Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve this please :)

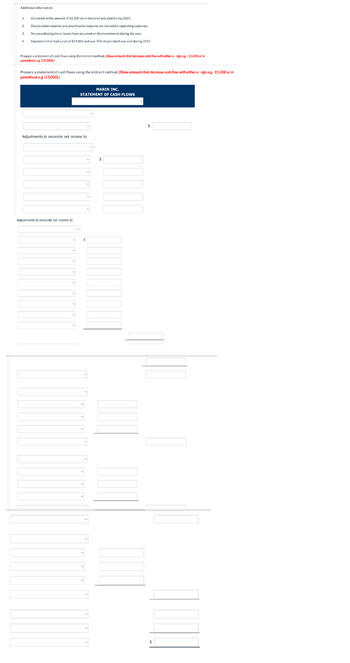

Transcribed Image Text:Additional information:

1.

2.

4.

Dividends in the amount of $6,100 were declared and paid during 2025.

Depreciation expense and amortization expense are included in operating expenses.

No unrealized gains or losses have occurred on the investments during the year.

Equipment that had a cost of $19,800 and was 70% depreciated was sold during 2025.

Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a sign eg-15,000 or in

parenthesis eg. (15,000)

Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in

parenthesis eg (15,000))

MARIN INC.

STATEMENT OF CASH FLOWS

Adjustments to reconcile net income to

Adjustments to reconcile net income to

$

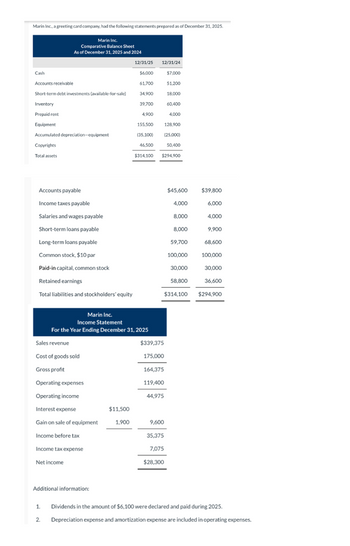

Transcribed Image Text:Marin Inc., a greeting card company, had the following statements prepared as of December 31, 2025.

Marin Inc.

Comparative Balance Sheet

As of December 31, 2025 and 2024

12/31/25

12/31/24

Cash

$6,000

$7,000

Accounts receivable

61,700

51,200

Short-term debt investments (available-for-sale)

34,900

18,000

Inventory

39,700

60,400

Prepaid rent

4,900

4,000

Equipment

155,500 128,900

Accumulated depreciation-equipment

(35,100) (25,000)

Copyrights

46,500

50,400

Total assets

$314,100 $294,900

Accounts payable

$45,600

$39,800

Income taxes payable

4,000

6,000

Salaries and wages payable

8,000

4,000

Short-term loans payable

8,000

9,900

Long-term loans payable

59,700

68,600

Common stock, $10 par

100,000

100,000

Paid-in capital, common stock

30,000

30,000

Retained earnings

58,800

36,600

Total liabilities and stockholders' equity

$314,100

$294,900

Marin Inc.

Income Statement

For the Year Ending December 31, 2025

Sales revenue

$339,375

Cost of goods sold

175,000

Gross profit

164,375

Operating expenses

119,400

Operating income

44,975

Interest expense

$11,500

Gain on sale of equipment

1,900

9,600

Income before tax

35,375

Income tax expense

7,075

Net income

$28,300

Additional information:

1.

Dividends in the amount of $6,100 were declared and paid during 2025.

2. Depreciation expense and amortization expense are included in operating expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 26. Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2020. CORONADO INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $5,900 $7,000 Accounts receivable 61,400 51,500 Short-term debt investments (available-for-sale) 35,000 18,200 Inventory 40,000 60,500 Prepaid rent 5,000 4,100 Equipment 152,900 131,100 Accumulated depreciation—equipment (35,200 ) (25,100 ) Copyrights 45,800 50,000 Total assets $310,800 $297,300 Accounts payable $46,100 $40,100 Income taxes payable 3,900 5,900 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,100 10,000 Long-term loans payable 60,400 69,300 Common stock, $10 par 100,000 100,000…arrow_forwardSuppose the Crane Ltd's 2020 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities NT$3,536.0 31,408.0 3,016.0 16,640.0 Compute the following values. Interest expense Income taxes Net income NT$520.0 (a) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 1,976.0 4,590.0 (b) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) % timesarrow_forwardCalculate the Debt to Equity ratio for Urban Outfitters for both 2018 and 2019. Be sure to round your answer to 2 decimal place.arrow_forward

- An extract from a computer company's 2021 financial statements follows: Balance sheet As of December 31, 2021 As of December 31, 2020 Total assets 57,699 54,013 Total liabilities 37,682 37,919 Total stockholders' equity 20,017 16,096 What was the company's debt-to- equity ratio for 2021? OA. 2.5 OB. 1.6 O C. 0.9 O D. 1.9arrow_forwardA Corporation had the following data concerning selected financial data taken from the records listed below.For the year ended December 312021 2020Cash 80,000 640,000Note and account receivable 400,000 1,200,000Merchandise Inventory 720,000 1,200,000Marketable Securities 240,000 80,000Land and Building (net) 2,720,000 2,880,000Bond Payable 2,160,000 2,240,000Account Payable 560,000 880,000Note Payable Short Term 160,000 320,000Sales (20% cash, 80% credit) 18,400,000 19,200,000Cost of Good Sold 8,000,000 11,200,000Required : Compute the following ratios1. current ratio as of December 31,20212. Quick ratio as of December 31, 20213. Account Receivable Turnover ratio for 20214. Merchandise inventory turn over for 20215. The Gross margin for 20206. the average age of account Receivable for 2021( use 360 daysarrow_forwardGiven the data in the following table, the entry for Inventories on the 2023 common-sized balance sheet was %.arrow_forward

- An extract from a printing company's 2021 financial statements follows: Balance sheet As of December 31, 2021 As of December 31, 2020 Total assets 57,699 54,013 Total liabilities 37,682 37,919 Total stockholders' equity 20,017 16,096 What was the company's debt-to- assets ratio for 2021? O A. 0.75 B. 0.65 O C.3.32 O D. 0.50arrow_forwardMSI Inc -(ALL ENTRIES FOR MSI ONLY) KEY for Accounting Component Assets = A Liabilities = L Stockholders' Equity = SE Accounting Component On July 1st 2019, MSI Inc issued $800,000, 3%, 10 year bonds at 103. The bonds pay interest annually. Prepare the Debit (DR) Credit (CR) Account 3 journal entry to record the issuance of the bonds. What is the total cost of borrowing? TOTAL COST OF BORROWING = On January 1st 2020, MSI Inc issues $500,000 4%, 6 year bonds at face value. Prepare the entry to record the issuance of the bonds. On December 31st 2020, MSI Inc does an adjusting entry to record the accrual of interest for #4 above. On January 1st, 2020, MSI pays the accrued bond interest and calls the bonds at 101 (refer to #4 above). Record the payment of interest and redemption of the bonds.arrow_forwardThe following investment account was taken from the general ledger of One Dream Investment Company: Debt Investments - Fulfilled Dream 6% bonds (2,000,000 face value, due December 31, 2027) Date PR Debit Credit Balance January2, 2022 VR VR P1,812,300 P1,812,300 June 30, 2022 CRJ 60,000 1,752,300 Dec. 31, 2022 CRJ 60,000 1,692,300 Dec. 31, 2022 195,000 1,497,300 In the course of your examination, you obtained the following information: Interest checks were received on June 30 and December 31 and were credited to the investment account. One dream sold P200,000 of its investment on December 31, 2022 for P195,000. Effective interest rate on this investment, as computed by your audit staff, is 8%. (4% - semi annual) One Dream included this investment in a portfolio that is held to collect and for sale. The fair value at December 31, 2022 and 2023 is 97.5 and 105, respectively. How much is the gain or…arrow_forward

- Use the table for the question(s) below. Consider the following balance sheet: Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in $ millions) Assets 2019 2018 Liabilities and Stockholders' Equity 2019 2018 Current Assets Current Liabilities Cash 63.6 58.5 Accounts payable 87.6 73.5 Accounts receivable 55.5 39.6 Notes payable / short−term debt 10.5 9.6 Inventories 45.9 42.9 Current maturities of long−term debt 39.9 36.9 Other current assets 6.0 3.0 Other current liabilities 6.0 12.0 Total current assets 171.0 144.0 Total current liabilities 144.0 132.0 Long−Term Assets Long−Term Liabilities Land 66.6 62.1 Long−term debt 239.7 168.9 Buildings 109.5 91.5 Capital lease obligations −−− −−−…arrow_forwardS Find online the annual 10 - K report for Costco Wholesale Corporation (COST) for September 28, 2023 f. Did the company have any contingent liabilities at the balance sheet date? Discuss the specific nature of these contingencies and how (or whether) they are expected to affect the firm's financial health h ASSEN s Ope TOTAL ASSETS CURRENT LIABILITIES LABILITIES AND EQUITY A Der Cap OTT L se org TOTAL LIATES COMMITMENTS AND CONTINGENCIES COUNTY 10 suhted this Consescanda Talk sil TOTAL LIABUTES AND EQUITY 2/12 3/18 2241 17667 Sa 24741 2/14 4 04.15 17482 s 52.545 2321 7301 топ 2337 2174 1.589 22 5611 TRE 3377 242 2482 2555 2.558 BUX 4351 = - 2 7.340 084 138931 21842 25194 21547 94111arrow_forwardBarger Corporation has the following data as of December 31, 2024: Total Stockholders' Equity Total Current Liabilities Total Current Assets $ 36,210 58,200 181,630 Other Assets Long-term Liabilities Property, Plant, and Equipment, Net Compute the debt to equity ratio at December 31, 2024. (Round your answer to two decimal places, X.XX.) = = C $? 45,600 269,640 Debt to equity ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning