FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

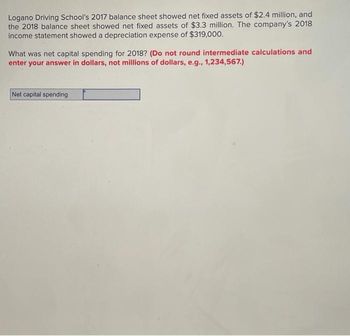

Transcribed Image Text:Logano Driving School's 2017 balance sheet showed net fixed assets of $2.4 million, and

the 2018 balance sheet showed net fixed assets of $3.3 million. The company's 2018

income statement showed a depreciation expense of $319,000.

What was net capital spending for 2018? (Do not round intermediate calculations and

enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)

Net capital spending

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you get the last answer please? It is not 354,820.arrow_forwardIn 2023, Amalgamated Industries' net fixed assets decreased from $380,000 to $260,000. depreciation expense for the period was $90,000. What was Net Capital Spending for 2023? $150,000 ($210,000) $170,000 ($30,000) $290,000arrow_forwardRottweiler Obedience School's December 31, 2021, balance sheet showed net fixed assets of $1,785,000, and the December 31, 2022, balance sheet showed net fixed assets of $2,160,000. The company's 2022 income statement showed a depreciation expense of $333,000. What was the company's net capital spending for 2022? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Net capital spendingarrow_forward

- Hampton Industries had $68,000 in cash at year-end 2020 and $16,000 in cash at year-end 2021. The firm invested in property, plant, and equipment totaling $170,000 - the majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$100,000. Round your answers to the nearest dollar, if necessary. a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign. b. If accruals increased by $35,000, receivables and inventories increased by $195,000, and depreciation and amortization totaled $13,000, what was the firm's net income?arrow_forwardThe 2021 Income statement for Egyptian Nolse Blasters shows that depreciation expense is $80 million, NOPAT is $239 million. At the end of the year, the balance of gross fixed assets was $650 million. The change in net operating working capital during the year was $70 million. Egyptian's free cash flow for the year was $180 million. Calculate the beginning-of-year balance for gross fixed assets. (Enter your answer in millions of dollars.) Gross fixed assets millionarrow_forwardShamrock Company has decided to expand its operations. The bookkeeper recently completed the following balance sheet in order to obtain additional funds for expansion. SHAMROCK COMPANY BALANCE SHEET FOR THE YEAR ENDED 2020 Current assets Cash $236,500 Accounts receivable (net) 346,500 Inventory (lower-of-average-cost-or-market) 407,500 Equity investments (marketable)-at cost (fair value $126,500) 146,500 Property, plant, and equipment Buildings (net) 576,500 Equipment (net) 166,500 Land held for future use 181.500 Intangible assets Goodwill 86,500 Cash surrender value of life insurance 96,500 Prepaid expenses 18,500 Current liabilities Accounts payable 141.500 Notes payable (due next year) 131,500 Pension obligation 88,500 Rent payable 55,500 Premium on bonds payable 59,500 Long-term liabilities Bonds payable 506,500 Stockholders' equity Common stock, $1.0 par, authorized 400,000 shares, issued 296,500 296,500 Additional paid-in capital 166,500 Retained earnings Prepare a revised…arrow_forward

- 11.4 Great Forks Hospital reported net income for 2016 of $2.4 million on total revenues of $30 million. Depreciation expense totaled $1 million. What were total expenses for 2016? What were total cash expenses for 2016? (Hint: Assume that all expenses,except depreciation, were cash expenses.) What was the hospital’s 2016 estimated cash flow?arrow_forwardanswer must be in table format and written format or i will give you down votearrow_forwardHampton Industries had $44,000 in cash at year-end 2020 and $27,000 in cash at year-end 2021. The firm invested in property, plant, and equipment totaling $170,000 - the majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$150,000. Round your answers to the nearest dollar, if necessary. a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign. b. If accruals increased by $50,000, receivables and inventories increased by $125,000, and depreciation and amortization totaled $73,000, what was the firm's net income?arrow_forward

- The following December 31, 2021, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents $ 5,000Accounts receivable (net) 20,000Inventory 60,000Property, plant, and equipment (net) 120,000Accounts payable 44,000Salaries payable 15,000Paid-in capital 100,000 The only asset not listed is short-term investments. The only liabilities not listed are $30,000 notes payable due in two years and related accrued interest of $1,000 due in four months. The current ratio at year-end is 1.5:1.Required:Determine the following…arrow_forwardFordson has the following financial information for FY 2023 (in thousands): Operating revenue Salary expense Depreciation expense All other operating expenses Tax expense (20% tax rate) Net Income Expected working capital increase of Capital expenditure What is free cash flow? O 420 720 820 O 1120 O Cannot be calculated 4000 1000 400 1200 280 1120 300 400arrow_forwardBakiponi Corp. provides the following data from its recent financial statements: (Dollars in millions) 2022 2023 Beginning Gross Fixed Assets $2,440,000 $2,560,000 Ending Gross Fixed Assets 2,560,000 2,680,000 Beginning Accumulated Depreciation 910,000 1,110,000 Current-year Depreciation Expense 200,000 250,000 Current-year Sales Revenue 3,050,000 3,920,000 What is the average remaining life of the company's fixed assets as of the end of 2023? (Round your answer to two decimal places, X.XX.) Group of answer choices 5.44 years 4.80 years 5.28 years 6.28 yearsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education