FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

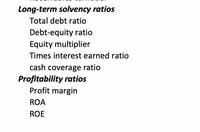

Transcribed Image Text:Long-term solvency ratios

Total debt ratio

Debt-equity ratio

Equity multiplier

Times interest earned ratio

cash coverage ratio

Profitability ratios

Profit margin

ROA

ROE

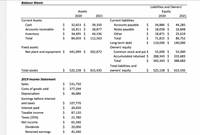

Transcribed Image Text:Balance Sheets

Liabilities and Owners'

Assets

Equity

2020

2021

2020

2021

Current Assets

Current liabilities

$

32,653 $

$

16,911 $

2$

34,495 $

$

84,059 $

Accounts payable

Notes payable

$

34,886 $

$

18,058 $

2$

18,871 $

$

71,815 $

$

110,000 $

Cash

39,350

44,285

Accounts receivable

28,877

16,848

Inventory

44,336

Other

25,619

Total

112,563

Total

86,752

Long-term debt

Owners' equity

Common stock and pai $

Accumulated retained $

140,000

Fixed assets

Net plant and equipment $

441,099 $

55,000 $

288,343 $

502,872

55,000

333,683

Total

$

343,343 $

388,683

Total liabilities and

Total assets

525,158 $

615,435

owners' equity

24

525,158 $

615,435

2019 Income Statement

Sales

$

531,750

Costs of goods sold

Depreciation

377,294

$

46,686

Earnings before interest

and taxes

107,770

Interest paid

20,650

Taxable income

87,120

Texes (25%)

21,780

Net income

$

65,340

Dividends

20,000

Retained earnings

45,340

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q: Choose all that apply: The following ratios may be impacted by the adoption of the new standard: A. Revenue growth B. Net margin C. Return on equity D. Price to earnings multiples E. Return on assets F. Debt to equity G. Current ratio The Question is: Why "Debt to equity" and "Current ratios" may be impacted?arrow_forward5. Definitions: Pick 5 and define, describe why each matter, provide an example Define Describe why it matters Term Time value of money Passive income Net Worth Credit Score/Credit rating Risk Evaluation Stocks bonds Gross income v. Net income Mutual funds ETFs Index funds RRSP Consumer Debt OSAP Example(s)arrow_forwardare designed to indicate the potential default risk that lenders are undertaking when they grant a loan. Repayment capacity ratios O Financial efficiency ratios Profitability ratios Solvency ratios Liquidity ratiosarrow_forward

- Define debt ratioarrow_forwardAccount Title Dabit $4 Credit Cash Accounts receivable Office supplies 8,100 19,500 6,958 181,000 Trucks Accumulated depreciation-Trucks Land $ 37,286 48,000 Accounts payable Interest payable Long-term notes payable Common stock 12,100 2,000 57,000 29,929 135,500 Retained earnings Dividends 43,000 Trucking fees earned Depreciation expense-Trucks Salaries expense Office supplies expense Repairs expense-Trucks 129,000 24,049 59,329 2,000 10,879 Totals $402,815 $402,815 Use the above adjusted trial balance to prepare Wilson Trucking Company's classified balance sheet as of December 31. WILSON TRUCKING COMPANY Balance Sheet December 31 Assets MacBook Airarrow_forwardDefine required rate of return on debtarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education