Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

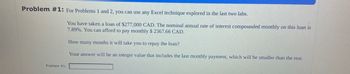

Transcribed Image Text:Problem #1: For Problems 1 and 2, you can use any Excel technique explored in the last two labs.

Problem #1:

You have taken a loan of $277,000 CAD. The nominal annual rate of interest compounded monthly on this loan is

7.89%. You can afford to pay monthly $ 2367.66 CAD.

How many months it will take you to repay the loan?

Your answer will be an integer value that includes the last monthly payment, which will be smaller than the rest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You want to buy a nice road bike. You place $2,400 each year in an investment account that earns 4% compounded annually. How much will be in the account after (a) two years, (b) three years, or (c) four years? Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (EV of $1. PV of $1. EVA of $1, and PVA of $1) a. b. C Annuity Annual Interest Payment Rate Compounded $ 2,400 2,400 2,400 4% Annually 4% Annually 4% Annually Period: Invested 2 years 3 years 4 years Future Value of Annuityarrow_forwardSaving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions: 19. Create the following table of values for this investment plan, Saving Later Plan 2, (the table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate variable. P = A = t 3D M =arrow_forwardCan you please help me with the following questions? 1. Determine the total amount of an investment of $1,400 at 3.5% simple interest for 48 months. 2. Determine the total interest on a loan of $5,000 if the interest rate is 6.24%, compounded monthly for 12 years. 3. Use a TVM solver to determine the interest rate on a loan of $5,400 if interest is compounded monthly for 72 months and the final amount of the loan is $6,965.35. List the values you used for present value, future value, number of years, and number of compounding periods per year. 4. Use a TVM solver to determine the monthly payment of a lease of $21,568 if the interest rate is 4.8% compounded monthly for 48 months. 5. Over a five-year period, the maintenance on a car included two oil changes per year ($48 each), new brakes ($452), new tires ($678), and a new set of spark plugs ($145). What is the average yearly maintenance fee on the car for the five-year period? 6. Compare the…arrow_forward

- Which investment will give you the higher future value in 5 years? Investment 1: You deposit $100 every month into an investment savings account that has an interest rate of 2.5% compounded daily. Investment 2: You deposit $300 every three months into an investment savings account that has an interest rate of 2.6% compounded semi-annually.arrow_forwardsolve using the appropriate formulas show full workings and find the answer. DONT USE EXCEL TO SOLVE ANYTHING ONLY USE RELEVANT FORMULAS TO SOLVE AND SHOW ALL WORKINGS 5. You have $33,556.25 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $220,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal?arrow_forwardCalculating Loan Payments You want to buy a new sports coupe for $69,300, and the finance office at the dealership has quoted you a loan with an APR of 5.6 percent for 48 months to buy the car. What will your monthly payments be? What is the effective annual rate on this loan?arrow_forward

- If you could solve option 5 with the formulas please Option 5: Half the required money is taken out of an investment account that pays monthly interest at a 3% annual rate. The rest of the money is borrowed from a bank at a 4% annual interest rate, should payback within 3 years in equal monthly payments. Find the future value of the money taken from the investment account at the end of the shop development and periodic payments to the bank. Calculate Cumulative interest and principal payments.arrow_forwardpart : creating a proposal after a number of years of saving up all your pennies you have finally reached a total amount of $ 4,000. you have decided to put your money into a savings account. after an extensive amount of research, you have the following options to choose from : bank 1 offers a 5% annual interest rate compounded monthly. • bank 2 offers a annual interest rate compounded quarterly . bank 3 offers a 5% annual interest rate compounded weekly. decide which bank is the best option to open a savings account for one year. show the total amounts for each bank to justify your answer . 2. decide which bank is the best option to open a savings account for 10 years . show the total amounts for each bank to justify your answer. 3.how much money would you make from saving $ 4000 in the bank selected after 10 years?arrow_forwardSimple Interest: Solve for the followingarrow_forward

- You just deposited $9,500 in an investment account and will deposit $5000 more four years from now. What is the built-in functions on a spreadsheet to determine how much will be in the account 11 years from now if the rate of return is 10% per year? The built-in function is =FV (10%, 11,,9500) + FV(10%,7, ,5000) and it displays $arrow_forwardPlease refer to the formulas in the lesson and on the following website. Pay particular attention to the examples. Scroll to the bottom to review a table with a list of various formula arrangements that may be helpful in completing this assignment. 1) If you deposit $4,000 today in a bank account and the interest is compounded annually at 10 percent, what will be the value of this investment: a. five years from now? b. ten years from now? c. fifteen years from now? d. twenty years from now? 2) If a business manager deposits $12,000 in a savings account at the end of each year for twenty years, what will be the value of her investment: a. at a compounded rate of 12 percent? b. at a compounded rate of 18 percent? 3) The chief financial officer of a home health agency needs to determine the present value of a $60,000 investment received at the end of year 15. What is the present value if the discount rate is 5%? 4) After completing her residency, an obstetrician plans to invest $9,000…arrow_forwardSuppose you have a student loan of $45,000 with an APR of 12% for 20 years. Complete parts (a) through (c) below. a. What are your required monthly payments? The required monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education