FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:LO 6-4

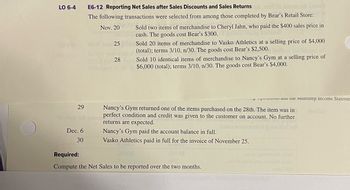

E6-12 Reporting Net Sales after Sales Discounts and Sales Returns Alamd

The following transactions were selected from among those completed by Bear's Retail Store:

Nov. 2001 Sold two items of merchandise to Cheryl Jahn, who paid the $400 sales price in

Jugoon cash. The goods cost Bear's $300. guized zboog bemiss

29

to rosa 30t yoqm

Dec. 6

30

25 Sold 20 items of merchandise to Vasko Athletics at a selling price of $4,000

(total); terms 3/10, n/30. The goods cost Bear's $2,500.

28

Sold 10 identical items of merchandise to Nancy's Gym at a selling price of

$6,000 (total); terms 3/10, n/30. The goods cost Bear's $4,000.

Nancy's Gym returned one of the items purchased on the 28th. The item was in

perfect condition and credit was given to the customer on account. No further

returns are expected.

Nancy's Gym paid the account balance in full.

Vasko Athletics paid in full for the invoice of November 25.

000.02

i au ue Multistep Income Stateme

Required:

Compute the Net Sales to be reported over the two months.

22010 2900evel pole 2

espridwolla one emuladas

20162 IBM

3801

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following merchandise transactions: a. Sold merchandise on account, $94,800 with terms 2/10, n/30. The cost of the merchandise sold was $56,900. b. Received payment less the discount. c. Issued a $500 credit memo for damaged merchandise. The customer agreed to keep the merchandise.arrow_forwardA5arrow_forwardShow Journal entries 3/1/22 Purchased $10,000 merchandise on account. Terms were 2/10, n/30, FOB Shipping Point. Sales taxes were 6% not included in the price. The shipping cost was $100. 3/3/22 Sold $20,000 merchandise to WG Company. Credit terms were 2/10, n/30, FOB Destination. The cost of goods sold was $8,000. Sales tax was 7% not included in the price. Paid $100 to UPS to ship the merchandise to WG Company 3/6/22 Bought back 500 shares of its own common stock at $14 per share from an unsatisfied stockholder 3/10 Collected from WG Company for the above sales.arrow_forward

- Carla Vista Company uses special journals and a general journal. The following transactions occurred during September 2022. Sept. 2 (a) 10 12 21 25 Purchased merchandise on account from D. Downs $820, terms n/30. 27 Sold merchandise to S. Miller for $730 cash. The cost of the merchandise sold was $415. Sold merchandise on account to H. Drew, invoice no. 101, $695, terms n/30. The cost of the merchandise sold was $375. Date Purchased merchandise on account from A. Pagan $555, terms 2/10, n/30. Purchased office equipment on account from R. Cairo $6,400. Sold merchandise on account to G. Holliday, invoice no. 102 for $765, terms 2/10, n/30. The cost of the merchandise sold was $465. Prepare a sales journal and record the transactions for September that should be journalized. (Record entries in the order presented in the problem statement.) 2022 Account Debited CARLA VISTA COMPANY Sales Journal Invoice No. Ref. Accounts Receivable Dr. Sales Revenue Cr. S1 Cost of Goods Sold Dr. Inventory…arrow_forwardHow do you make a general journal entry for these sales transactions?arrow_forwardHi, please answer the attached question BR,arrow_forward

- Journalizing Sales Transactions Enter the following transactions in a sales journal. Use a 6% sales tax rate. May 1 Sold merchandise on account to J. Adams, $1,800, plus sales tax. Sale No. 488. 4 Sold merchandise on account to B. Clark, $1,800, plus sales tax. Sale No. 489. 8 Sold merchandise on account to A. Duck, $1,500, plus sales tax. Sale No. 490. 11 Sold merchandise on account to E. Hill, $1,950, plus sales tax. Sale No. 491.arrow_forwardPrime book entries?arrow_forwardPart 1: Consider the following perpetual system merchandising transactions of Belton Company. Use a separate account for each receivable and payable; for example, record the sale on June 1 in Accounts Receivable-Avery & Wiest. June 1 Sold merchandise to Avery & Wiest for $9,550; terms 2/5, n/15, FOB destination (cost of sales $6,700). 2 Purchased $4,950 of merchandise from Angolac Suppliers; terms 2/10, n/20, FOB shipping point. 4 Purchased merchandise inventory from Bastille Sales for $11,500; terms 3/15, n/45, FOB Bastille Sales. 5 Sold merchandise to Gelgar for $11,100; terms 1/5, n/15, FOB destination (cost of sales $7,750). 6 Collected the amount owing from Avery & Wiest regarding the June 1 sale. 12 Paid Angolac Suppliers for the June 2 purchase. 20 Collected the amount owing from Gelgar regarding the June 5 sale. 30 Paid Bastille Sales for the June 4 purchase. Prepare General Journal entries to record the above transactions. View transaction list Prepare General Journal entries…arrow_forward

- Your company completed the following merchandise transactions during year 6: 1. On January 1, Year 6, your company had merchandise which cost $18,000 and had a net realizable value of $17,900. 2. Purchased $23,000 of merchandise for cash 3. Sold $19,000 of the merchandise for $36,400 on account. 4. Purchased $10,000 of merchandise on account, terms 2/10, n/30. 5. Paid for the merchandise in #3 on the eighth day after the purchase. 6. There were other purchases and sales throughout the year, but you do not need to record them, so no entry here. 7. Ended the year with merchandise which cost $26,000 (according to your calculations) and had a net realizable value of $25,400. INSTRUCTIONS: a. Prepare the entries for the transactions above assuming a Periodic inventory system, the allowance method for LCNRV, and the net method for purchase discounts. b. Prepare the entries for the transactions above assuming a Perpetual inventory system, the direct inventory reduction method for LCNRV, and…arrow_forwardCalculate the gross profit percentage for the sale to Sarah’s cyclesarrow_forwardOn September 1, ABC Company bought goods with a list price of $20,000 terms 2/10, n/30. On On September 5, ABC Company returned goods with a list price of $2,500 for credit. On September 9, ABC Company made a payment for their inventory purchase. How much did ABC Company pay for the inventory? $17,500 $19,600 $20,000 $17,150arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education