FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

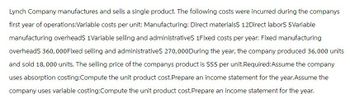

Transcribed Image Text:Lynch Company manufactures and sells a single product. The following costs were incurred during the companys

first year of operations:Variable costs per unit: Manufacturing: Direct materials$ 12Direct labor$ 5 Variable

manufacturing overheads 1Variable selling and administratives 1Fixed costs per year: Fixed manufacturing

overhead$ 360,000Fixed selling and administratives 270,000 During the year, the company produced 36,000 units

and sold 18,000 units. The selling price of the companys product is $55 per unit.Required:Assume the company

uses absorption costing:Compute the unit product cost.Prepare an income statement for the year. Assume the

company uses variable costing:Compute the unit product cost. Prepare an income statement for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Ross Corporation manufactures and sells one product. The following information pertains to the company's first year of operations: Variable costs per unit: Direct materials $81 Fixed costs per year Direct labor $1,008,000 Fixed manufacturing overhead $2,520,000 Fixed selling and administrative $1,440,000 The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 36,000 units and sold 30,000 units. There was no ending work-in-process inventory. The company's only product is sold for $251 per unit. 9.1 What is the unit product cost under super-variable costing? 9.2 What is the net operating income under super-variable costing? 9.3 Assume that the company uses a variable costing system that assigns $28 of direct labor cost to each unit that is produced. How much higher or lower is variable costing income compared to that under super-variable costing? 9.4 Assume that the company…arrow_forwardDiego Company manufactures one product that is sold for $76 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 58,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 23 Direct labor $ 15 Variable manufacturing overhead $ 3 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,160,000 Fixed selling and administrative expense $ 640,000 The company sold 40,000 units in the East region and 14,000 units in the West region. It determined that $320,000 of its fixed selling and administrative expense is traceable to the West region, $270,000 is traceable to the East region, and the remaining $50,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its…arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forward

- Lynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 14 Direct labor $ 8 Variable manufacturing overhead $ 2 Variable selling and administrative $2 Fixed costs per year: Fixed manufacturing overhead $ 250,000 Fixed selling and administrative $ 160,000 During the year, the company produced 25,000 units and sold 21,000 units. The selling price of the company's product is $47 per unit. Required: Assume the company uses absorption costing: Compute the unit product cost. Prepare an income statement for the year. Assume the company uses variable costing: Compute the unit product cost. Prepare an income statement for the year.arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forwardDiego Company manufactures one product that is sold for $72 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 55,000 units and sold 50,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Profit will Fixed manufacturing overhead Fixed selling and administrative expense $ 23 $ 14 $3 $5 The company sold 37,000 units in the East region and 13,000 units in the West region. It determined that $290,000 of its fixed selling and administrative expense is traceable to the West region, $240,000 is traceable to the East region, and the remaining $77,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. $ 770,000 $ 607,000 15. Assume the…arrow_forward

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 87,600 units per year is: Direct materials Direct labor Variable manufacturing overhead $ 2.20 $ 4.00 $ 0.70 $ 4.25 Variable selling and administrative expenses Fixed selling and administrative expenses $ 1.80 $ 3.00 Fixed manufacturing overhead 5 The normal selling price is $20.00 per unit. The company's capacity is 111,600 units per year. An order has been received from a mail-order house for 2,000 units at a special price of $17.00 per unit. This order would not affect regular sales or total fixed costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these…arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forwardDiego Company manufactures one product that is sold for $75 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 46,000 units and sold 42,000 units. 2 W Variable costs per unit: Manufacturing: Direct materials Direct labor # S Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense The company sold 31,000 units in the East region and 11,000 units in the West region. It determined that $200,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $38,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product. 10. What would have been the company's variable costing…arrow_forward

- Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $52 per unit. Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses variable costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for…arrow_forwardDiego Company manufactures one product that is sold for $77 per unit in two geographic regions—the East and West regions. The following information pertains to the company’s first year of operations in which it produced 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials $ 27 Direct labor $ 10 Variable manufacturing overhead $ 2 Variable selling and administrative $ 3 Fixed costs per year: Fixed manufacturing overhead $ 1,298,000 Fixed selling and administrative expense $ 662,000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education