FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

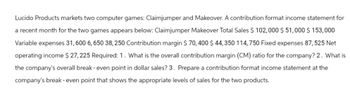

Transcribed Image Text:Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for

a recent month for the two games appears below: Claimjumper Makeover Total Sales $ 102,000 $51,000 $ 153,000

Variable expenses 31,600 6,650 38, 250 Contribution margin $ 70,400 $ 44,350 114,750 Fixed expenses 87, 525 Net

operating income $27,225 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is

the company's overall break - even point in dollar sales? 3. Prepare a contribution format income statement at the

company's break - even point that shows the appropriate levels of sales for the two products.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bed & Bath, a retaling company, has two departments-Hardware and Linens. The company's most recent monthly contribution format Income statement follows: Departnent Linens $ 4, 290,000 $ 3,130,000 $ 1,160,000 414, 000 Total Hardware sales variable expenses 1,364,000 95e, eee Contribution margin Fixed expenses 2,926, 000 2,160, 000 2,180, e00 1,318, eee 870, 000 s (104, eee) 746, 000 85e, e00 Net operating incone (loss) 766,000 $ A study indicates that $378.000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. in addition, the ellmination of the Linens Department will result in a 14% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department?arrow_forwardStonebraker Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range. Sales (9,300 units) Variable expenses Contribution margin Fixed expenses Net operating income $ 306,900 204,600 102,300 77,500 $ 24,800 Required: a. If sales increase to 9,370 units, what would be the estimated increase in net operating income? b. If the variable cost per unit increases by $7, spending on advertising increases by $3,500, and unit sales increase by 20,500 units, what would be the estimated net operating income? c. Estimate how many units must be sold to achieve a target profit of $36,460.arrow_forwardConsider the following information: Sales revenue: $12,000 Variable manufacturing expenses: $3,000 Variable marketing and admin. expenses: $1,000 Fixed manufacturing expenses: $1,500 Fixed marketing and admin. expenses: $500 Based on the above information, the contribution margin is:arrow_forward

- Dartmount Corporation has provided its contribution format income statement for June. The company produces and sells a single product. Sales (2,900 units) $ 275,500 Variable costs 116,000 Contribution margin 159,500 Fixed costs 136,100 Operating profit $ 23,400 If the company sells 3,200 units, its total contribution margin should be closest to:arrow_forwardWild-Water Works Water Park provides for a fun day by offering a variety of rides. Wild-Water Works Water Park sells tickets at $69 per person as a one-day entrance fee. Variable costs per person are $24 and a fixed cost amount to $236,300 per month. (Round your answers to two decimal places when needed and use rounded answers for all future calculations). 1. Compute the new contribution margin per unit and the contribution margin ratio if Wild-Water Works Water Park cuts it ticket price to $40 per person. Net Sales revenue per unit Contribution margin / Net sales revenue = Contribution margin ratio (%) (Fixed Costs 2. Find the break-even point in units and in dollars using the contribution margin approach. (Reminder to write answer in whole units). + Variable costs per unit = Unit Contribution margin (Fixed Costs + Target Profit) / (Contribution Margin per unit) + + Target Profit) 1 = = 1 / (Contribution Margin ratio %) = = Required Sales in Units Required Sales in Dollarsarrow_forwardDry Cleaners has determined the following about its costs: Total variable expenses are screenshot attache dtahnkng rnkgwrarrow_forward

- Please prepare h contribution margin income statement for the month of June thankuarrow_forward[The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 70,000 Variable expenses 38,500 Contribution margin 31,500 Fixed expenses 23,310 Net operating income $ 8,190 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.) 2. What is the contribution margin ratio? 3. What is the variable expense ratio? 4. If sales increase to 1,001 units, what would be the increase in net operating income?arrow_forwardSandhill Company makes three models of tasers. Information on the three products is given below. Tingler Shocker Stunner Sales $296,000 $504,000 $200,000 Variable expenses 151,700 207,900 138,200 Contribution margin 144,300 296,100 61,800 Fixed expenses 117,800 231,800 95,000 Net income $26,500 $64,300 $(33,200) Fixed expenses consist of $300,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $29,000 (Tingler), $80,600 (Shocker), and $35,000 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. (a) Compute current net income for Sandhill Company. Net income Aarrow_forward

- Following is relevant information for Philly's Sandwich Shop, a small business that serves sandwiches: Total fixed cost per month Variable cost per sandwich $1,020.00 1.50 Sales price per sandwich 5.75 During the month of June, Philly's sold 580 sandwiches. Required: Complete the contribution margin income statement for the month of June. Note: Round your final answers to the nearest whole dollar. Philly's Sandwich Shop Contribution Margin Income Statement Month of June Contribution margin Net Operating incomearrow_forwardBob's Bike Shop has the following income statement. Sales ($150 per unit) Less Cost of Goods sold ($96 per unit) Gross margin Less Operating costs Salaries Advertising Shipping ($6 per unit) Operating income Required: a. b. d. $150,000 96,000 $24,000 12,000 54,000 6,000 42,000 $ 12,000 Calculate the contribution margin per unit. Calculate the contribution margin ratio. Calculate the breakeven point in units. In sales dollars. Calculate the margin of safety in units. In dollars.arrow_forwardLucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $57,600 38,400 $ 19, 200 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. Required 1 Required 2 Required 3 Complete this question by entering your answers in the tabs below. Sales Variable expenses Contribution margin Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Engberg Company Contribution Income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education