FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

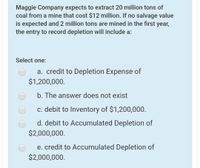

Transcribed Image Text:Maggie Company expects to extract 20 million tons of

coal from a mine that cost $12 million. If no salvage value

is expected and 2 million tons are mined in the fırst year,

the entry to record depletion will include a:

Select one:

a. credit to Depletion Expense of

$1,200,000.

b. The answer does not exist

c. debit to Inventory of $1,200,000.

d. debit to Accumulated Depletion of

$2,000,000.

e. credit to Accumulated Depletion of

$2,000,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A new machine tool is being purchased for $260,000 and is expected to have a $36,000 salvage value at the end of its 5-year useful life. Assume any remaining depreciation is claimed in the last year. Compute the depreciation schedules for this capital asset, using the following methods: (a) Straight-line depreciation (b) MACRS Note: No statement is required for this problem.arrow_forwardPlease help with questionarrow_forwardAssume that an asset costing $72,000 is expected to produce 500,000 units and have a salvage value of $6,000. The first year, 90,000 units are produced; the second year, 82,000 units are produced; the third year, 94,000 units are produced. Using the units-of-production method, complete the following: Year DepreciationExpense BookValue 0 — $72,000 1 fill in the blank 1 fill in the blank 2 2 fill in the blank 3 fill in the blank 4 3 fill in the blank 5arrow_forward

- Your company has purchased a large new trucktractor for over-the-road use (asset class 00.26). It has a cost basis of $179,000. With additional options costing $14,000, the cost basis for depreciation purposes is $193,000. Its MV at the end of six years is estimated as $36,000. Assume it will be depreciated under the GDS: a. What is the cumulative depreciation through the end of year two? b. What is the MACRS depreciation in the second year? c. What is the BV at the end of year one? Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the GDS Recovery Rates (rk). a. The cumulative depreciation through the end of year two is $ (Round to the nearest dollar.) b. The MACRS depreciation in the second year is $ (Round to the nearest dollar.) c. The BV at the end of year one is $ (Round to the nearest dollar.)arrow_forwardA machine costing P480,000 is estimated to have a salvage value of 10% of the first cost when retired at the end of 12 years. Depreciation cost using declining balance method. Find the book value at the end of 5 years.arrow_forwardFreeport-McMoRan Copper and Gold has purchased a new ore grading unit for $80,000. The unit has an anticipated life of 10 years and a salvage value of $ 10,000. Use the DB and DDB methods to compare the schedule of depreciation and book values for each year. Solve by hand and by spreadsheet.arrow_forward

- A company is considering the purchase of a capital asset for $135,000. Installation charges needed to make the asset serviceable will total $25,000. The asset will be depreciated over six years using the straight-line method and an estimated salvage value (SV6) of $10,000. The asset will be kept in service for six years, after which it will be sold for $ 30,000. During its useful life, it is estimated that the asset will produce annual revenues of $40,000. Operating and maintenance (O&M) costs are estimated to be $8,000 in the first year. These O&M costs are projected to increase by $ 1,200 per year each year thereafter. The after-tax MARR is 12% and the effective tax rate is 40 % .C) The before - tax present worth of this asset is -$60,000. By how much would the annual revenues have to increase to make the purchase of this asset justifiable on a before - tax basis?arrow_forwardA two-year project has an initial requirement of $500,000 for fixed assets and $100,000 for net working capital. The fixed assets will be depreciated using MACRS and the fixed asset falls into the three-year MACRS class. Depreciation rates for years 1 and 2 are 0.3333 and 0.4445. The estimated salvage value is $120,000. All of the net working capital will be recouped at the end of the 2 years. Management estimates that sales revenues less costs will be $700,000 per year for years 1 and 2. The discount rate is 9 percent and tax rate is 35 percent. What is the initial investment for this project? $513,327.50 ○ $600,000 $1,300,000 $500,000arrow_forwardAn asset costs $290,000 and is classified as a ten-year asset. What is the annual depreciation expense for the first three years under the straight-line and the modified accelerated cost recovery systems of depreciation? Be sure to apply the half-year convention to straight-line depreciation. Use Exhibit 9.4 to answer the question. Round your answers to the nearest dollar. Straight-line depreciation: Year Depreciation expense 1 $ 2 $ 3 $ Accelerated cost recovery system of depreciation: Year Depreciation expense 1 $ 2 $ 3 $arrow_forward

- An industrial equipment is purchased for $300,000. It is expected to work for 12 years before it is sold for $50,000. Moreover, the annual cost of maintaining this equipment is estimated to be $20,000. Given those information and MARR-10%, answer Questions 1-4 below: For all questions, you are required to show all calculations. 1) Use the switchover technique of 150% DB to depreciate this equipment during its service life 2) Use the Corporate Federal Tax (2006) to construct the AFTCF given the calculations obtained in Question 1 and annual revenue of $150,000 3) Use 25% income tax rate to construct the AFTCF given the calculations obtained in Question 1 and annual revenue of $150,000 4) Calculate the PWs of the two cashflows obtained in Questions 2 & 3arrow_forwardDo in excel pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education