Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

A 250.

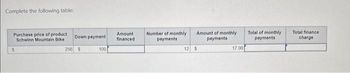

Transcribed Image Text:Complete the following table:

Purchase price of product

Schwinn Mountain Bike

$

Down payment

256 $

100

Amount

financed

Number of monthly

payments

Amount of monthly

payments

12 $

17.00

Total of monthly

payments

Total finance

charge

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- irr?arrow_forwardWhat is the $/€ spread of 1.33 35/ 45 worth on €5 million? A. €5000 B.$5000 C. €50,000 D. $50,000 Please show Mathematical calculations and currency symbol calculations to get the answer of $5000arrow_forwardCashbalance,beginning.....................P9 P ? P ? P? P?Add collectionsfromcustomers..... ? ? 125 ? 391Totalcash available................... 85 ? ? ? ?Less disbursements:Purchaseofinventory..................... 40 58 ? 32 ?Operatingexpenses............... ? 42 54 ? 180Equipmentpurchases................... 10 8 8 ? 36Dividends.......................... 2 2 2 2 ?Totaldisbursement.................... ? 110 ? ? ?Excess (deficiency) of cash availableOrdisbursements... ...................... (3) ? 30 ? ? Financing:Borrowings......................... ? 20 - - ?Repayments (including interest)*.. - - (?) (7) (?)Total financing......................... ? ? (?) (?) ?Cash balance, ending................... P ? P ? P ? P ? P ? *Interest will total P4, 000 for the year.arrow_forward

- givon: i=10% find: p=? N=0 $ 2000 $ 1000 3 4 5arrow_forwardAlice Longtree has decided to invest $430 quarterly for 4 years in an ordinary annuity at 8%. As her financial adviser, calculate for Alice the total cash value of the annuity at the end of year 4. (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Future valuearrow_forwardHt.24.arrow_forward

- Ay 2.arrow_forward5 a. What is the payback period (Be exact to 1 decimal place) of the cash flow below? 1500 1700 10000 1900 2300 2100 0 1 2 3 4 5 m 1800 2000 1500 00 1700 1900 9 10 2100 11 2300 12arrow_forwardHere is a multiple decrement table: Age x 60 0.13 0.17 61 0.08 0.14 62 0.11 0.11 63 0.14 0.08 64 0.17 0.05 65 0.20 0.02 бб 0.23 0.02 67 0.26 0.02 68 0.29 0.02 69 0.32 0.02 70 0.95 0.05 r, is the rate of retirement, and t, is the rate of termination. Decrements occur at the end of the year. No one ever dies! If you retire, you receive $100 per year for life (thus in perpetuity), with the first payment happening 1 year after you retire. i = .05 We currently have 1,000 employees who are all aged 60. Calculate the expected present value of all of the retirement benefits:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education