FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

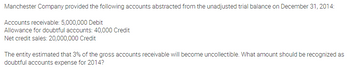

Transcribed Image Text:Manchester Company provided the following accounts abstracted from the unadjusted trial balance on December 31, 2014:

Accounts receivable: 5,000,000 Debit

Allowance for doubtful accounts: 40,000 Credit

Net credit sales: 20,000,000 Credit

The entity estimated that 3% of the gross accounts receivable will become uncollectible. What amount should be recognized as

doubtful accounts expense for 2014?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2016, when its Allowance for Doubtful Accounts had a debit balance of $1,301, Windsor, Inc. estimates that 8% of its accounts receivable balance of $97,300 will become uncollectible and records 1. the necessary adjustment to Allowance for Doubtful Accounts. 2. On May 11, 2017, Windsor, Inc. determined that B. Jared's account was uncollectible and wrote off $1,120. 3. On June 12, 2017, Jared paid the amount previously written off. Prepare the journal entries on December 31, 2016, May 11, 2017, and June 12, 2017. (Credit account titles are automatically Indented when amount Is entered. Do not Indent manually.) No. Date Account Titles and Explanation Debit 1. 3:01arrow_forwardThe following accounts were taken from Skysong Inc.’s unadjusted trial balance at December 31, 2020: Debit Credit Sales revenue (all on credit) $960,000 Sales discounts $21,500 Allowance for doubtful accounts 33,600 Accounts receivable 660,000 If doubtful accounts are 8% of accounts receivable, what is the bad debt expense amount to be reported for 2020?arrow_forwardIvanhoe Company provides for doubtful accounts based on 4.0% of credit sales. The following data are available for 2020: Credit sales during 2020 $3,020,000 Allowance for doubtful accounts 1/1/20 37,700 Collection of accounts written off in prior years (customer credit was re-established) 15,500 Customer accounts written off as uncollectible during 2020 36,100 What is the balance in Allowance for Doubtful Accounts at December 31, 2020? Allowance for doubtful accounts 12/31/20 $Enter your answer in accordance to the question statementarrow_forward

- Datarrow_forwardPT ABC's accounts receivable as of December 31, 2015 and allowance for doubtful accounts of Rp 250,000,000 and Rp 8,500,000. Based on the aging list of accounts receivables as of December 31, 2015, it indicates that a total of Rp 17,500,000 was uncollectible. The net realizable value of accounts receivables is:a. Rp 241,500,000b. Rp 250,000,000c. Rp 232,500,000d. Rp 224,000,000e. All wrongarrow_forwardOne company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forward

- Minquo Company had a $700 credit balance in Allowance for Doubtful Accounts at December 31, 2012, before the current year's provision for uncollectible accounts. why we didnt consider $700 in our caculation?arrow_forwardSheffield Corp. had a $300 credit balance in Allowance for Doubtful Accounts at December 31, 2022, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following: Estimated Percentage Uncollectible Current Accounts $110,000 1 % 1-30 days past due 18,000 3 % 31-60 days past due 13,500 5 % 61-90 days past due 7,600 17 % Over 90 days past due 9,400 31 % Total Accounts Receivable $158,500 PART A Prepare the adjusting entry on December 31, 2022, to recognize bad debts expense. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Bad Debt Expense Allowance for Doubtful Accounts PART B I NEED HELP WITH PART B Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $300 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision…arrow_forwardAt the beginning of the current period, Skysong Corp. had balances in Accounts Receivable of $190,400 and in Allowance for Doubtful Accounts of $9,040 (credit). During the period, it had net credit sales of $839,100 and collections of $760,090. It wrote off as uncollectible accounts receivable of $6,576. However, a $3,350 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $26,900 at the end of the period. (Omit cost of goods sold entries.) (a)Prepare the entries to record sales and collections during the period.(b)Prepare the entry to record the write-off of uncollectible accounts during the period.(c)Prepare the entries to record the recovery of the uncollectible account during the period.(d)Prepare the entry to record bad debt expense for the period. No. Account Titles and Explanation Debit Credit (a) Enter an account title to record sales Enter a debit amount…arrow_forward

- For each of the following scenarios, indicate the amount of the adjusting journal entry for Bad Debt Expense to be recorded, the balance in Allowance for Doubtful Accounts after adjustment at December 31, and the net realizable value of Accounts Receivable at December 31. a. Based on an analysis of Simmons Company's $380,000 balance in Accounts Receivable at December 31, it was estimated that $15,500 will be uncollectible. There is a credit balance of $1,200 in Allowance for Doubtful Accounts before adjustment. Bad Debt Expense $ Allowance for Doubtful Accounts at Dec. 31 Net Realizable Value of Accounts Receivable at Dec. 31 b. Blake Company had credit sales of $900,000 at year-end, an Accounts Receivable balance of $425,000 at December 31, and an Allowance for Doubtful Accounts credit balance of $11,000 before adjustment. Blake estimates bad debt expense as ¾ of 1% of credit sales. Bad Debt Expense $ Allowance for Doubtful Accounts at Dec. 31 Net Realizable…arrow_forwardOn December 31, 2017, when its accounts receivable were $252,000 and its account Allowance for Doubtful Accounts had an unadjusted debit balance of $1,700, Oak Ridge Corp. estimated that $14,100 of its accounts receivable would become uncollectible, and it recorded the bad debts adjusting entry. On May 11, 2018, Oak Ridge determined that Fei Ya Cheng’s account was uncollectible and wrote off $1,600. On November 12, 2018, Cheng paid the amount previously written off. What is the carrying amount of the receivables on (1) December 31, 2017; (2) May 11, 2018; and (3) November 12, 2018, assuming that the total amount of accounts receivable of $252,000 is unchanged on each of these three dates except for any changes recorded above.arrow_forwardZebra Company reported the following for 2022: Credit sales = $419884 Accounts Receivable = $16376 Allowance for Doubtful Accounts = $291 (credit balance) Bad Debt is estimated at 0.31 of 1% of sales After the adjusting entry is recorded, what is the value of Allowance for Doubtful Accounts? ROUND TO THE NEAREST DOLLARarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education