Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

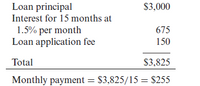

A loan of $3,000 for a new, high-end laptop computer is to be repaid in 15 end-of-month payments (starting one month from now). The monthly payments are determined as shown follows.What nominal and effective interest rates per year are actually being paid? Hint: Draw a cash-flow diagram from the perspective of the lender.

Transcribed Image Text:Loan principal

$3,000

Interest for 15 months at

1.5% per month

Loan application fee

675

150

Total

$3,825

Monthly payment = $3,825/15 = $255

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Van Buren Resources Inc. is considering borrowing $100,000 for 182 days from its bank. Van Buren will pay $6,000 of interest at maturity, and it will repay the $100,000 of principal at maturity. a. Calculate the loan’s annual financing cost. b. Calculate the loan’s annual percentage rate. c. What is the reason for the difference in your answers to Parts a and b?arrow_forwardConsider a $150,000 loan with an annual interest rate of 6.5 percent and a 30-year term. Discount points are equal to 2 percent. All other up-front financing costs to be paid by the borrower total $3,000. Compute the monthly payment and the loan balance at the end of months 1–6. What is the effective borrowing cost (EBC), assuming that the loan remains outstanding to maturity?arrow_forwardPlease include the excel formula If the following is a loan, identify a) the principal amount, b) the monthly interest rate, and c) the length of the loan in months. Determine if the following situation is an investment or a loan. If the following is an investment, identify a) if it is a one-time or recurring investment, b) the number of compounding periods per year and c) the total number of compounding periods. If the following is a loan, identify a) the principal amount, b) the monthly interest rate, and c) the length of the loan in months. Ashtyn purchased new appliances for her house for a total of $5,744. The store she buys the appliances from offers an annual simple interest rate of 8.5% with no down payment and monthly payments for 3 years. This situation represents a(n) . a) b) c) What will be your monthly payments? Use Excel to calculate the value.arrow_forward

- You want to buy a car, and a local bank will lend you $35,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 6% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? Do not round intermediate calculations. Round your answer for the monthly loan payment to the nearest cent and for EAR to two decimal places. Monthly loan payment: $ EAR: %arrow_forwardWhat is the internal rate of return on a $3,000 loan to be repaid as $3,500 twoyears from now?arrow_forwardThe executive of a label is looking to purchase a new rental for $3.9 million. Financing is offered for a 3.9% rate over 6 years. If $800,000 is place down towards the entire purchase, what will the monthly payment for the loan be? Use Excel functions to complete the calculation.arrow_forward

- An automobile with a total transaction price of $20,000 with a down payment of 20% is being financed for 48 months. Banks and credit unions require a monthly payment of $400.36. What is the APR for this auto loan? Use the table in the Business Math Handbookarrow_forwardAssume you take out a car loan of $8,600 that calls for 48 monthly payments of $300 each. a. What is the APR of the loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Use a financial calculator or Excel.) b. What is the effective annual interest rate on the loan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardData Back-Up Systems has obtained a $29,000, 90-day bank loan at an annual interest rate of 15%, payable at maturity. (Note: Assume a 365-day year.) a. How much interest (in dollars) will the firm pay on the 90-day loan? b. Find the 90-day rate on the loan. c. Annualize your result in part b to find the effective annual rate for this loan, assuming that it is rolled over every 90 days throughout the year under the same terms and circumstances. Answers a. The amount of interest on the loan is $___. (Round to the nearest cent.) b. The effective 90-day rate is___%. (Round to two decimal places.) c. The effective annual rate is___%. (Round to two decimal places.)arrow_forward

- Data Back-Up Systems has obtained a $10,000, 90-day bank loan at an annual interest rate of 15%, payable at maturity. Show Solutions and Explanation. (Note: Assume a 365-day year.) A. How much interest (in dollars) will the firm pay on the 90-day loan? (Format: 111.11) B. Find the 90-day rate on the loan. (Format: 1.11%) C. Annualize your result in Part B to find the effective annual rate for this loan, assuming that it is rolled over every 90 days throughout the year under the same terms and circumstances. (Format: 11.11%)arrow_forwardThe time value of money is used for many important financial decisions that could affect long-term goals. The interest rate you pay on a loan can affect the amount you pay each period. An advertised monthly lending rate of 9% is about 11% per year. This difference between an advertised rate and the annualized rate is based on finer TVM details that may be overlooked by borrowers. What practical TVM application would you expect to encounter in your future? Explain.arrow_forwardusing excel do the following Create an amoritization schedule for a $1,000,000 loan that requires equal annual payments in each of the next 10 years. The annual rate is 6%. How much is the remaining loan balance after 5 years? Analyze the amount of each equal payment that goes towards interest and principal in each year. What do you notice?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education