Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

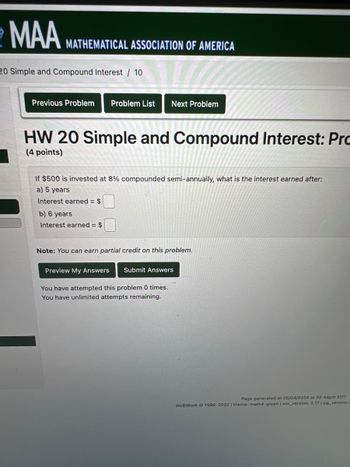

Transcribed Image Text:MAA MATHEMATICAL ASSOCIATION OF AMERICA

20 Simple and Compound Interest / 10

Previous Problem Problem List Next Problem

HW 20 Simple and Compound Interest: Pro

(4 points)

If $500 is invested at 8% compounded semi-annually, what is the interest earned after:

a) 5 years

Interest earned = $

b) 6 years

Interest earned = $

Note: You can earn partial credit on this problem.

Preview My Answers

Submit Answers

You have attempted this problem 0 times.

You have unlimited attempts remaining.

Page generated at 05/04/2024 at 02:44pm EDT

WeBWorK 1996-2022 | theme: math4-green | ww_version: 2.17 | pg_version.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Saving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions. 19. Create the following table of values for this investment plan. Saving Later Plan 2, tuho table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate varlable. P%3D r = A = M = n = 20. Indicate the best formula to use to compute the amount available after 15 years. 21. Substitute the values into the formula and compute how much money will be available after 15 years.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardSaving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions: 19. Create the following table of values for this investment plan, Saving Later Plan 2, (the table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate variable. P = A = t 3D M =arrow_forward

- Capital One is advertising a 60-month, 5.99% APR motorcycle loan. If you need to borrow $8,000 to purchase your dream Harley Davidson, what will your monthly payment be? Question content area bottom Part 1 Your monthly payment will be $enter your response here. (Round to the nearest cent.)arrow_forwardYou want to buy a $13,000 car. The company is offering a 3.46% monthly interest rate for 60 months (5 years). What will your monthly payments be? Question Help: D Video 1 D Video 2 D Video 3 Submit Questionarrow_forwardLike the solution i attach solve the problem now in 20 min and take a thumb up plzarrow_forward

- ework - 3 attempts You want to buy a house in 5 years and expect to need $25000 for a down payment. If you have $14000 to invest, how much interest do you have to earn (compounded annually) to reach your goal? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) 0:arrow_forwardPlz solve both correctly I vill definitely upvote.arrow_forwardPls solve this question correctly in 5 min i will give u like for surearrow_forward

- Problem #1: For Problems 1 and 2, you can use any Excel technique explored in the last two labs. Problem #1: You have taken a loan of $277,000 CAD. The nominal annual rate of interest compounded monthly on this loan is 7.89%. You can afford to pay monthly $ 2367.66 CAD. How many months it will take you to repay the loan? Your answer will be an integer value that includes the last monthly payment, which will be smaller than the rest.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education