FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

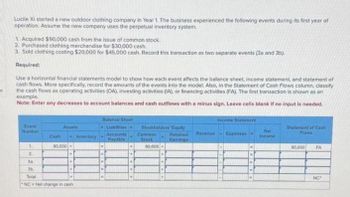

Transcribed Image Text:Lucile Xi started a new outdoor clothing company in Year 1. The business experienced the following events during its first year of

operation. Assume the new company uses the perpetual inventory system.

1. Acquired $90,000 cash from the issue of common stock.

2. Purchased clothing merchandise for $30,000 cash.

3. Sold clothing costing $20,000 for $45,000 cash. Record this transaction as two separate events (38 and 3b).

Required:

Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of

cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify

the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). The first transaction is shown as an

example.

Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed.

Balance Sheet

Income Statement

Event

Number

Assets

Liabilities

Accounts

Blockholders' Equity

Cash

Inventory

Payable

Common

Stock

Retained Revenue Expenses

Eamings

Net

Income

Statement of Cash

Flows

1

90,000

90.000+

90,000

FA

2

3a

36

Total

NC Net change in cash

NO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Dan Watson started a small merchandising business in Year 1. The business experienced the following events during its first year of operation. Assume that Watson uses the perpetual inventory system. Acquired $30,000 cash from the issue of common stock. Purchased inventory for $24,000 cash. Sold inventory costing $16,100 for $30,500 cash. Required Record the events in a horizontal statement model. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, or NC for net change in cash. If the element is not affected by the event, leave the cell blank. Prepare an income statement for Year 1 (use the multistep format). What is the amount of total assets at the end of the period?arrow_forwardRite Shoes was involved in the transactions described below. Purchased $9,500 of inventory on account. Paid weekly salaries, $1,050. Recorded sales for the first week: Cash: $8,400; On account: $6,600. Paid for inventory purchased in event (1). Placed an order for $7,500 of inventory. Required: Prepare the appropriate journal entry for each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardQuasar, Inc. sells clothing, accessories, and personal care products for men and women through its retail stores. Quasar reported the following data for two recent years: Year 2 Year 1 Sales $1,904,205 $1,877,925 Accounts receivable 175,200 $167,900 Assume that accounts receivable were $189,800 at the beginning of Year 1. a. Compute the accounts receivable turnover for Year 2 and Year 1. Round to one decimal place. Year 2: fill in the blank 1 Year 1: fill in the blank 2 b. Compute the days' sales in receivables for Year 2 and Year 1. Round interim calculations and final answers to one decimal place. Use 365 days per year in your calculations. Year 2: fill in the blank 3 days Year 1: fill in the blank 4 days c. The change in accounts receivable turnover from year 1 to year 2 indicates a(n) ______ in the efficiency of collecting accounts receivable and is a(n) ______ change. The change in the days' sales in receivables indicates a(n) ______…arrow_forward

- Every March, Buddie, who owns and operates a small retail shop, takes a large box of receipts and invoices to her accountant so the accountant can file Buddie's taxes in April. Only then does Buddie know if her business has been profitable. Buddie could benefit from a(n) ________.Select one:a. concurrent control systemb. management information system c. balanced scorecard systemd. inventory control systemarrow_forward16. Joseph Howard owns a bicycle parts business called Quality Bike Products. The following transactions took place during July the current year. July 5 Purchased merchandise on account from Wheeler Warehouse, $3,300. 8 Paid freight charge on merchandise purchased, $330. 12 Sold merchandise on account to Big Time Spoiler, $4,500. The merchandise cost $2,500. 15 Received a credit memo from Wheeler Warehouse for merchandise, $470. Required: 1. Journalize the above transactions in a general journal using the periodic inventory method. 2. Journalize the above transactions in a general journal using the perpetual inventory method. GENERAL JOURNAL (Periodic Inventory Method) Page 1 Post Date Description Ref. Debit Creditarrow_forwardBased on the following transactions, answer the following questions. i. ii. iii. iv. V. vi. vii. Purchased inventory with a cost of $28,300 on account. Sales on account to customers totalled $54,700. Payments made to employees for wages totalled $19,600. Cash collections from customers settling their accounts totalled $49,500. Invoice received from the utility company for $6,100 is due in 30 days. Payments totalling $19,500 were made to suppliers to settle part of the balance owing to them. Received a deposit of $1,800 from a customer for goods to be delivered next month.arrow_forward

- Harry Gryffindor incorporated Harry's Pottery on March 1, 20x7. Harry's Pottery is a merchandising company located in Hogwarts Station, MD. During his first month of operations Harry reported the following data related to his purchases for his only product: In addition, Harry made one sale on March 15 when he sold 28 customized cauldrons to Rowena Ravenclaw for $50 each. Purchases on March 7 Purchases on March 14 Purchases on March 21 Harry Gryffindor made one sale on March 15 when he sold 28 customized cauldrons to Rowena Ravenclaw for $50 each. Assuming that Harry uses a perpetual inventory system, use the information provided above to calculate ending inventory on March 30 if Harry uses the weighted average method to assign costs to inventory. (Round your per unit costs to 2 decimal places.) Weighted Average - Perpetual: Date March 7 March 14 Average cost March 15 March 21 Average cost # of units Goods purchased Cost per unit 18 @ $20.00 32 @ $30.00 28 @ $36.00 18 units @ $20.00…arrow_forwardThe following transactions occurred during the month of November in the operation of Wonderful Buy, Inc, a retailer of electronic merchandise. Record each transaction listed below to show its impact on the accounting equation in the table provided on the next page for that purpose. For any entry that impacts Retained Earnings, write a brief description in the column provided. November 4 Purchased merchandise for $6,000 on account from International Fragrance Corporation, terms: 3/10, n/60. November 16 Sold merchandise to a customer on account for $8,000, terms 2/10, n/30. The merchandise had cost Wonderful Buy’s $4,000. November 18 Sold merchandise to a customer for cash, $850. The merchandise had cost Wonderful Buy’s $350. November 19 Customer returned $200 of the merchandise from the sale on November 18 and was given a refund. The…arrow_forward73. Meadows Company headquarters records all of its branch equipment in its own general ledger. Prepare the journal entries in the horne office books and in the branch books as a result of the following transactions: (a) At the beginning of 1986, the branch office purchased branch inventory for $2,500, terms of purchase 2/10, n/30. (b) Head office pays invoices within the discount period. (c) Depreciation on equipment is recorded at the end of the year at a rate of 10%. (d) In earty 1987, the branch's old inventory was exchanged for new inventory for $4,000; A trade-in of $1,500 is received on the old inventory and headquarters pays the balance.arrow_forward

- The question in the images. Thank you for your help!arrow_forwardSandy Chen owns a small specialty store, named Chen's Chattel, whose year-end is June 30. A physical inventory taken on June 30 reveals the following: Cost of merchandise on the showroom floor and in the warehouse $38,300 Goods held on consignment (consignor is National Manufacturer) 6,400 Goods that Chen's Chattel, as the consignor, has for sale at the location of the Grand Avenue Vista 4,600 Sales invoices indicate that merchandise was shipped on June 29, terms FOB shipping point, delivered at buyer's receiving dock on July 3 3,800 Sales invoices indicate that merchandise was shipped on June 25, terms FOB destination, delivered at buyer's receiving dock on July 5 3,100 Determine the total amount that should be included in Chen's Chattel's year-end inventory.arrow_forward2 Nunez Company, a retail hardware store, began business in August and elected a calendar year for tax purposes. From August through December, Nunez paid $319,000 for inventory to stock the store. According to a physical inventory count on December 31, Nunez had $64,600 of inventory on hand. Required: a. Compute Nunez's cost of goods sold for its first year assuming Nunez adopted the cash method as its overall method of accounting. b. Compute Nunez's cost of goods sold for its first year assuming Nunez adopted the accrual method as its overall method of accounting. Complete this question by entering your answers in the tabs below. Required A Required B Compute Nunez's cost of goods sold for its first year assuming Nunez adopted the cash method as its overall method of accounting. Cost of goods soldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education