FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

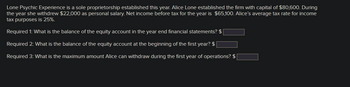

Transcribed Image Text:Lone Psychic Experience is a sole proprietorship established this year. Alice Lone established the firm with capital of $80,600. During

the year she withdrew $22,000 as personal salary. Net income before tax for the year is $65,100. Alice's average tax rate for income

tax purposes is 25%.

Required 1: What is the balance of the equity account in the year end financial statements? $

Required 2: What is the balance of the equity account at the beginning of the first year? $

Required 3: What is the maximum amount Alice can withdraw during the first year of operations? $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following year 2 income statement for Johnstone Corporation, which was a C corporation in year 1 and elected to be taxed as an S corporation beginning in year 2. Johnstone's earnings and profits at the end of year 1 were $11,560. Marcus is Johnstone's sole shareholder, and he has a stock basis of $46,000 at the end of year 1. Johnstone Corporation Income Statement December 31, Year 2 Year 2 (S Corporation) $ 174,000 ( 41,000) (66,000) (56,500) (10,000) ( 4,600) 12,540 $ 8,440 Sales revenue Cost of goods sold Salary to owners Employee wages Depreciation expense Miscellaneous expenses Interest income Overall net income What is Johnstone's accumulated adjustments account at the end of year 2, and what amount of dividend income does Marcus recognize on the year 2 distribution in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) b. Johnstone distributed $11,200 to Marcus in year 2. Accumulated adjustments account Dividend incomearrow_forwardDengararrow_forwardPlease do not give image formatarrow_forward

- why?arrow_forwardDog Subject: acountingarrow_forwardNicole organized a new corporation. The corporation began business on April 1 of year 1. She made the following expenditures associated with getting the corporation started: (Leave no answer blank. Enter zero if applicable.) Expense Date Amount Attorney fees for articles of incorporation February 10 $ 36,500 March 1 – March 30 wages March 30 5,200 March 1 – March 30 rent March 30 2,450 Stock issuance costs April 1 32,000 April 1 – May 30 wages May 30 13,000 What amount of the start-up costs and organizational expenditures may the corporation immediately expense in year 1 (excluding the portion of the expenditures that are amortized over 180 months)? START-UP COST EXPENSED ORGANIZATIONAL EXPENDITURES EXPENSEDarrow_forward

- Analyze and journal the transactions: The Company is VAT- registered with 5% tax rate. 03-Jan Mr Y used his money to put up a business amounting 500,000 Dhs with a trade name of Amazing Company. 03-Jan The annual office rent contract is 150,000+5% which is agreed to be paid quarterly with a security deposit of 5,000 Dhs. 03-Jan Paid deposit for DEWA 2,000 & etisalat 500 in cash 03-Jan Paid security deposit for rent 5,000 dhs in cash. 04-Jan Pay Ejari amounting 219.50 AED in cash. 04-Jan Trade Licenses amounting 15,788 AED, was complited and granted, pay in cash. 04-Jan Open an account to Dubai Islamic Bank at 100,000 Dhs cash. 04-Jan Purchase a machinery ( with 5yrs useful life) to be used in business 50,000 Dhs+5% in cash from Greece Company. 05-Jan Paid the PRO who process the trade licenses 2,500 AED in cash. 05-Jan Purchase…arrow_forward3 Net Income. A calendar year S corporation has the following information for the current taxable year: Sales $180,000 Cost of goods sold. Dividend income Net capital loss Salary to Z. Life insurance for Z (70,000) 5,000 (4,000) 12,000 500 Other operating expenses Cash distributions to owners 40,000 20,000 Assume Z is single and her only other income is $30,000 salary from an unrelated employer. She is a 20% owner with a $10,000 basis in the S stock at the beginning of the year. Calculate the S corporation's net ordinary income and Z's adjusted gross income and ending basis in the S corporation stock.arrow_forwardSolve both questionsarrow_forward

- Which of these businesses would NOT be required to file a balance sheet with the tax return? ORB, a C corporation, with $245,000 in gross receipts and $50,000 in assets. DBS, a partnership, with $275,000 in gross receipts and $150,000 in assets. JAS, an S corporation, with $175,000 in gross receipts and $260,000 in assets. BLA, a C corporation, with $240,000 in gross receipts and $290,000 in assets.arrow_forwarddeductible)? 73. Nicole organized a new corporation. The corporation began business on April 1 of year 1. She made the following expenditures associated with getting the corporation started: Expense Attorney fees for articles of incorporation February 10 March 1-March 30 wages March 30 March 1-March 30 rent March 30 Stock issuance costs April 1 April 1-May 30 wages May 30 Date Amount $32,000 4,500 2,000 20,000 12,000 a) What is the total amount of the start-up costs and organizational expenditures for Nicole's corporation? b) What amount of the start-up costs and organizational expenditures may the corporation immediately expense in year 1 (excluding the portion of the expenditures that are amortized over 180 months)? c) What amount can the corporation deduct as amortization expense for the organizational expenditures and for the start-up costs for year 1 [not including the amount determined in part (b)]? d) What would be the total allowable organizational expenditures if Nicole…arrow_forwardHank started a new business, Hank's Donut World (HW for short), in June of last year. He has requested your advice on the following specific tax matters associated with HW's first year of operations. Hank has estimated HW's income for the first year as follows: Revenue: Donut sales Catering revenues Expenditures: Donut supplies Catering expense Salaries to shop employees Rent expense Accident insurance premiums Other business expenditures Net Income $ 290,000 96,390 $394,398 $153,220 39,640 64,000 49,940 8,952 9,610 -325,362 $ 69,028 HW operates as a sole proprietorship, and Hank reports on a calendar year. Hank uses the cash method of accounting and plans to do the same with HW (HW has no inventory of donuts because unsold donuts are not salable). HW does not purchase donut supplies on credit, nor does it generally make sales on credit. Hank has provided the following details for specific first-year transactions. 1. A small minority of HW clients complained about the catering service.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education