FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

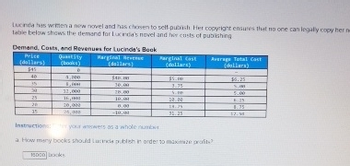

Transcribed Image Text:Lucinda hes written a new novel and has chosen to self-pubish. Her copyright ensures that no one can legally copy her ne

table below shows the demand for Lucenda's novel and her costs of publishing

Demand, Costs, and Revenues for Lucinda's Book

Harginal Reven

(dollars)

Price

(dallars)

$45

40

35

30

25

20

15

Quantity

(books)

B

4,000

5,00

12,000

16,99

20,000

24,900

$4.

15000 k

10.00

28.00

10.09

0.00

-18.00

Marginal Cast

(dollars)

$5.00

3.75

5.00

22.00

18.30

32.25

Average Total Cast

(dollars)

Instruction

her your answers as a whole numbr

a. How many bocks should Lucencle publish in order to maximize profit?

$5.25

S.m

6:25

8.75

12.94

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Fred Tang is a property investor. He owns an apartment at Harbord, and a house at Glebe which have been leased to tenants for several years. He also owns land in Shellharbour. Fred received the following amounts in respect of the Harbord and Glebe properties: Receipts Rent Income (net of agent's commission $5,200) $ 64,250 Rent received from the rental bond board, which represented unpaid rent from April 2015 1,640 Water usage component of water rates paid recouped from tenant 1,040 Settlement from a tenant that was held to have breached the terms of the lease. The settlement included $10,400 which was in respect of a garage that had to be completely rebuilt. The balance was unpaid rent 13,400 Deductions Water & Council Rates 3,200 Cleaning of properties after tenants vacated 740 Landscaping at Glebe property 5,000 Building insurance 380 Repairs and Maintenance 4,400 Decline in Value…arrow_forwardY2 A jewelry store in Lanberry bought a gold ring for $550 and marked it up 50% from the original cost. Later on, Beth purchased the gold ring and paid Lanberry sales tax of 8%. How much, including tax, did she pay for the gold ring? Submitarrow_forwardNancy Houser has a $1,500 overdue debt for medical books and supplies at Ken's Bookstore. She has only $500 in her checking account and doesn't want her parents to know about this debt. Ken's tells her that she may settle the account in one of two ways since she can't pay it all now: 1. Pay $500 now and $1,200 when she completes her residency, two years from today. 2. Pay $2,000 one year after completion of residency, three years from today. Assuming that the cost of money is the only factor in Nancy's decision and that the cost of money to her is 8%, which alternative should she choose?arrow_forward

- Nat is a salesman for a real estate developer. His employer permits him to purchase a lot for $75,000. The employer’s adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat’s recognized gain and his basis for the lot? Recognized Gain Basis $0 $ 75,000 $0 $ 90,000 $15,000 $ 75,000 $15,000 $ 90,000arrow_forwardAmelia’s business goes bankrupt this year. To close her business, Amelia starts by selling off her business assets. Below are the asset disposition transactions: Assets Purchased Date Cost Sold date Sold price Delivery car 5/1/23 30k 12/31/23 25k Furniture 3/20/20 40k 12/31/23 20k Equipment 4/1/20 110k 12/31/23 100k Land 1/1/22 150k 12/31/23 180k Assume there is no Section 179 and bonus depreciation. Use MACRS only for depreciation. Show detailed calculation and explanation a) Calculate total accumulated depreciation of each asset until the sold date (12/31/23). b) Calculate the adjusted basis for each asset c) Calculate the gain/loss for each asset d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules Hint: Review textbook chapter on this. In the year of disposition, under half-year convention, only ½ of MACRS…arrow_forwardDavid and Gary are students at Berkeley College. They share an apartment that is owned by Gary. Gary is considering subscribing to an Internet provider that has the following packages available: Package A. Internet access B. Phone services C. Internet access + phone services (a) Stand-alone (b) Incremental David primary user Gary primary user Per Month (c) Shapley $ 85 15 90 Requirement 1. Allocate the $90 between David and Gary using (a) the stand-alone cost-allocation method, (b) the incremental cost-allocation method, and (c) the Shapley value method. (Round your answers to the nearest cent.) Costs allocated to David Gary C David spends most of his time on the Internet ("everything can be found online now"). Gary prefers to spend his time talking on the phone rather than using the Internet ("going online is a waste of time"). They agree that the purchase of the $90 total package is a "win-win" situation. Requirements 1. Allocate the $90 between David and Gary using (a) the…arrow_forward

- Muriel Evan write the following note on the back of an envelope: "I, Murierl Evans, promis to pay Karen Marvins or bearer $100 on demand. " Is this a negottiable instrument? Discuss why or why not.arrow_forwardNonearrow_forwardJoy, a sole proprietor involved in AirBnB, needs to sell almost all of his apartments. The selling prices were originally 500,000 on average. Because of circumstances, she had to quickly sell these at 350,000 on average less a 10% commission payable to whoever referred the buyers to her. The form of liquidation process described here is?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education