FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Using FIFO, the cost of the 12,000 units transferred to Department B is:

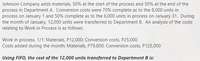

Transcribed Image Text:Johnson Company adds materials, 50% at the start of the process and 50% at the end of the

process in Department A. Conversion costs were 70% complete as to the 8,000 units in

process on January 1 and 50% complete as to the 6,000 units in process on January 31. During

the month of January, 12,000 units were transferred to Department B. An analysis of the costs

relating to Work in Process is as follows:

Work in process, 1/1: Materials, P12,000; Conversion costs, P25,000

Costs added during the month: Materials, P79,800; Conversion costs, P125,000

Using FIFO, the cost of the 12,000 units transferred to Department B is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For Penny Corp, materials are added at the start of the process in Department B. Units received from Department A costs P11.10 while in Department B, unit costs for materials and conversion costs were P1 and P1.22 respectively. The company’s quantity data showed that WIP beg, which had a cost of P80,000, had 8,000 units and were ¾ done. During the period, Department A transferred 50,000 units to Department B. At the end of the period, WIP has 10,000 units which are 1/5 done and there were 3,000 lost units. Required: a.) Compute for the unit cost transferred to finished goods if the 3,000 units were lost at the end of processing but were considered abnormal.arrow_forwardCost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Oak Ridge Steel Company is $462,800. The conversion cost for the period in the Rolling Department is $286,700. The total equivalent units for direct materials and conversion are 2,600 tons and 4,700 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $fill in the blank 1 per ton Conversion cost per equivalent unit: $fill in the blank 2 per tonarrow_forwardThe cost of warehouse space is allocated to three inventories: raw materials, work - process, and finished goods. The inventories use the warehouse space in the ratio of one-third to one-sixth to three-eighths, respectively. If the total warehouse space is 9.6 million square meters at a cost of $11.55 million, how much of the cost should be allocated to each of the inventories?arrow_forward

- Use this information about Department E to answer the question that follows. Department E had 4,000 units in Work in Process that were 40% completed at the beginning of the period at a cost of $12,500. There were 14,000 units of direct materials added during the period at a cost of $28,700. There were 15,000 units completed during the period, and 3,000 units were 75% completed at the end of the period. All materials are added at the beginning of the process, and the average cost method is used to cost inventories. Direct labor was $32,450, and factory overhead was $18,710. The number of equivalent units of production for the period is a.17,250 b.15,650 c.18,000 d.14,850arrow_forwardCompany C transfers 3,199 units from the packaging department to finished goods. The material cost per unit is $6.17 and the conversion cost per unit is $7.22. What is the total cost transferred? Round to the nearest penny, two decimal places.arrow_forwardSacramento Company has two service departments (A and B) and two producing departments (C and D). Last year, direct costs were A P80,000; B P60,000; C P15,000 and D P20,000. A provides services to B 10%, C 60% and D 30% while B provides services to A 30%, C 20% and D 50%. Using the algebraic method, Dept. A's allocation to Dept. C was * P60,619. P14,021. P21,031. P35,051.arrow_forward

- Cost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Kraus Company is $459,000. The conversion cost for the period in the Rolling Department is $303,800. The total equivalent units for direct materials and conversion are 2,700 tons and 4,900 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $fill in the blank 1 per ton Conversion cost per equivalent unit: $fill in the blank 2 per tonarrow_forwardDepartment 1 is transferring units that cost $40,000 to Department 2. Give the journal entry.arrow_forwardAt the beginning of the year, you estimated the following - Production - 75,000 units Raw Material - 270,000 pounds at a cost of $1,026,000 Direct Labor - 187,500 hours at a cost of $4,125,000 Variable Overhead - 135,000 machine hours at a cost of $567,000 Fixed Overhead - $900,000 At the end of year, the actual results were as follows - Production - 73,000 units Raw Material - 265,720 pounds purchased and used at a cost of $1,036,308 Direct Labor - 179,580 hours at a cost of $3,968,718 Variable Overhead - 133,590 machine hours at a cost of $558,406.20 Fixed Overhead - $891,000arrow_forward

- 1) Department W had 2,160 units, one-third completed at the beginning of the period. 13,000 units were transferred to Department X from Department W during the period, and 1,550 units were one-half completed at the end of the period. Assume the completion ratios apply to direct materials and conversion costs. 12,280 units b.10,840 units c.16,710 units d.13,055 units 2) If the contribution margin ratio for France Company is 39%, sales were $424,000, and fixed costs were $105,000, what was the income from operations? a.$60,360 b.$48,288 c.$105,000 d.$165,360arrow_forwardThe cost of direct materials transferred into the Rolling Department of Kraus Company is $3,000,000. The conversion cost for the period in the Rolling Department is $462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardFor Tabik Corp, materials are added at the start of the process in Department B. Units received from Department A costs P11.10 while in Department B, unit costs for materials and conversion costs were P1 and P1.22 respectively. The company’s quantity data showed that WIP beg, which had a cost of P80,000, had 8,000 units and were ¾ done. During the period, Department A transferred 50,000 units to Department B. At the end of the period, WIP has 10,000 units which are 1/5 done and there were 3,000 lost units. What is the unit cost transferred to finished goods if the 3,000 units were lost at the end of processing but were considered abnormal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education