmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forwardCozy, Inc., manufactures small and large blankets. It estimates $350,000 in overhead during the manufacturing of 75,000 small blankets and 25,000 large blankets. What is the predetermined overhead rate if a small blanket takes 1 machine hour and a large blanket takes 2 machine hours?arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- Boarders estimates overhead will utilize 160,000 machine hours and cost $80,000. It takes 4 machine hours per unit, direct material cost of $5 per unit, and direct labor of $5 per unit. What is the cost of each unit produced?arrow_forwardCrystal Pools estimates overhead will utilize 250,000 machine hours and cost $750,000. It takes 2 machine hours per unit, direct material cost of $14 per unit, and direct labor of $20 per unit. What is the cost of each unit produced?arrow_forwardPlata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub