FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

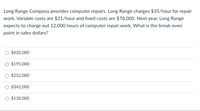

Transcribed Image Text:Long Range Company provides computer repairs. Long Range charges $35/hour for repair

work. Variable costs are $21/hour and fixed costs are $78,000. Next year, Long Range

expects to charge out 12,000 hours of computer repair work. What is the break-even

point in sales dollars?

$420,000

O $195,000

$252,000

$342,000

O $130,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pauley Company provides home health care. Pauley charges $85/hour for professional care. Variable costs are $29/hour and fixed costs are $78,000. Next year, Pauley expects to charge out 12,000 hours of home health care. What is the break-even point in hours? (Round to the nearest whole hour.)arrow_forwardAnderson Inc. uses packing machines to prepare their product for shipping. One machine costs $136,000 and lasts about 5 years before it needs to be replaced. The operating cost per machine is $6,500 a year. Ignoring taxes, what is the equivalent annual cost of one packing machine if the required rate of return is 11%? Multiple Choice $49,904 $51,036 $44,298 $43,298 $50,776arrow_forwardTom's Trashbins Inc. has fixed costs of $225,530. The firm's sales are expected to be $427,772 this year if the firm sells 9,458 units. Variable costs amount to 41 percent of sales. What is the breakeven point in units for Tom's Trashbins? SET YOUR CALCULATOR TO 4 DECIMAL PLACES. ROUND TO THE NEAREST WHOLE NUMBER AT THE END. FOR EXAMPLE, IF YOUR ANSWER IS 8297.6901, ROUND TO 8298.arrow_forward

- During a slack period, a manufacturer can sell 3000 articles per month at a price of $1.20 each. A $200,000 investment is used which is depreciated over a 20-year life. An annual fixed cost of $20,000 myst be considered well as an annual maintenance cost of $10,000. The production cost is $1.10 per item. The manufacturer's tax rate is 45%. Should the factory shut down?arrow_forwardwhat is the break even point in units and the break even point in sales dollars?arrow_forwardUnited Snack Company sells 50-pound bags of peanuts to university dormitories for $5 a bag. The fixed costs of this operation are $60,000, while the variable costs of peanuts are $.5 per pound. a. What is the break-even point in bags? b. Calculate the profit or loss on 18,000 bags. c. What is the degree of operating leverage at 20,000 bags ? d. If United Snack Company has an annual interest expense of $10,000, and EBIT $80.000, calculate the degree of financial leverage at 18,000. e. What is the degree of combined leverage at both sales levelarrow_forward

- Jamestown Industries sells $48,000 in gift cards and expects 20% breakage. Cost of goods sold is 25% of each gift card. When the expected gift cards are redeemed, how much cost of goods sold will Jamestown record? O $12,000 $24,000 O $10,000 O $9,600arrow_forwardRoseberg Theater sells tickets for dinner and a show for $60 each. The cost of providing dinner is $31 per ticket and the fixed cost of operating the theater is $65,000 per month. The company can accommodate 15,000 patrons each month. What is the contribution margin ratio? 51.67% 207% 48.33% 40.00%arrow_forwardGolden Gate Novelties (GGN) sells souvenir key chains at the local airport. GGN charges $12.00 per chain. The variable cost for a chain, including the wholesale cost of the chain, packaging, the commission paid to the airport operator, and so on, is $10.40. The annual fixed cost for GGN is $15,000. Required: a. How many cases must Golden Gate Novelties sell every year to break even? Note: Do not round intermediate calculations. b. The owner of GGN believes that the company can sell 12,500 chains a year. What is the margin of safety in terms of the number of chains? a. Break-even point b. Margin of safety chains chainsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education