Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

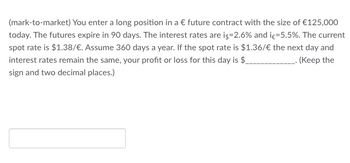

Transcribed Image Text:(mark-to-market) You enter a long position in a € future contract with the size of €125,000

today. The futures expire in 90 days. The interest rates are i$=2.6% and iç-5.5%. The current

spot rate is $1.38/€. Assume 360 days a year. If the spot rate is $1.36/€ the next day and

interest rates remain the same, your profit or loss for this day is $_ ____.(Keep the

sign and two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The 1-year forward price of copper is $ 1/lb. The 1-year continuously compounded interest rate is 6%. One-year option prices for copper are shown in the table below. Strike Call| Put 0.95 0.0649 0.0178 0.975 0.05 0.0265 1 0.0376 0.0376 1.025 0.02740.0509 1.034 0.02430.0563 1.05 0.0194 0.0665| Suppose CDE mines copper, with fixed costs of $ 0.50/lb and variable cost of $ 0.40/lb. If CDE does nothing to manage copper risk: What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 0.80 $ ? What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 0.90 $ ? What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.00 $ What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.10 $ ? What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.20 $ ? If on the other hand CDE sells forward its expected copper production:…arrow_forwardAssume today's settlement price on a CME EUR futures contract is $1.3154 per euro. You have a short position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond account currently has a balance of $2,400. The next three days' settlement prices are $1.3140, $1.3147, $1.3063. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. Required: Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Balance of the performance bond accountarrow_forwardThe 3-month March 2024 dollar interest rate futures contract on the dollar is currently priced at 96.00. The contract has a nominal value of 1 million dollars. a.)What 3-month dollar interest rate in March 2024 will give a break-even position for the buyer of the contract? b.) What is the profit or loss for the seller of the contract if the 3 month dollar interest rate in March is 3%?arrow_forward

- Give typing answer with explanation and conclusionarrow_forwardThe contract size for platinum futures is 50 troy ounces. Suppose you need 450 troy ounces of platinum and the current futures price is $820 per ounce. How many contracts do you need to purchase? How much will you pay for your platinum? What is your dollar profit if platinum sells for $870 a troy ounce when the futures contract expires? What if the price is $770 at expiration?arrow_forwardA one year gold futures contract is selling for $1,754. Spot gold prices are $1,600 and the one-year risk free rate is 3.4%. The arbitrage profit per contract implied by these prices is____________arrow_forward

- A plain vanilla 2-year interest rate swap with annual payments has a notional principal of $1 million. 4 month(s) into the swap, the term structure of interest rates is flat at 4.87%. The first floating-rate payment has already been set to 4.60%. The fixed payments are 4.99%. What is the value of this swap? Round to the nearest dollar.arrow_forwardYour company needs £500,000 per month. You choose to hedge half of the required amount by entering into a futures contract at $1.148/E. How much did you save by hedging if the spot price today is $1.195/£?arrow_forwardAssume oat forward prices over the next 3 years are $2.30, $2.40, and $2.33, respectively. Effective annual interest rates over the same period are 5.5%, 5.8%, and 6.1%. What is the 3-year swap price if the delivery in year 1 is 100,000 bushels, the delivery in year 2 is 125,000 bushels and the delivery in year 3 is 175,000 bushels?arrow_forward

- If the spot price for silver is $18.56 per ounce, what should the futures contract price be for a three-month contract at an annual interest rate of 3.5%?arrow_forwardOne year T-bills yield 2.50%. Based on futures rates, the market expects that one year from now, new one year t-bill will yield 2.75%. Based on the Pure Expectations theory, what is the yield of a 2-year treasury note?arrow_forwardRefer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day.a. If the margin requirement is 23% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the March maturity contract? (Round your answer to the nearest whole dollar.)Required margin depositb. If the March futures price increases to 2594.70, what percentage return will you earn on your investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.)Percentage return on net investment%c. If the March futures price falls by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)Percentage return on net investment%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education