Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

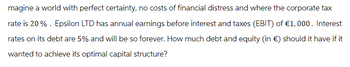

Transcribed Image Text:magine a world with perfect certainty, no costs of financial distress and where the corporate tax

rate is 20%. Epsilon LTD has annual earnings before interest and taxes (EBIT) of €1,000. Interest

rates on its debt are 5% and will be so forever. How much debt and equity (in €) should it have if it

wanted to achieve its optimal capital structure?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A firm wants to fund a $7 million project by raising both short-term and long-term debt. Because short-term debt is less risky, its cost is 5%. The long-term debt (bond) must pay 5.5% annual coupons. If the firm raises $5 million in short-term debt and the remainder in long-term debt, what is this project's WACC? Assume the tax rate = 26%. a. 5.14% b. 3.81% c. 3.89% d. 5.25% e. 1.34%arrow_forwardAssume perfect capital markets. A firm has a market value of $30, 000 and debt of $7, 500 horrowed at 7%. The return on equity is 18%. What is the return on equity if the firm was unlevered? (Hint: Think about WACC, WACCL = WACCU)arrow_forward) Suppose a company’s current free cash flow (i.e. FCF0) is $100 million and is expected to grow at a constant rate of 5 percent. If the company’s overall cost of capital is 15 percent, what is the current value of operations? $ 913 million $1,000 million $1,050 million $1,500 million $2,000 millionarrow_forward

- /arrow_forwardCarambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger Wayne estimates that Carambola will generate a free cash flow of 12 million Honduran lempiras (Lp) next year, and that this free cash flow will continue to grow at a constant rate of 7.0% per annum indefinitely. A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp15.8194/$, but the Honduran inflation rate is expected to remain at a relatively high rate of 15.0% per annum compared to the U.S. dollar inflation rate of only 2.5% per annum. Slinger Wayne expects to earn at least a 21% annual rate of return on international investments like Carambola. a. What is Carambola worth if the Honduran lempira were to…arrow_forwardklp.1arrow_forward

- Suppose MMC Industries has calculated its external funds needed (EFN) to be $23,000,000, but now management is considering raising the previously assumed dividend payout ratio from 35% to 40%. If the payout ratio is increased, what will happen to EFN?arrow_forward9arrow_forwardPlease help me with part D. Thank you so mucharrow_forward

- You are going to allocate capital into safe and risky assets. The risky asset will earn 200% return if the economy is good (with a 55% chance). If, otherwise, it will lose 60% of the investment principal. States of Rate of Prob. nature Return According to the Kelly's criterion, how much do you have to allocate for the risky asset to maximize final wealth? (The safe asset earns zero return.) → (1) 35%; (2) 47%; (3) 59%; (4) 65%; 1 Good 55% 200% your |(5) 69%; (6) 75%; (7) 85%; (8) 97%; (9) 102%; (10) 114%; (11) 115%; Bad 45% -60%arrow_forwardCarambola de Honduras. Slinger Wayne, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Carambola. Slinger Wayne estimates that Carambola will generate a free cash flow of 10 million Honduran lempiras (Lp) next year, and that this free cash flow will continue to grow at a constant rate of 8.5% per annum indefinitely. A private equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambola at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp14.3439/$, but the Honduran inflation rate is expected to remain at a relatively high rate of 15.0% per annum compared to the U.S. dollar inflation rate of only 3.0% per annum. Slinger Wayne expects to earn at least a 22.5% annual rate of return on international investments like Carambola. a. What is Carambola worth if the Honduran lempira were to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education