Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

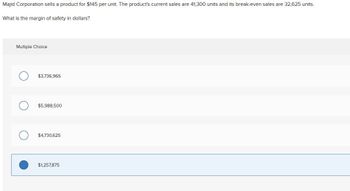

Transcribed Image Text:Majid Corporation sells a product for $145 per unit. The product's current sales are 41,300 units and its break-even sales are 32,625 units.

What is the margin of safety in dollars?

Multiple Choice

$3,736,965

$5,988,500

$4,730,625

$1,257,875

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Maruska Corporation has provided the following data concerning its only product Selling price Current sales $ 180 per unit 29,800 units 25,032 units Break-even sales What is the margin of safety in dollars? Multiple Choice О $5,364,000 $4,505,760 $3,576,000 О $858,240arrow_forwardPlease explain in detailarrow_forward39arrow_forward

- Moon Karak sells tea. The average selling price of a cup is OMR 0.200 and the average variable expense per cup is OMR 0.150. The average fixed expense per month is OMR 600. An average of 20,000 cups are sold each month. What is the margin of safety expressed as a percentage of sales? Select one: а. 30% b. 25% c. 35% d. None of the answers given e. 40% The correct answer is: 40%arrow_forwardFlare Enterprises sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $60 per unit. Flare management desires a 15% profit margin on sales. Their current full cost for the product is $52 per unit. In order to meet the new target cost, how much will the company have to cut costs per unit, if any? a. $3 b. $4 c. $5 d. $1 provide answer to this financial accounting questionarrow_forwardFlyer Company sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $48 per unit. Flyer management desires a 12.5% profit margin on sales. Flyer's current full cost for the product is $44 per unit. In order to meet the new target cost, how much will the company have to cut costs per unit, if any? Oa. $1 Ob. $3 Oc. $0 Od. $2arrow_forward

- Alvarez Company's break-even point in units is 1,650. The sales price per unit is $12 and variable cost per unit is $10. If the company sells 3,800 units, what will net income be? Multiple Choice $4,300 $7,600 $3,000. $65,400 $36,300arrow_forwardFlyer Company sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $48 per unit. Flyer management desires a 12.5% profit margin on sales. Their current full cost for the product is $44 per unit.In order to meet the new target cost, how much will the company have to cut costs per unit, if any? a.$1 b.$2 c.$3 d.$0arrow_forwardDaisy Inc., wants to make a profit of $25,000. It has variable costs of $80 per unit and fixed costs of $15,000. How much must it charge per unit if 4,000 units are sold? a. $85 b. $105 c. $100 d. $90 correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning