FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

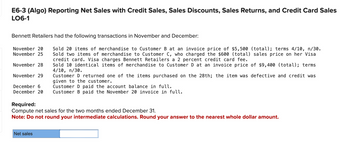

Transcribed Image Text:E6-3 (Algo) Reporting Net Sales with Credit Sales, Sales Discounts, Sales Returns, and Credit Card Sales

LO6-1

Bennett Retailers had the following transactions in November and December:

November 20 Sold 20 items of merchandise to Customer B at an invoice price of $5,500 (total); terms 4/10, n/30.

November 25 Sold two items of merchandise to Customer C, who charged the $600 (total) sales price on her Visa

credit card. Visa charges Bennett Retailers a 2 percent credit card fee.

Sold 10 identical items of merchandise to Customer D at an invoice price of $9,400 (total); terms

4/10, n/30.

Customer D returned one of the items purchased on the 28th; the item was defective and credit was

given to the customer.

December 6

Customer D paid the account balance in full.

December 20 Customer B paid the November 20 invoice in full.

November 28

November 29

Required:

Compute net sales for the two months ended December 31.

Note: Do not round your intermediate calculations. Round your answer to the nearest whole dollar amount.

Net sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A-8arrow_forwardSubject:- accountingarrow_forwardSales Transactions Journalize the following merchandise transactions: a. Sold merchandise on account, $23,950 with terms 2/10, n/30. The cost of the merchandise sold was $14,370. If an amount box does not require an entry, leave it blank. Sale Accounts Receivable Sales Cost Cost of Merchandise Sold Merchandise Inventory b. Received payment less the discount. If an amount box does not require an entry, leave it blank. Cash Accounts Receivable c. Issued a $1,100 credit memo for damaged merchandise. The customer agreed to keep the merchandise. If an amount box does not require an entry, leave it blank. Customer Refunds Payable Accounts Receivablearrow_forward

- am. 103.arrow_forwardRecord the following selected transactions: a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510. b. Paid $436 to the state sales tax department for taxes collected. Required: Journalize the entries. Refer to the Chart of Accounts for exact wording of account titles. Chart of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 131 Estimated Returns Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 221 Sales Tax Payable 222 Customers Refunds Payable 231 Unearned Rent 241 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales EXPENSES 510 Cost of Goods Sold 521 Delivery Expense 522…arrow_forwardCredit Card Sales Prepare journal entries for the following credit card sales transactions (the company uses the perpetual inventory system). 1. Sold $20,000 of merchandise, that cost $15,000, on MasterCard credit cards. The net cash receipts from sales are immediately deposited in the seller's bank account. MasterCard charges a 5% fee. 2. Sold $5,000 of merchandise, that cost $3,000, on an assortment of credit cards. Net cash receipts are received 5 days later, and a 4% fee is charged. 1arrow_forward

- Prime book entries?arrow_forwardPart 1: Consider the following perpetual system merchandising transactions of Belton Company. Use a separate account for each receivable and payable; for example, record the sale on June 1 in Accounts Receivable-Avery & Wiest. June 1 Sold merchandise to Avery & Wiest for $9,550; terms 2/5, n/15, FOB destination (cost of sales $6,700). 2 Purchased $4,950 of merchandise from Angolac Suppliers; terms 2/10, n/20, FOB shipping point. 4 Purchased merchandise inventory from Bastille Sales for $11,500; terms 3/15, n/45, FOB Bastille Sales. 5 Sold merchandise to Gelgar for $11,100; terms 1/5, n/15, FOB destination (cost of sales $7,750). 6 Collected the amount owing from Avery & Wiest regarding the June 1 sale. 12 Paid Angolac Suppliers for the June 2 purchase. 20 Collected the amount owing from Gelgar regarding the June 5 sale. 30 Paid Bastille Sales for the June 4 purchase. Prepare General Journal entries to record the above transactions. View transaction list Prepare General Journal entries…arrow_forwardOn October 4, 2008, Terry Corporation had credit sales transactions of P2,800 from merchandise having cost P1,900. The entries to record the day's credit transactions include aarrow_forward

- Hh1. calculate net sales, cost of goods sold and gross profit from salesarrow_forwardPart 1: Consider the following perpetual system merchandising transactions of Belton Company. Use a separate account for each receivable and payable; for example, record the sale on June 1 in Accounts Receivable-Avery & Wiest. June 1 Sold merchandise to Avery & Wiest for $9,450; terms 2/5, n/15, FOB destination (cost of sales $6,600). 2 Purchased $4,850 of merchandise from Angolac Suppliers; terms 2/10, n/20, FOB shipping point. 4 Purchased merchandise inventory from Bastille Sales for $11,300; terms 2/15, n/45, FOB Bastille Sales. 5 Sold merchandise to Gelgar for $10,900; terms 3/5, n/15, FOB destination (cost of sales $7,650). 6 Collected the amount owing from Avery & Wiest regarding the June 1 sale. 12 Paid Angolac Suppliers for the June 2 purchase. 20 Collected the amount owing from Gelgar regarding the June 5 sale.. 30 Paid Bastille Sales for the June 4 purchase. Prepare General Journal entries to record the above transactions.arrow_forwardRecording Sales and Shipping Terms Milano Company shipped the following merchandise during the last week of December 2022. All sales were on credit. Sales Price Shipping Terms Date Goods Shipped Date Goods Received $5,460 FOB shipping point December 27 January 3 $3,800 FOB destination December 29 January 5 $4,250 FOB destination December 29 December 31 Required: 1. Compute the total amount of sales revenue recognized by Milano from these transactions. 2. If Milano included all of the above shipments as revenue, what would be the effect on the financial statements? Enter all amounts as positive numbers.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education