FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:M40.eth help

450 000.

కాి

direct la bor cost

200% of dırect laber cost

Per

Tedel adutes B)

Activity rake

C A/B

per machine hour

2000+200e..

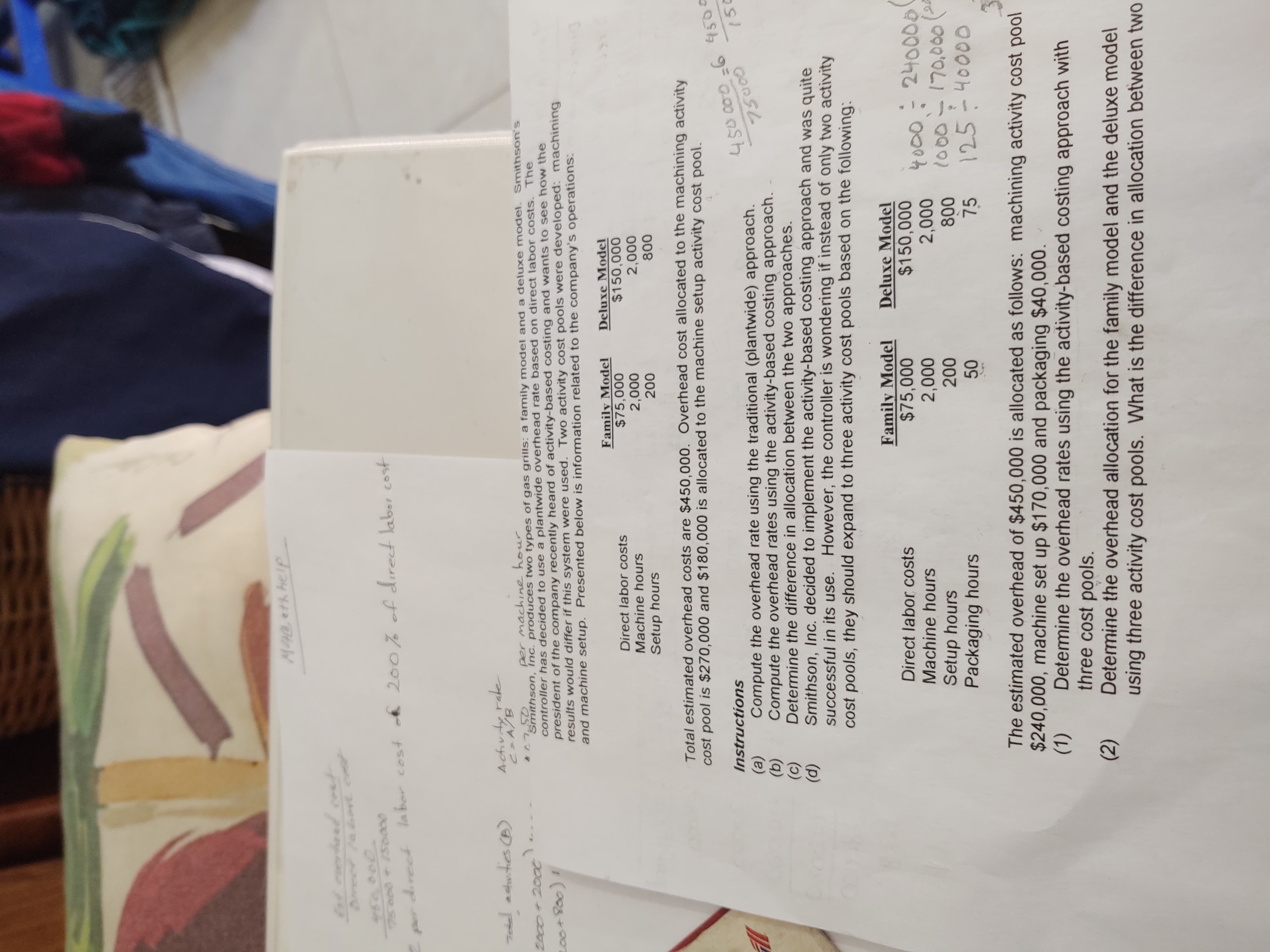

Smithson, Inc. produces two types of gas grills: a family model and a deluxe model. Smithson's

controller has decided to use a plantwide overhead rate based on direct labor costs. The

president of the company recently heard of activity-based costing and wants to see how the

results would differ if this system were used. Two activity cost pools were developed: machining

and machine setup. Presented below is information related to the company's operations:

c00+800)!

Family Model

$75,000

2,000

200

Deluxe Model

$150,000

2,000

Direct labor costs

Machine hours

Setup hours

800

Total estimated overhead costs are $450,000. Overhead cost allocated to the machining activity

cost pool is $270,000 and $180,000 is allocated to the machine setup activity cost pool.

450000-6 4500

ల

Instructions

(a)

(b)

(c)

(d)

150

Compute the overhead rate using the traditional (plantwide) approach.

Compute the overhead rates using the activity-based costing approach.

Determine the difference in allocation between the two approaches.

Smithson, Inc. decided to implement the activity-based costing approach and was quite

successful in its use. However, the controller is wondering if instead of only two activity

cost pools, they should expand to three activity cost pools based on the following:

Family Model

$75,000

2,000

200

Deluxe Model

$150,000

2,000

Direct labor costs

240000

4000-

1000-170,000 (

125-40000

Machine hours

Setup hours

Packaging hours

800

50

75

The estimated overhead of $450,000 is allocated as follows: machining activity cost pool

$240,000, machine set up $170,000 and packaging $40,000.

(1)

Determine the overhead rates using the activity-based costing approach with

three cost pools.

Determine the overhead allocation for the family model and the deluxe model

using three activity cost pools. What is the difference in allocation between two

(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- One of Concord Company's activity cost pools is machine setups with estimated overhead of $220000. Concord produces sparklers (320 setups) and lighters (680 setups). How much of the machine setup cost pool should be assigned to sparklers? $220000 $70400 O $110000 O $149600arrow_forwardi need the answer quicklyarrow_forwardConsider zagol manufacturing which is engaged in the manufacturing of product ABC. To produce one unit of the product the company incurs the following costs: Direct material ______$5/kg Direct labor_________$10/hour Total Manufacturing overhead __________________$30000 The company produces a total of 10000 units per month. And the actual price the product is sold is around $24. Company XYZ offers to buy a total of 5000 units this month at the price of $ 17/unit. Would you accept the order if you are the manager? (assume 20% of the manufacturing overhead is variable costarrow_forward

- Give me correct answer with explanation..arrow_forwardLean Mfg: Vintage Audio Incarrow_forwardEdgerron Company is able to produce two products, G and B, with the same machine in its factory. The following information is available. Product G Product B Selling price per unit $ 200 $ 230 Variable costs per unit 85 138 Contribution margin per unit $ 115 $ 92 Machine hours to produce 1 unit 0.4 hours 1.0 hours Maximum unit sales per month 650 units 250 units The company presently operates the machine for a single eight-hour shift for 22 working days each month. Management is thinking about operating the machine for two shifts, which will increase its productivity by another eight hours per day for 22 days per month. This change would require $11,500 additional fixed costs per month. (Round hours per unit answers to 1 decimal place. Enter operating losses, if any, as negative values.)arrow_forward

- Zion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $13 each. Zion uses 4,400 units of Component K2 each year. The cost per unit of this component is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total $7.84 2.84 1.67 4.00 $16.35 The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 1. What are the alternatives facing Zion Manufacturing with respect to production of Component K2? 2. List the relevant costs for each alternative. If required, round your answers to the nearest cent. Total Relevant Cost Make per unit Buy per unit Differential Cost to Make per unitarrow_forward2arrow_forwardVikram bhaiarrow_forward

- Please help me with this questionarrow_forwardSunland Irrigation, Inc. is known throughout the world for its H2O-X high-capacity water pump, used in irrigation systems. The pump’s standard cost is as follows. The company’s predetermined fixed overhead rate is based on an expected capacity of 100,000 direct labor hours per month. StandardPrice StandardQuantity StandardCost Direct materials $7 per pound 14 pounds $98 Direct labor $10 per DLH 4 DLH 40 Variable overhead $9 per DLH 4 DLH 36 Fixed overhead $4 per DLH 4 DLH 16 $190 During the month of September, the company produced 21,860 of the 25,000 pumps that had been scheduled for production in the budget. The company used 356,350 pounds of material during September. The direct labor payroll for the month was $773,200 for 92,900 direct labor hours. Variable overhead costs were $825,800; fixed overhead costs were $363,200. The company’s purchasing agent signed a new supply contract that resulted…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education