FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

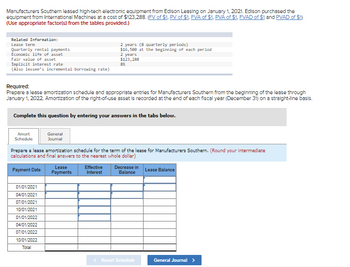

Transcribed Image Text:# Lease Amortization and Journal Entries for Manufacturers Southern

**Background:**

Manufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2021. Edison purchased the equipment from International Machines at a cost of $123,288. To prepare the entries and calculate the lease amortization, use the following financial data:

- **Lease Information:**

- Lease Term: 2 years (8 quarterly periods)

- Quarterly Rental Payments: $16,508 at the beginning of each period

- Economic Life of Asset: 2 years

- Fair Value of Asset: $123,288

- Implicit Interest Rate: 8% (Also lessee's incremental borrowing rate)

**Required Tasks:**

1. Prepare a lease amortization schedule and appropriate journal entries for Manufacturers Southern from the beginning of the lease through January 1, 2022.

2. Amortize the right-of-use asset using a straight-line basis, recorded at the end of each fiscal year (December 31).

**Instructions:**

To complete the task, enter your answers in the provided tabs.

**Lease Amortization Schedule:**

- **Columns:**

- Payment Date

- Lease Payments

- Effective Interest

- Decrease in Balance

- Lease Balance

**Graph/Table Explanation:**

- **Payment Date:**

- Lists dates for each quarterly payment starting from 01/01/2021 to 10/01/2022.

- **Lease Payments:**

- Amount paid each quarter under the lease terms.

- **Effective Interest:**

- Interest amount calculated based on the outstanding balance and the implicit rate.

- **Decrease in Balance:**

- Reduction in the lease obligation after each payment, excluding interest.

- **Lease Balance:**

- Remaining balance of the lease obligation after each payment.

**Navigation:**

Use the "Amort Schedule" for updating or reviewing the payment schedule and click "General Journal" for adding the journal entries related to these transactions.

**Note:** Remember to round your intermediate calculations and final answers to the nearest whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manufacturers Southern leased high-tech electronic equipment from International Machines on January 1, 2021. International Machines manufactured the equipment at a cost of $105,000. Manufacturers Southern's fiscal year ends December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term 2 years (8 quarterly periods) Quarterly rental payments $17,000 at the beginning of each period Economic life of asset 2 years Fair value of asset $127,024 Implicit interest rate 8% Required:1. Show how International Machines determined the $17,000 quarterly lease payments.2. Prepare appropriate entries for International Machines to record the lease at its beginning, January 1, 2021, and the second lease payment on April 1, 2021.arrow_forwardBaillie Power leased high-tech electronic equipment from Courtney Leasing on January 1, 2021. Courtney purchased the equipment from Doane Machines at a cost of $252,000, its fair value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Quarterly lease payments Economic life of asset Interest rate charged by the lessor Required: Prepare a lease amortization schedule and appropriate entries for Baillie Power from the beginning of the lease through December 31, 2021. December 31 is the fiscal year end for each company. Appropriate adjusting entries are recorded at the end of each quarter. Complete this question by entering your answers in the tabs below. Amort Schedule General Journal 01/01/2021 03/31/2021 06/30/2021 09/30/2021 12/31/2021 03/31/2022 06/30/2022 09/30/2022 Total Prepare a lease amortization schedule. (Round your intermediate calculations and final answers to the nearest…arrow_forwardTeak Outdoor Furniture manufactures wood patio furniture. If the company reports the following costs for June 2024, what is the balance in the Manufacturing Overhead account before Overhead is allocated to jobs? Assume that the labor has been incurred, but not yet paid. Prepare journal entries for overhead costs incurred in June. (Click the icon to view the costs.) What is the balance in the Manufacturing Overhead account before overhead is allocated to jobs? Enter the costs and calculate the balance ("Bal.") of the Manufacturing Overhead T-account. Manufacturing Overhead pages Get more help - Data Table Wood Nails, glue, stain Depreciation on saws Indirect manufacturing labor Depreciation on delivery truck Assembly-line workers' wages Print (...) $ 280,000 19,000 4,500 39,000 2,500 57,000 Done - X Save Clear all ROAS Check answerarrow_forward

- Eastern Edison Company leased equipment from Low-Tech Leasing on January 1, 2018. Low-Tech recently purchased the equipment at a cost of $366,951. Other information: 5 years $88,000 on January 1 each year 5 years Lease term Annual payments Life of asset Fair value of asset $366,951 Implicit interest rate 10% Incrementa1 rate 10% There is no expected residual value. Required: Prepare appropriate journal entries for Low-Tech Leasing for 2018. Assume a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) View transaction list Journal entry worksheet 1 2 3 Record the entry at the inception of the lease. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018arrow_forwardDinesh bhaiarrow_forwardSouthwestern Edison Company leased equipment from Hi-Tech Leasing on January 1, 2018. Hi-Tech manufactured the equipment at a cost of $94,500. Other information: 3 years $49,000 on January 1 each year 3 years $136, 382 Lease term Annual payments Life of asset Fair value of asset Implicit interest rate 8% Incremental rate 8% There is no expected residual value. Required: Prepare appropriate journal entries for Hi-Tech Leasing for 2018. Assume a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) View transaction list Journal entry worksheet 2 3 > Record the lease. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education