FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

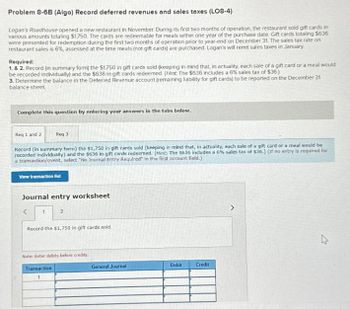

Transcribed Image Text:Problem 8-6B (Algo) Record deferred revenues and sales taxes (LO8-4)

Logan's Roadhouse opened a new restaurant in November. During its first two months of operation, the restaurant sold gift cards in

various amounts totaling $1,750. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $636

were presented for redemption during the first two months of operation prior to year-end on December 31. The sales tax rate on

restaurant sales is 6%, assessed at the time meals (not gift cards) are purchased. Logan's will remit sales taxes in January.

Required:

1. & 2. Record (in summary form) the $1,750 in gift cards sold (keeping in mind that, in actuality, each sale of a gift card or a meal would

be recorded individually) and the $636 in gift cards redeemed. (Hint The $636 includes a 6% sales tax of $36)

3. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) to be reported on the December 31

balance sheet

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Record (in summary form) the $1,750 in gift cards sold (keeping in mind that, in actuality, each sale of a gift card or a meal would be

recorded individually) and the $636 in gift cards redeemed. (Hint: The $636 includes a 6% sales tax of $36.) (If no entry is required for

a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

<

1

2

Record the $1,750 in gift cards sold.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Splish Brothers Inc. sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 days of the invoice date. The number of customers taking the full 30 days to pay has increased within the last year. Current indications are that less than 60% of the customers are now taking the discount. Bad debts as a percentage of gross credit sales have risen from the 2.5% average in past years to about 4.7% in the current year. The company's Finance Committee has requested more information on the collections of accounts receivable. The controller responded to this request with the following report. Proportion of Total 60% 22% (b1) 9% 5% 214% 13% Age Categories not yet due less than 30 days past due 30 to 60 days past due 61 to 120 days past due 121 to 180 days past due over 180 days past due Probability of Collection 98% 96% Additional…arrow_forwardBavarian Bar and Grill opened for business in November 2018. During its first two months of operation, the restaurant sold gift certificates in various amounts totaling $5,200, mostly as Christmas presents. They are redeemablefor meals within two years of the purchase date, although experience within the industry indicates that 80% of giftcertificates are redeemed within one year. Certificates totaling $1,300 were presented for redemption during 2018for meals having a total price of $2,100. The sales tax rate on restaurant sales is 4%, assessed at the time meals (notgift certificates) are purchased. Sales taxes will be remitted in January.Required:1. Prepare the appropriate journal entries (in summary form) for the gift certificates sold during 2018 (keepingin mind that, in actuality, each sale of a gift certificate or a meal would be recorded individually).2. Determine the liability for gift certificates to be reported on the December 31, 2018, balance sheet.3. What is the appropriate…arrow_forwardStork Enterprises delivers care packages for special occasions. They charge $45 for a small package, and $80 for a large package. The sales tax rate is 6%. During the month of May, Stork delivers 38 small packages and 22 large packages. PLEASE NOTE: All dollar amounts will be rounded to two decimal places using "$" with commas as needed (i.e. $12,345). What is the total tax charged to the customer per small package? $2.70 What is the overall charge per small package? $47.70 What is the total tax charged to the customer per large package? $4.80 What is the overall charge per large package? __________ How much sales tax liability does Stork Enterprises have for the month of May? __________arrow_forward

- Ganja Motors is a small car dealership. On average, it sells a car for $54,000, which it purchases from the manufacturer for $46,000. Each month, Ganja Motors pays $96,400 in rent and utilities and $136,000 for salespeople’s salaries. In addition to their salaries, salespeople are paid a commission of $1200 for each car they sell. Ganja Motors also spends $26,000 each month for local advertisements. Its tax rate is 40%. How many cars must Ganja Motors sell each month to break even? Ganja Motors has a target monthly net income of $102,000. What is its target monthly operating income? How many cars must be sold each month to reach the target monthly net income of $102,000?arrow_forwardRoyall Company purchased a delivery truck at $25,000 plus 8% sales taxes. Royall paid $3,000 in cash and financed the rest at 6% requiring 40 equal monthly payments at the end of each month. Compute the amount of the monthly payment that Royall must pay.arrow_forwardDuring the first quarter of 2021, a company sold on credit, 2,000 truck tires at $85 each plus harmonized sales tax (HST) of 13%. The HST is paid to the federal government. Prepare the following journal entries a) On March 31, to record the sale of truck tires in the first quarter. b) On April 30, to record payment of first quarter sales taxes to the government.arrow_forward

- A restaurant granted a 25% discount to senior citizens in excess of the 20% mandatory requirement. During the year, the restaurant reported receipts of P108,000 from senior citizen customers.Compute the deduction for senior citizens’ discountarrow_forwardBavarian Bar and Grill opened for business in November 2021. During its first two months of operation, the restaurant sold gift cards in various amounts totaling $7,600, mostly as Christmas presents. They are redeemable for meals within two years of the purchase date, although experience within the industry indicates that 90% of gift cards are redeemed within one year. Gift cards totaling $2,500 were presented for redemption during 2021 for meals having a total price of $2,900. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Sales taxes will be remitted in January.Required:1. Prepare the appropriate journal entries (in summary form) for the gift cards and meals sold during 2021 (keeping in mind that, in actuality, each sale of a gift card or a meal would be recorded individually).2. Determine the liability for gift cards to be reported on the December 31, 2021, balance sheet.3. What is the appropriate classification (current or…arrow_forwardCobb Baseball Bats sold 45 bats for $50 each, plus an additional state sales tax of 6%. The customer paid cash.Required:Prepare the journal entry to record the sale.arrow_forward

- The Continental Bank made a loan of $ 24 comma 000.00 on March 10 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a demand loan subject to a variable rate of interest that was 5% on March 10. The rate of interest was raised to 5.25% effective July 1 and to 5.75% effective September 1. Dr. Hirsch made partial payments on the loan as follows: $1000 on May 24; $700 on June 28; and $300 on October 22. Each payment is first applied to any accumulated interest. Any remainder is then used to reduce the outstanding principal. The terms of the note require payment on October 31 of any interest not paid off by partial payments. How much must Dr. Hirsch pay on October 31 ? Question content area bottom Part 1 Dr. Hirsch must pay $ enter your response here on October 31. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardRestaurant A serves lunch and dinner. It is open 5 days a week all year long. The total revenue for the past year was $1,000,000. The manager of Matt's Deli estimates that 52% of its revenue is provided by lunch service and the remainder by dinner service. Matt's has 50 seats, with a seat turnover rate of 7.3 for lunch and 4.8 for dinner. Determine the average check per meal for lunch. Select one: a. $237 b. $653 c. None of the available choices d. $333arrow_forwardRequired information (The following information applies to the questions displayed below) The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month 1. Cash sales for November Year 1 were $66,000 plus sales tax of 7 percent. 2 Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $79,500 plus sales tax of 7 percent. d. What is the amount of the sales tax liability as of December 31, Year 1? Sales tar labityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education