ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

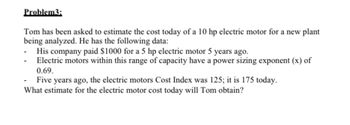

Transcribed Image Text:Problem3:

Tom has been asked to estimate the cost today of a 10 hp electric motor for a new plant

being analyzed. He has the following data:

- His company paid $1000 for a 5 hp electric motor 5 years ago.

Electric motors within this range of capacity have a power sizing exponent (x) of

0.69.

- Five years ago, the electric motors Cost Index was 125; it is 175 today.

What estimate for the electric motor cost today will Tom obtain?

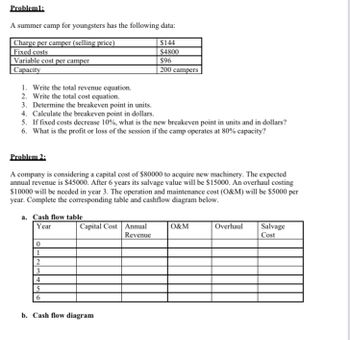

Transcribed Image Text:Problem1:

A summer camp for youngsters has the following data:

Charge per camper (selling price)

Fixed costs

$144

$4800

Variable cost per camper

Capacity

1. Write the total revenue equation.

2. Write the total cost equation.

3. Determine the breakeven point in units.

4. Calculate the breakeven point in dollars.

5. If fixed costs decrease 10%, what is the new breakeven point in units and in dollars?

6. What is the profit or loss of the session if the camp operates at 80% capacity?

Problem 2:

A company is considering a capital cost of $80000 to acquire new machinery. The expected

annual revenue is $45000. After 6 years its salvage value will be $15000. An overhaul costing

$10000 will be needed in year 3. The operation and maintenance cost (O&M) will be $5000 per

year. Complete the corresponding table and cashflow diagram below.

a. Cash flow table

Year

0

1

2

3

4

5

6

$96

200 campers

Capital Cost Annual

Revenue

b. Cash flow diagram

O&M

Overhaul

Salvage

Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Big Boss Company produces 125 units of outputat a total cost of $2453. The marignal cost of the 126th unit is $154. What is the total cost of the 126 units?arrow_forwardAssume you were hired as a Production Engineer in a global Bearing Manufacturer company and given the following inputs: Equipment Maintenance Cost per Month Utilities Cost per Month Material Cost per Unit Labor Cost per Unit Selling Price per Unit S60,000.00 $12.000.00 $12.00 $3.00 $24.00 Calculate Total Fixed Cost per Month Calculate Total Variable Cost per Unit = Calculate number of Units to be sold to reach Break-Even Point = Calculate number of Units that must be sold to eam profit of $90,000.00arrow_forwardThe AVC at 2 units is:A) 80;B) 35;C) can not be determined;D) 70;E) 40.arrow_forward

- If the total fixed cost is 4400 and the number units is 10 units find the average fixed cost?arrow_forwardDetermine the Total Cost if the Fixed cost are $16000 and the variable cost are $22000?arrow_forwarda manufacturer produces certain items at a labor cost of 150 each, the material cost is 75 each, and the variable cost of 2.50 each. if the item has a unit price of 500, how many number of units must be manufactured each mont for the manufacturer to break even if the monthly overhead of 299,750?arrow_forward

- Equipment purchased in 2006 for $36,000 must be replaced in late 2017. What is the estimated cost of the replacement equipment based on the following cost indices? TITI End of Year Index End of Year Index 2011 202 209 222 134 2004 2005 2006 2007 2008 2009 2010 2012 2013 149 155 2014 2015 2016 242 263 156 170 183 278 194 2017 289 (estimated) The estimated cost of the replacement equipment based on the cost indices provided is S (Round to the nearest dollar.) Enter your answer in the answer box.arrow_forwardA car wheel making company has the following data related to cost: Total Cost = $ 15000 + 1000X and Total Revenue = 2500X, where X is the number of wheel. Calculate the amount profit or loss required to make X = 1500 wheels.arrow_forwardEvery year, there is some form of construction work going on at UF's campus. In January 2018, bids were opened for a new building on campus for UFPD. The bid/construction value of the building was set at $5 Million. Another building of similar structure and purpose is planned with a bid opening in January 2023. What is the expected bid for the new building? It is given that in January 2000, the Florida Construction Cost Index had a value of 5550, while in January 2018, that value was 8000. You can use these price indices to calculate an average inflation in construction costs.arrow_forward

- It is given that the total fixed cost incurred by the firm is $300 and the total variable cost is $50 for the 2nd unit. Calculate the total cost for the second unit. (B) Is the total cost for all the other units be same?arrow_forwardall average cost can be calculated by deriving the per unit cost. True or Falsearrow_forwardSOLVE STEP BY STEP IN DIGITAL FORMAT The company Cielito S.A. It manufactures clothing for older adults and has a large presence in Mexico, due to the comfort and good taste of its garments. It has 60 seamstresses who work 8 hours a day; Indirect manufacturing expenses are $9,500.00 MXN. Every day Cielito S.A. produces 1,500 garments. The cost per hour of labor is $55.00 MXN. With this data, you must calculate: a. Labor or labor productivity. b. The productivity of manufacturing indirect expenses. c. The total productivity of Cielito S.A.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education