FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Payroll Accounting Class (2301-900)

Cengage - eBook Bieg/Toland's Payroll Accounting (2021, 31th Edition)

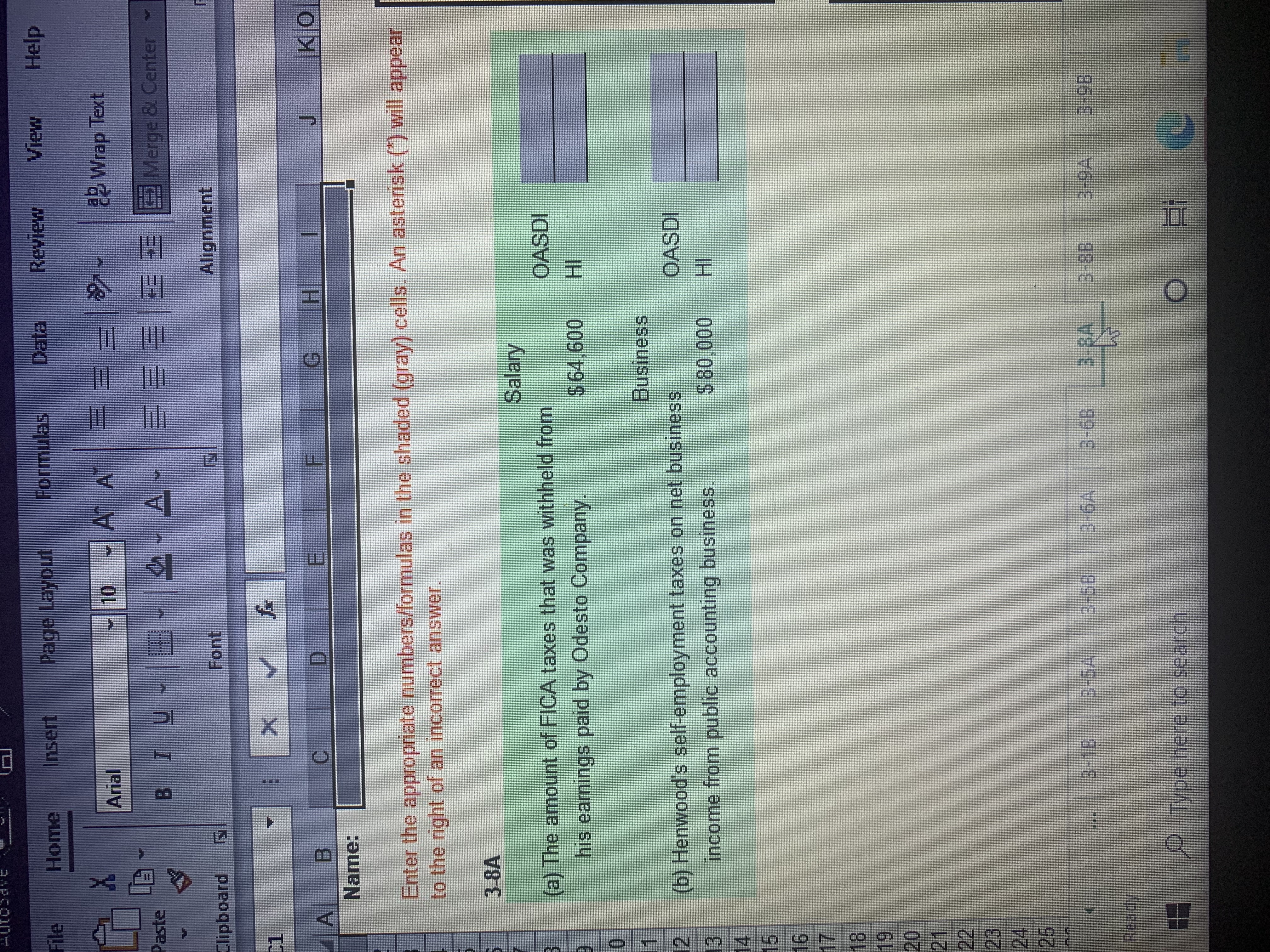

Ch. 3: Problem Case 3-8A

I need help with finding the formula used to get the answer

OASDI Taxable Wage Base = 137,700

Transcribed Image Text:O 3-8A

LO 3 D See Example 3-5

Ralph Henwood was paid a salary of $64.600 during 20- by Odesto Company: In addition, during the

year Hemwood started his own business as a public accountant and reported a net business income of

$80.000 an his income tax return for 20-. Compute the following

a. The amount of FICA taves that was withheld from his

OASDI S

camings during 20- by Odesto Company.

HI S

b. Henwood's sel-employment laves on the income derived

from the public accounting business for 20-

OASDI S

HI S

Transcribed Image Text:lili

File

Insert

Page Laycut

Formulas

Data

Help

=|シ.

三三

2Wrap Text

Arial

10

A

王王|三三三

Merge & Center

Alignment

Paste

Clipboard

Font

A

B.

Name:

Enter the appropriate numbers/formulas in the shaded (gray) cells. An asterisk (*) will appear

to the right of an incorrect answer.

3-8A

Salary

(a) The amount of FICA taxes that was withheld from

OASDI

his earnings paid by Odesto Company.

IH

Business

1.

(b) Henwood's self-employment taxes on net business

2.

income from public accounting business.

OASDI

3.

4.

1.

21

22

23.

25

B-1B

B-6B

3-8B

H Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Assume that the payroll records of Bramble Oil Company provided the following information for the weekly payroll ended November 30, 2020. Employee T. King T. Binion N.Cole C. Hennesey Hours Worked Date 44 46 Nov. 30 40 Show Transcribed Text Nov. 30 42 Your answer is partially correct. Hourly Pay Rate $69 Salaries and Wages Expense FICA Taxes Payable Account Titles and Explanation Federal Income Taxes Payable Union Dues Payable Salaries and Wages Payable (To record weekly payroll) Payroll Tax Expense 34 FICA Taxes Payable 39 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $132,900 of each employee's annual earnings and 1.45% on any earnings over $132,900. The employer pays unemployment taxes of 6.0% (5.4% for state and .6% for federal) on the first $7,000 of each employee's annual earnings. 44 State Income Taxes Payable Federal Income Taxes Payable Federal Income Tax Prepare…arrow_forwardA5arrow_forwardAnswer fully and correctly u will get upvotearrow_forward

- Summary Payroll Data In the following summary of data for a payroll period, some amounts have been intentionally omitted: Earnings: 1. At regular rate 2. At overtime rate 3. Total earnings Deductions: 4. Social security tax 5. Medicare tax 6. Income tax withheld 7. Medical insurance 8. Union dues 9. Total deductions 10. Net amount paid Accounts debited: 11. Factory Wages 12. Sales Salaries 13. Office Salaries $80,000 ? (32,400) (8,100) (135,000) (18,900) (201,150) $338,850 285,000 ? 120,000 a. Calculate the amounts omitted in lines (1), (3), (8), and (12). Assume that the social security tax rate was 6.0% and the Medicare tax rate was 1.5%. (1) (3)arrow_forwardplease explain me how to the green boxes now filled, show the formulas and compuations step by steparrow_forwardS eBook Ask Print eferences Mc Graw Hill :: -WKCTC_....txt FI 2 W S KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August 2021, the payroll taxes (employee and employer share combined) were as follows: X Social Security tax: $5,056.78 Medicare tax: $1,182.63 Employee Federal income tax: $3,960.00 Required: Create the General Journal entry for the remittance of the taxes. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) View transaction list A Journal entry worksheet 4² Record the remittance of August payroll taxes. Note: Enter debits before credits. # 3 1 E D Data C 8.0 F3 $ 4 JUL 22 R F a F4 V General Inurnal % 5 T F5 G 8 DII FB M 1 ( 9 K ران DD F9 O ) O A F10 L P Ⓡ command C F11 - 9 F12 optionarrow_forward

- Bart Consulting Firm has the following payroll information for the week ended March 20th: Name Earnings at the end of the previous week Sun. Mon. Tues. Wed. Thurs. Fri. Sat. Pay Rate Federal Income Tax Lauren, F 14,400 8 8 8 8 8 30.00 222.52 Baylor, M 12,000 8 8 8 8 8 25.00 178.55 Lims, T 7,200 8 8 8 8 8 15.00 78.00 Tate, C 6,000 8 8 8 8 8 15.00 62.00 Musker, J 4,320 8 8 8 15.00 15.00 Mako, W 3,888 8 8 8 13.50 11.00 Additional Information: Taxable earnings for Social Security are based on the first $132,900. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-and-a-half for work in excess of 40 hours per week. Round amounts to the nearest penny. What you must do: Complete the attached Payroll Register (Excel Spreadsheet). Use the following information to help: The Social Security tax rate is 6.2 percent. The Medicare tax…arrow_forwardDIRECTIONS 1 Journalize the entry to RECORD the payroll 2 Journalize the entry to RECORD the employer's payroll taxes (SUTA rate is 3.7%) 3 Journalize the entry to deposit the FICA and FIT taxes TOTAL EARNINGS FICA OASDI FICA HI FIT W/H STATE TAX UNION DUES NET PAY $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 1 JOURNAL DATE DESCRIPTION DEBIT CREDIT 2 JOURNAL DATE DESCRIPTION DEBIT CREDIT…arrow_forwardgo.2arrow_forward

- Question text The totals from the first payroll of the year are shown below. Total Earnings FICA OASDI FICA HI FIT W/H State Tax Union Dues Net Pay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the entry to deposit the FICA and FIT taxes.arrow_forwardDo not give image formatarrow_forwardI need help getting the answer to question #2!!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education